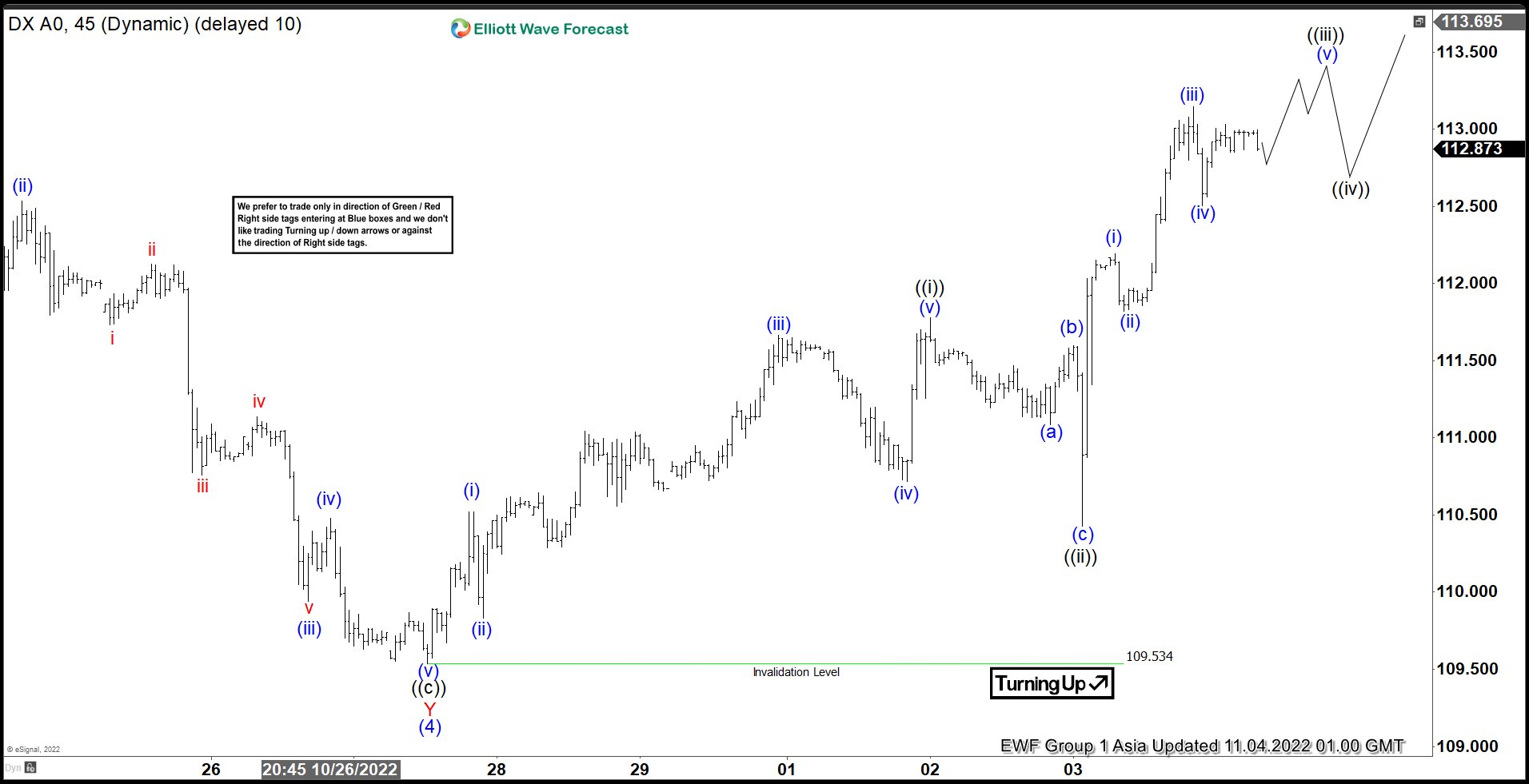

Elliott Wave View: Dollar Index (DXY) Has Resumed Higher

Short term Elliott Wave view suggests correction from 9.28.2022 high ended at 109.53 as wave (4). Internal subdivision of wave (4) unfolded as a double three Elliott Wave structure. Down from 9.28.2022 high, wave W ended at 110.055 and wave X ended at 113.942. Index then resumes lower in wave Y to 109.53 and this completed wave (4) in higher degree. Dollar Index has turned higher in wave (5) but it still needs to break above previous peak on 9.28.2022 at 114.78 to rule out a double correction.

Up from wave (4), wave ((i)) ended at 111.78 and pullback in wave ((ii)) ended at 110.42. Index then resumes higher again and wave ((iii)) should end soon after a few more highs. Afterwards, it should pullback in wave ((iv)) to correct cycle from 11.3.2022 low before the rally resumes in wave ((v)). After wave ((v)) ends, the Index should complete wave 1 of (5). It should then pullback in wave 2 to correct cycle from 10.27.2022 low in larger degree 3, 7, or 11 swing before the rally resumes again. Near term, as far as pivot at 109.53 low stays intact, expect dips to find support in 3, 7, or 11 swing for further upside. Potential target for wave (5) higher is 123.6 inverse retracement of wave (4) at 114.78.

DXY 45 Minutes Elliott Wave Chart

(Click on image to enlarge)

More By This Author:

GDXJ Looking To Form BottomCaterpillar Inc. Bounce Is A Bull Trap. More Downside Should Take Place Soon.

Amazon Elliott Wave: Calling For A Further Decline

Disclaimer: InvestingHaven.com makes every effort to ensure that the information provided is complete, correct, accurate and ...

more