Economic Data, Intel Selloff Send Stocks Mixed

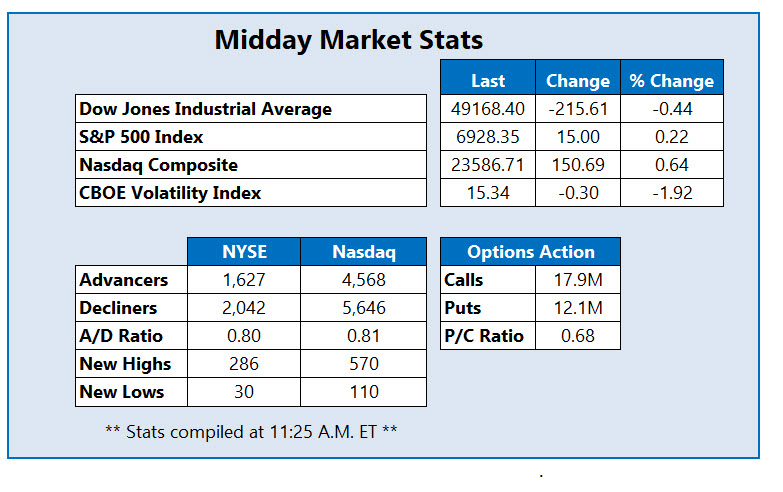

Major indexes are struggling for direction at midday, as investors digest comments from Greenland's Prime Minister Jens-Frederik Nielsen, who said President Donald Trump's "framework" plans need to involve territorial integrity. Goldman Sachs (GS) and Intel (INTC) are pressuring the Dow Jones Industrial Average (DJI), the latter posting a grim first-quarter outlook. The Nasdaq Composite (IXIC) is up triple digits, while the S&P 500 Index (SPX) is slightly above breakeven.

Consumer sentiment data for January showed improvement, with the University of Michigan survey's headline index coming in at 56.4, 6.6% higher than December’s reading and better than estimates of 54.0. Manufacturing and services activity missed estimates, however, with the purchasing managers' index (PMI) coming in at 51.9, compared to forecasts of 52.1. Services PMI registered at 52.5, below the 53.0 estimate

Molson Coors Beverage Co (NYSE: TAP) is seeing heightened activity in the options pits, last seen trading down 0.7% at $49.38, though the catalyst remains unclear. So far, 33,000 puts have been exchanged, a whopping 192 times the average daily pace. The influx stemming from more than 16,700 contracts being opened at both the February 47.50 and 45 puts. Despite its recent fall, TAP is clinging to a 5% gain for January.

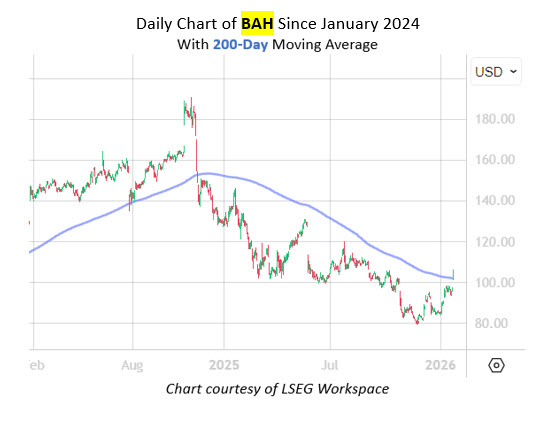

Software name Booz Allen Hamilton Holding Corporation (NYSE:BAH) is near the top of the New York Stock Exchange (NYSE), up 7.6% at $103.05 at last glance, after the company posted a fiscal third-quarter beat and an impressive full-year profit forecast. Trading at its highest level since October, BAH is eyeing its best daily pop since March and gapping above the 200-day moving average for the first time since November 2024.

One of the worst NYSE performers this afternoon is Bausch Health Companies Inc (NYSE: BHC), eyeing its eighth-straight daily drop, last seen down 9.8% at $5.92. The pharmaceuticals name reported a brain dysfunction treatment failure in its late-stage trial. Over the past six months, BHC has shed 11.6%.

More By This Author:

Dow Extends Comeback, Wipes Weekly Deficit Away

GDP Data, Cooling Geopolitical Tensions Boost Markets

Dow Adds 588 Points After Trump Abandons New Europe Tariffs