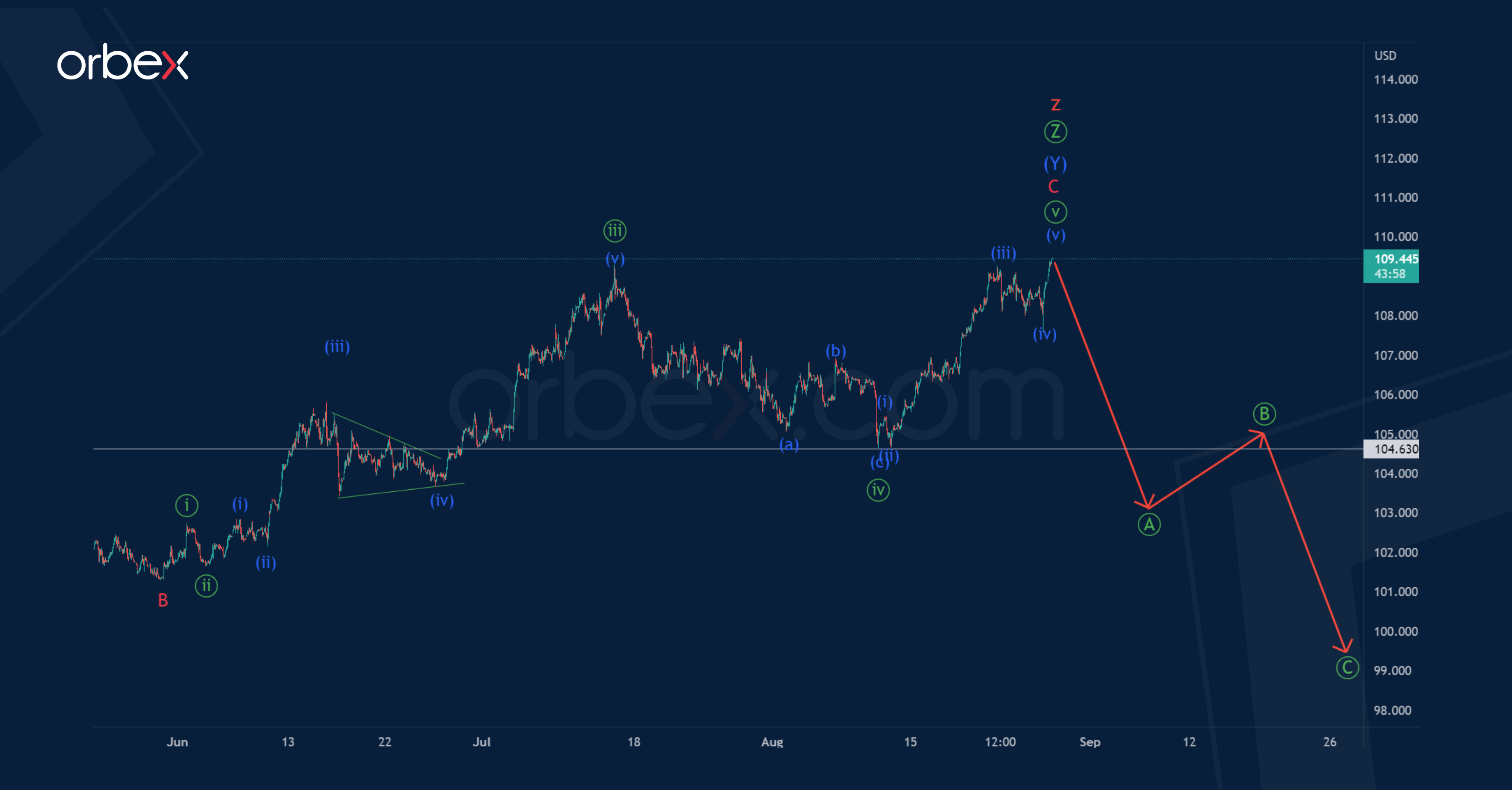

DXY: Has The Cycle Triple Zigzag Ended?

DXY

The 1H timeframe of the DXY index suggests the completion of a global corrective trend. This has taken the form of a triple zigzag consisting of five cycle waves w-x-y-x-z.

Therefore, the formation of the initial part of a new bearish trend could soon begin. This could be a standard zigzag Ⓐ-Ⓑ-Ⓒ

The end of the impulse Ⓐ is possible just below the minimum of 104.63. This is marked by a minute fourth correction.

In an alternative scenario, the formation of a cycle triple zigzag is not yet fully completed.

Most likely, at the level of 104.69, the bearish cycle wave x ended. This took the form of a standard zigzag Ⓐ-Ⓑ-Ⓒ of the primary degree. Then the market turned around, and prices moved higher in the initial part of the wave z.

The wave z can take the form of a zigzag Ⓐ-Ⓑ-Ⓒ, and could complete near 116.80. At that level, it will be at the 61.8% Fibonacci extension of wave y.

More By This Author:

Intraday Market Analysis – USD Back In Game

The Week Ahead – US Fed May Not Yield To Market Pressure

Forex Implications Of US-Europe Wage Divide

Disclaimer: Orbex LIMITED is a fully licensed and Regulated Cyprus Investment Firm (CIF) governed and supervised by the Cyprus Securities and Exchange Commission (CySEC) (License Number 124/10). ...

more

This is a rare fibonacci retrace Elliot wave bear flag 3 year head and shoulders of doom.