Energy Continues To Lead US Equity Sectors By Wide Margin In 2021

The reboot of energy stocks rolls on in the year-to-date sector horse race, based on a set of ETFs through Tuesday’s close (Oct. 26).

The rebound in the previously faltering energy sector began a month ago. In late September, CapitalSpectator.com reported that Energy Select Sector SPDR Fund (XLE) regained the lead for the major equity sectors in 2021. That lead has subsequently strengthened through October.

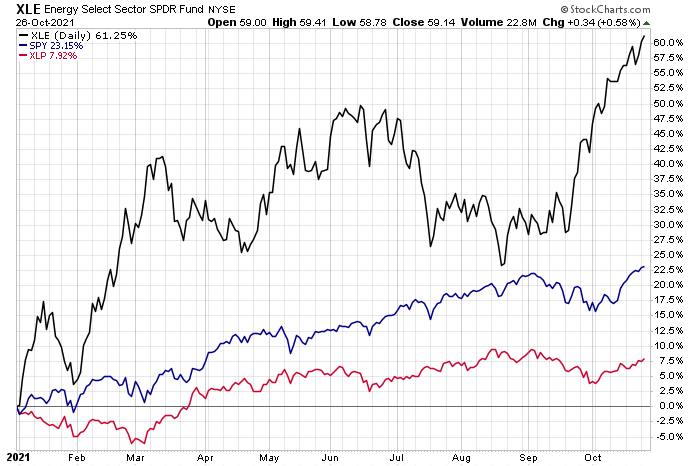

XLE is up an astonishing 61.3% so far this year, or roughly twice the year-to-date gain in our previous report from a month ago. Lifting the fund is a combination of surging oil and gas prices, which in turn is driving bullish earnings expectations amid mounting evidence that higher inflation may persist for longer than previously expected.

(Click on image to enlarge)

Not surprisingly, current conditions have triggered a bullish attitude adjustment for the sector’s outlook, reports Barron’s:

About 80% of all analysts’ profit forecasts for this year and next have been increased, higher than the 74% seen in September, according to Citigroup. That means more profit projections have been increased than reduced in the past month.

The strength of energy’s year-to-date rally is no less conspicuous when you consider that the second-best sector performer this year is far behind. Financial Select Sector SPDR (XLF) is up 39.5% — a strong gain in absolute terms, but nowhere near XLE’s surge.

The US stock market overall is posting an impressive rise this year via SPDR S&P 500 (SPY). But the ETF’s 23.2% increase so far this year pales next to XLE’s advance.

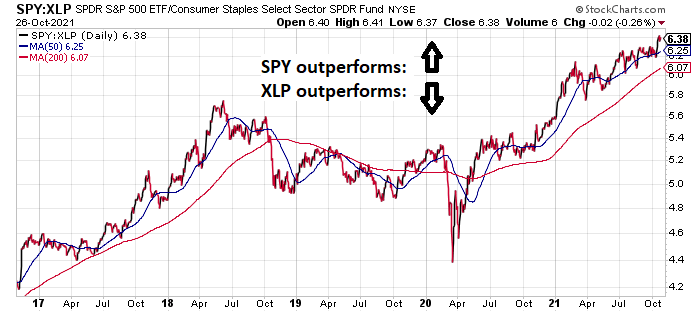

The weakest sector performer this year: Consumer Staples SPDR (XLP), which is higher by a relatively moderate 7.9% year to date. The sector, traditionally considered one of the more resilient, defensive corners of the market, is struggling to keep pace with equities overall (SPY), as this chart of relative performance history shows:

When the line is rising, the broad US equity market (SPY) is outperforming XLP. On that basis, XLP’s defensive features have remained out of favor for much of the time since the market began recovering from the coronavirus crash in the spring of 2020.

Disclosures: None.