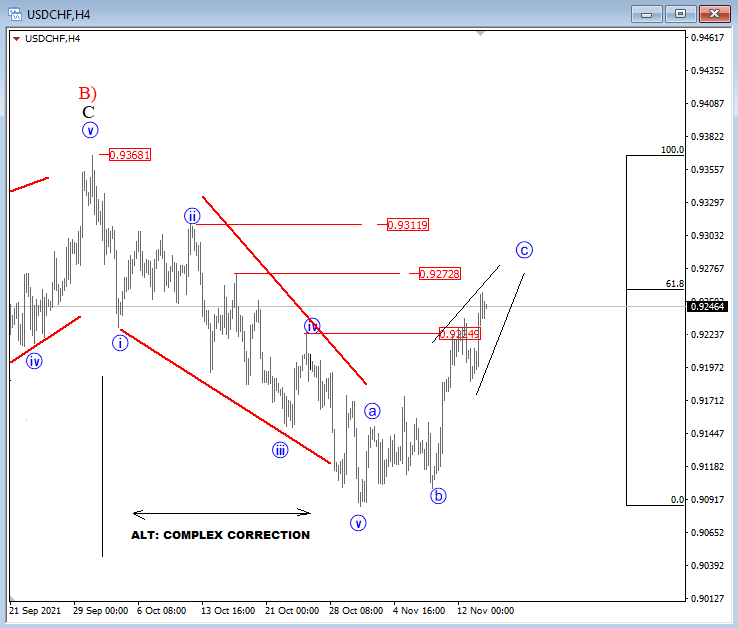

Elliott Wave Analysis: USDCHF And USDJPY Eyeing Higher

Swissy is trading south for the last few weeks after it stopped at the 78.6% Fib level where the market completed a corrective rally with three waves up, so it appears that the pair is now back in bearish play for the third wave of decline back to 0.8923 when looking at the daily time frame. In the 4-hour chart we see USDCHF in the recovery mode, but ideally as part of an a-b-c corrective movement that can potentially find the resistance here in the 0.92 - 0.93 area.

USDCHF 4h Elliott Wave Analysis

(Click on image to enlarge)

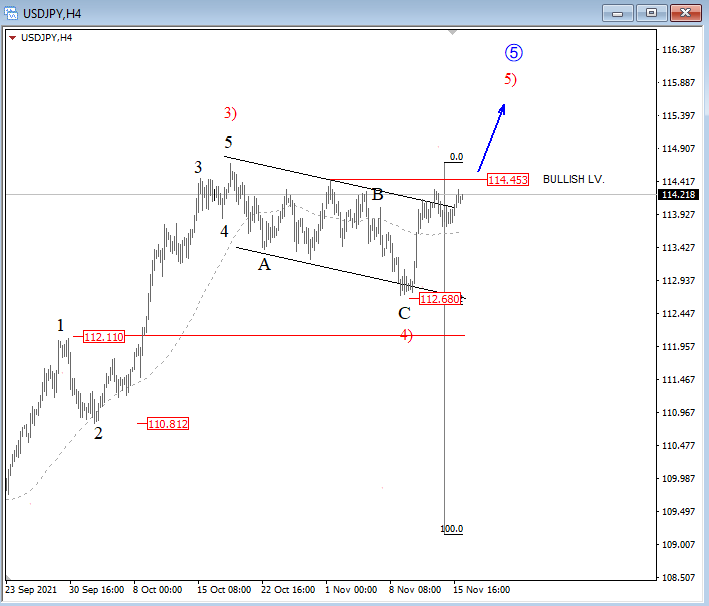

USDJPY is coming higher after only three waves down from October highs so looks like that market made a corrective drop on the 4h chart, ideally, a fourth wave that is now pointing higher into wave 5) above 115.

USDJPY 4h Elliott Wave Analysis

(Click on image to enlarge)

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.