Employment, Real Personal Income, Inflation… Favorable For Higher Equity Prices

“Davidson” submits:

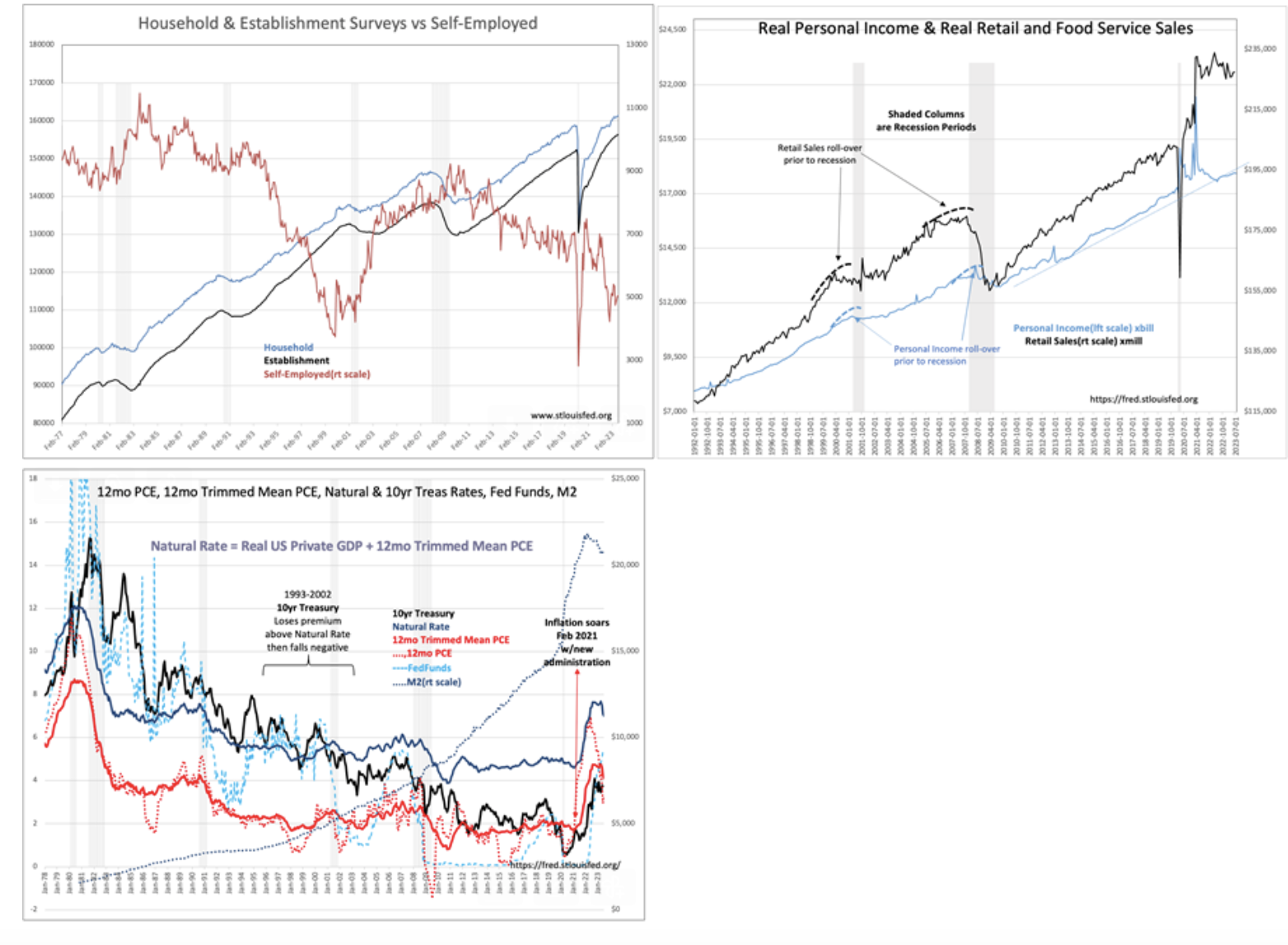

Establishment Survey reports a gain of 187,000 and the Household Survey reports a gain of 222,000. Each continues the rising trend since 2020. Real Personal Income continues to rise. Inflation reported as the 12mo Trimmed Mean PCE sustains above 4% while many, using the raw PCE data, forecast inflation declining towards 2%.In my analysis, the economy continues to expand in the face of higher interest rates and persistent inflation. This environment continues to support the position of holding core economically sensitive companies in portfolios.

Excerpt from the today’s US Employment Situation report:

“Total nonfarm payroll employment increased by 187,000 in August, and the unemployment rate rose to 3.8 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in health care, leisure and hospitality, social assistance, and construction. Employment in transportation and warehousing declined.”

Personal Consumption Expenditures(PCE) was reported Aug 31st as was the associated 12mo Trimmed PCE. The history of the 12mo PCE, 12mo Trimmed PCE, the Natural Rate, Fed Funds and M2 from Jan 1978 show that global shifts in market psychology do not match the mathematical-based thinking long-present in Western market analysis under the 1950’s Modern Portfolio Theory when finance was mostly isolated to Western markets. It used to be that investors demanded a Real(adjusted for inflation) for the 10yr Treasury. This gradually waned in the 1990s as foreign investors gained entry to Western markets and used Sovereign Debt as an investment option. The Natural Rate, a concept of Knut Wicksell, 1898, is the long-term US Real GDP trend plus the 12mo Trimmed Mean PCE. It is a benchmark the 10yr Treasury rate tracked above till Emerging Markets demand drove rates below what had been a Real rate of return. This lack of a Real return persists today with the Natural Rate of ~7% vs 10yr Treasury of 4.1% having no net return with the 12mo Trimmed Mean PCE at the just reported 4.1%.

Market psychology has shown greater influence over prices than underlying returns over periods that can last decades. It is apparent from US$(US Dollar) strength, since Putin and Xi rose to leadership of Russia and China respectively, that capital flows to the US have accelerated. Low interest rates in Western Sovereign Debt have been the result with periods of heavier flow driving rates negative for debt markets too small to absorb it. The dramatic rise in inflation since the change in US leadership Jan 2021 has changed the perception of the safety of 10yr Treasuries with the rise over 4% resulting in significant short-term losses for holders. The historical relationships of the rise in M2 and policy shifts indicate that inflation is likely to continue till there is some change in policies. There is a belief that the sharp rise in PCE now in apparent decline will continue to decline towards 2%. However, the 12mo Trimmed Mean PCE, which is designed to remove temporary inflation data spikes, never went as high as the …12mo PCE and is not declining as much as the PCE. In my opinion, price-trend followers seeing the current trend in PCE are making a lower inflation prediction that is not likely to occur. 4% inflation is likely to persist till M2 and policies are reversed in my analysis. It is very likely investors will eventually prove unwilling to buy the 10yr Treasury till the rate rises closer to the Natural Rate or 7%.

(Click on image to enlarge)

Economic growth has occurred in the past with persistent inflation and rising rates till delinquency rates on debt makes further debt issuance an untenable option by financial institutions. That condition remains several years into the future. Economic conditions are favorable for higher equity prices, especially shares of those companies where product demand is persistent and they have the ability to pass-through inflation costs profitably.

More By This Author:

Rising Yield Curve Means Rising MarketTruck Tonnage Remains In Uptrend

Nearly 1/2 Of SPR Gone

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more