Energy Fund Taken To The Chipper

Crude oil. Ugly move lower over the past two weeks.

The market pundits will try to explain the price action. They will offer evidence of President Trump’s tweet as the catalyst for the sell-off.

Or they will point to the decline resulting from market participants’ belief the global economy is about to roll over.

And if they don’t use that excuse, they will trot out the breakout in the US Dollar Index.

Either way, the chart looks about as attractive as my moldy 30-year old hockey equipment.

Although I don’t deny these three factors played a role in oil’s recent demise (especially the global slow-down narrative), I contend that these were just excuses.

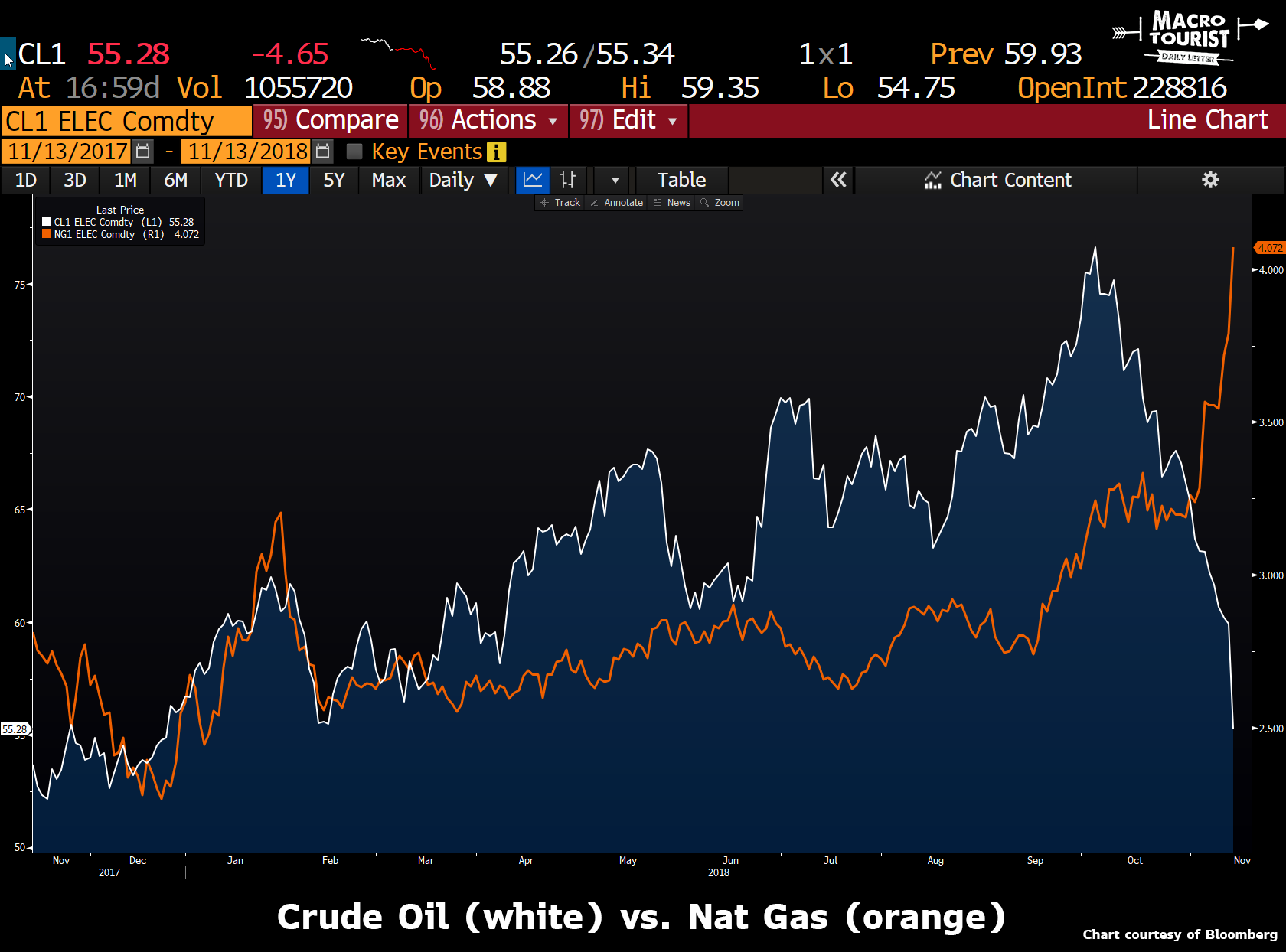

The truth of the matter is that there is a Behemoth out there that was long crude oil against short nat gas (along with short nat gas spreads).

Don’t believe me?

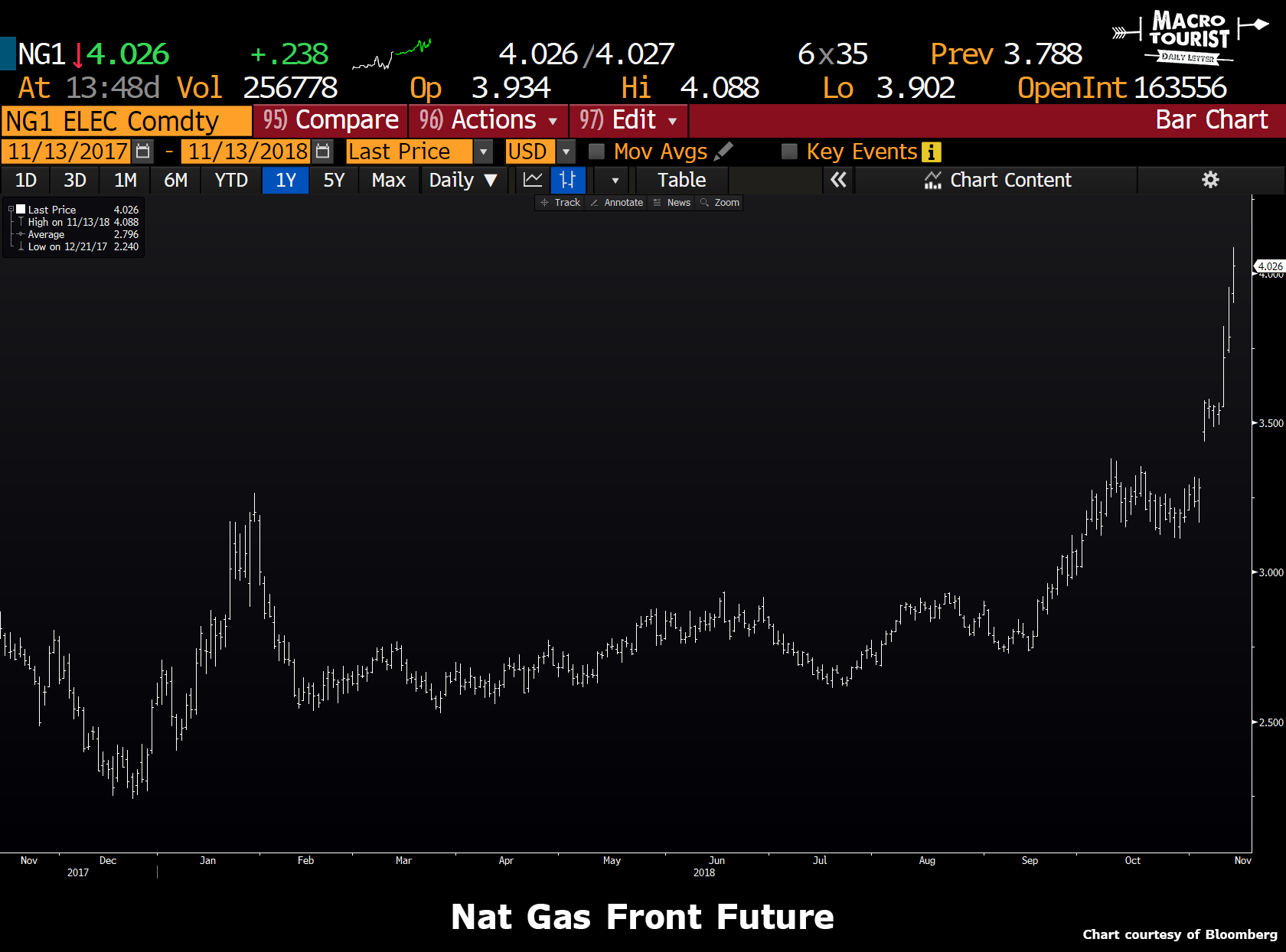

Although I acknowledge it has become mildly colder over the past couple of weeks, do you really believe that is was enough to spike the front nat gas future from $2.75 to $4.03?

A 46% increase in a couple of months. C’mon - that’s not weather.

Still, don’t believe me that someone is offside? If you can come up with a fundamental reason for the March / April 2019 Nat Gas spread to spike like this, then by all means, please pass it along.

Look closely at that chart. The spread has bounced around 25 and 40 cents for the past three years. Now, in November, a full 3 months ahead of the front-month coming due, they have decided it should trade at an 82 cent premium?

This week’s move in both crude oil and nat gas was not the result of some well-thought-out fundamental reasoning. Rather, in large part, it is due to a large hedge fund calling up their broker at 1-800-GET-ME-OUT.

Why would they have this position in the sort of size that can cause this sort of disruption? The answer is that it has been a great trade. Actually, I take that back. It’s been a fan-freaking-tastic trade.

Let’s start with nat gas. Here is a chart of the natural gas future over the past five years, with the contract being adjusted to account for the roll (and a log scale included to make percentage declines equal).

Natural gas is one of those commodities with a ‘wickawd yuge carry as our Boston friends would say. It’s like VIX or grains. Owning it is painful as you need to be perfect with your timing, otherwise, the negative carry eats away any profits. That’s why the continuous roll shows such a nice long downtrend. The actual spot price was much more choppy, but the real-world return for short positions has been remarkably consistent.

On the other side, being long crude oil over the past year has been an equally terrific trade.

So let’s review. Over the past five years, short natural gas has been a consistent source of profit while crude oil has been rallying due to the synchronized global recovery.

It’s hard to dream up a more ideal trade for a macro hedge fund.

Yet, these trades are a little like the Hotel California.

The hedge fund(s) with this position has probably given away a large portion of their profit getting out. They have been taken to the wood chipper.

I know there will be all sorts of attempts to explain the markets through fundamental reasoning. Ignore them. Someone big just hit the puke-point for unwinding their long crude oil short nat gas (and nat gas spreads) position. It’s as simple as that. That’s why we are hitting record number of down days in a row. And it will only end when they are finished selling their crude and buying back their nat gas.

When the snapback comes, it will be vicious. These aren’t good prices that the fund is getting. Yet right now they are demanding liquidity and it is what it is. And it’s ugly.

Disclosure: None.

Cannot share this article on phone. Links not working.

Thanks for bringing this problem to our attention. We'll have our tech team look into it asap.