DuSolo Fertilizers: Brazil's Best Agricultural Play

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

The Situation:

Due to the success of capitalism within private business, the tyranny of socialism has for the most part, taken a back seat ride. It is the ever present human desire to achieve a better standard of living for themselves and their families through hard work, that has enabled countless hundreds of millions of people to be pulled from the decrepit state of starvation and malnutrition.

It is the constant advancement of technology that has given people the ability to produce more with less, to derive bigger returns with less inputs. It is the dreamers, those with an imagination that dare to make their mark on history, that have provided us with the ideas and designs that enable us to enjoy the quality of life we now enjoy.

In the realm of the limited, exponential growth is a rarity. Constant innovation is needed to flatten the speed bumps nature throws at us. One such speed bump is the amount of food that can be produced per square hectare.

The Dilemma:

The best agricultural practices that can be utilized whilst still maintaining a profit margin can only produce a portion of the food humanity needs to survive. The sad reality is that without certain nutrients, the plant life we depend upon will not grow in the quantities demanded by the marketplace.

The three primary nutrients that are essential to plant growth are Nitrogen (N), Phosphorus (P) and Potassium(K). The secondary nutrients are Calcium (Ca), Magnesium (Mg) and Sulfate (S).

These nutrients are often lacking in the soil and without them, plants suffer from diminished growth, increased proneness to disease and the inability to provide humans and animals with nutritious food.

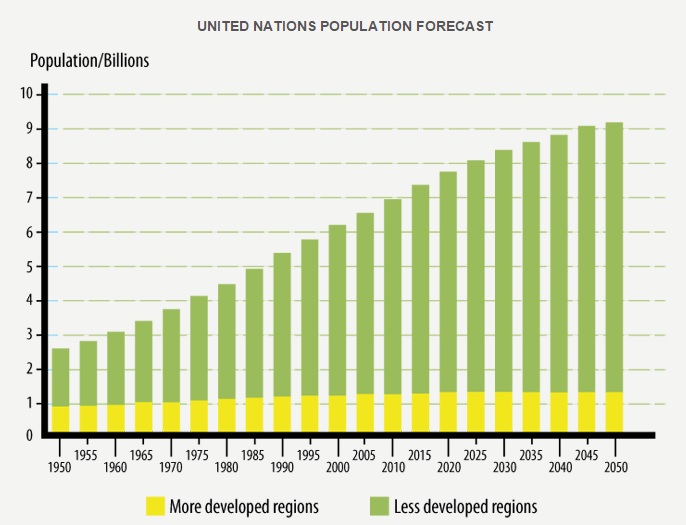

In the next 50 years, humanity is going to have to produce more food than it has in the previous 10,000 years. This may seem like it is a daunting task, especially when you consider all the factors that hinder the expansion of the food supply. That being said, it is completely achievable.

(Source: DuSolo Fertilizers/United Nations)

The Solution:

Whilst the world is making great advancements in the area of genetically modified organisms, this does not replace the need for nutrients. Since man discovered that if he mixed manure into the earth before he planted his crops he would receive a bigger harvest than if he did not, humanity has been applying fertilizer to crops to increase yields.

Having lived and worked on a farm, I know first hand the impressive yields that result in the correct application of fertilizers. If no fertilizer is applied, there can be a difference of at least 30-50% in the yield.

The greater adoption of the use of fertilizer in developing nations is going to feed the world. The wealth that will be created within the agricultural sector in the next 50 years is truly mind boggling.

As an intelligent investor, it behooves you to identify a trend like this and find the companies that stand to benefit from the trend. Following on from the interview with the CEO Eran Friedlander, I bring you Duolo Fertilizers.

The Company - DuSolo Fertilizers Inc (OTC: ELGSF)

History

Three years ago, the management team of DuSolo Fertilizers Inc. (formerly Eagle Star Minerals Corp) identified that the explosive growth in the agricultural sector within Brazil would cause the demand for fertilizer to substantially increase.

Acknowledging the fact that Brazil is a major importer of agro-minerals, the team set out with the goal of becoming a domestic producer of Phosphate based fertilizers. Their strategy would capitalize on the ability to sell Direct Application Natural Fertilizer (DANF) and other phosphate based fertilizers at a later stage, to local farmers at a significant discount to its competitors imported products.

On the 14th of October 2014, DuSolo received all necessary mining and environmental permits and successfully transitioned to a producer. No mean feat considering the short time frame.

The Country - Brazil:

- Ranked as the leading agrarian (agricultural exporting) country in the world.

- 1st in global exports of sugar, coffee, orange juice, soybeans and poultry.

- 4th largest consumer of agro-minerals.

- Economy expanding at a rapid rate, 3rd behind China and India.

- Leading economy in South America. On pace to be the 5th largest economy in the world.

- Small scale agriculture occupies 23% of Brazil's arable land (4.1 million small farms).

- 388 Million hectares of arable land, 90 Million not yet cultivated – largest arable land deposit in the world.

- 2nd largest importer of Phosphate ($1.1 Billion in annual sales revenues).

This has created a tremendous opportunity for local producers to gain significant share of arguably the world’s best market for this commodity, based on cost differentials.

The Commodity - Phosphate

- No substitute for phosphorus in agriculture.

- Essential for plant growth and high yields.

- More than 70% of global phosphate supplies are located in Morocco (high transport costs).

- Other major producing nations consume almost all domestic supply.

- Brazil imports 50% of its Phosphate demand.

The Why

"Why should I waste my valuable time reading about another boring junior mining company, let alone one in the agricultural sector?"

When over a third of the participants are insolvent (589 out of 1471) you literally cannot afford to speculate with the old maxim "got a hunch, bet a bunch". Agriculture has extremely compelling long term fundamentals and when legendary commodity investors are interested in a sector, all investors and speculators should listen.

"James West: So for example I’m a shareholder in a phosphate company that’s going into production in Brazil very soon – DuSolo Fertilizers – is that the kind of thing where an investor could benefit by exposure to the fertilizer business in Brazil, where consumption is growing?

Jim Rogers: Yes, yes. That’s exactly what I’m talking about. Now I have no idea whether your company is competent, if they know what they’re doing or anything else. But if they do, and if they do have a good deposit, and they are low-cost producers, yes! They’ll do extremely well, there’s no question about that. There are people who will tell you that some of the basic supplies for fertilizer are in decline, and so the world needs all the raw material they can get."

Jim raised some pertinent questions. Let’s cover off on them.

Management - Who are they? Relevant skills? Experience?

Management is the key component of any company especially a junior. In a market where 90% of the companies listed are not worth the intrinsic value of a politicians promise, you better hope the team you're examining exhibits an impressive CV. Fortunately, DuSolo's management has experience and success written all over them.

- The team is made up of people with Phosphate specific experience, handy when they're running a phosphate mine. Many of the team members worked for MbAC, a company that previously produced DANF in the same region as DuSolo’s.

- This team has flooded the company with a wealth of knowledge that is directly related to the product they are producing, the immediate location they are producing it in and all the industry contacts that will be needed to market the product to the end user.

- It's important to note that the entire technical team is derived from Brazil and they all have relevant local Phosphate experience.

- The ability of the team to get all the permits in place within 7 months demonstrates an in depth understanding of the Brazilian mining regulatory system. The fact that they deliver on their promises is not to be overlooked. Trustworthy management is a rare commodity these days.

If you only take away one thing from my research on management, let it be that they have previously made money in Phosphate.

Let’s have a look at the team:

ERAN FRIEDLANDER (LLG, MBA) > PRESIDENT & CEO

Strong business background within Europe and the Americas (specifically Brazil.) Founding partner of numerous successful private and public ventures active in the financial, natural resource and IT sectors.

DR. JOSE ELOI GUIMARAES CAMPOS (PHD GEOL.) > COO

Head Prof. of Geology at the University of Brasilia, expert in Stratigraphy Sedimentation and Tectonic Evolution. Responsible for the development of the genetic model behind the discovery of the Itafos Arraias SSP mine now owned and operated by MbAC Fertilizers Corp.

LESLIE SHEN (BBA, CA) > CFO

Held senior financial management, reporting and audit positions with top level accounting firms such as Manning Elliot LLP, Price Waterhouse Coopers LLP & BDO Canada LLP.

PROF. PAULO AMORIM (B.SC GEOLOGY) > VP OF EXPLORATION

Headed both exploration programs for both MbAC & Rio Verde Minerals. Head professor of Economic Geology at the University of Rio de Janeiro. 22 years employed at Vale as General Manager of Exploration & Acquisitions.

TIAGO PEREIRA (MASTERS DEGREE IN MINING) > PRODUCTION DEVELOPMENT MANAGER Mining engineer and MbAC’s former Production Manager for the Direct Application Natural Fertilizer Facility.

FABIO DE MENDONCA (MSC. GEOL) > VP OF BUSINESS DEVELOPMENT BRAZIL Senior geologist with vast Brazilian specific geological experience having worked with companies - Xstrata Nickel, Yamana Gold (AUY) and Castillion Resources.

I would encourage you to go to the website and examine the entire management team. The company’s CV is one of the most impressive I've seen.

The Projects

DuSolo has 3 projects. They include:

- Ruth

- Samba

- Bomfim (the producing property)

Bomfim is the company's flagship property now in production. There is currently an ongoing exploration program aimed towards expanding the already impressive resource estimate. Management is of the opinion that the current resource estimate is around 10% of the total potential that remains on the property. If that turns out to be the case, that is quite a substantial deposit.

The plan for Bomfim is as follows:

Stage 1 of Production – DANF

- Little processing is required to sell high-grade phosphate.

- Local market is established and is in close proximity.

- Sale of DANF covers initial investment in less than 1 year.

- Revenues generated will provide capital to develop the company further and prove larger tonnage resource at minimum dilution.

Stage 2 of Production

- Currently being investigated through internal scoping studies and would include either, Thermal phosphate, SSP, TSP or MAP.

The company owns 100% of the project and it borders MbAC Fertilizer Corp's SSP operation so there is a good chance their gut feeling is right.

The combined initial resource estimate using a 3% cut-off grade is as follows:

(Source: DuSolo Fertilizers Inc)

Further exploration of the Bomfim project has since been completed and includes:

- Santiago Target - 58 RC drill holes totaling 1301.5m

- Tataco Target - 32 RC drill holes totaling 600.5m

Santiago was focused on further defining the mineral resource. Tataco was focused on proving the existence of mineralized zones that were previously identified by mapping.

I'm pleased to see that shareholder cash is being used to further define the resource base. We should expect the lab results to be back by the end of April. They plan on releasing an updated 43-101 later on this year in conjunction with a feasibility study based on an audit of the company’s actual operational costs.

Production

The company just received the additional 3 hammer mills that are required to expand production from 80,000t to 160,000t. They will be installed shortly after the engineering work has been completed.

On January the 12th, they announced that they had secured a sales contract to supply 40,000t to a large local soybean producer at a price of $110t CAD for a total of $4.4 Million.

Subsequently, on April the 7th they announced that they had secured an additional sales contract of 10,000t to a local sugarcane grower. The total of 50,000t in contracts has gone a good way to reach their sales target of 160,000t in 2015.

They have been delivering on their promises to secure the contracts and it is highly likely there will be additional sales announced in the near future as the company is aggressively targeting the sugarcane producers for the beginning of the season.

Another demonstration of the management's business acumen was the announcement on February the 26th that the company would be purchasing Phosphate rock (10% P205) at a hefty discount of $22t CAD. The supplier is close to Bomfim and the company intends to blend the purchased Phosphate with it's own high grade Phosphate to create a DANF product of around 15% P205 that it will sell to farmers in the region.

Going off the average sales price of $90 CAD per tonne of DANF, this represents an excellent profit margin and it also means they will not be depleting as much of their own resource base.

I'm of the firm belief that they will have more demand for their products than they can supply. This is a good problem to have. The goal of becoming a mid tier local producer is completely achievable, especially considering the company's performance to date.

(Source: DuSolo Fertilizers)

Balance Sheet and Finances (December 31st 2014)

- Cash and cash equivalents $3,191,810

- Total assets $9,157,125

- Loan payable $510,064 (to be paid off in full by August 10th. On February 17th paid lump sum of USD $222,455)

- Total liabilities $2,140,514 (includes $1,170,000 of acquisition costs)

With the recently announced sales contracts, they're well positioned to be completely self sufficient for the foreseeable future.

The company is soon to be debt free as half the loan has been paid off with the rest soon to follow.

The cash burn rate is around $200k a month averaged out. The production season of the year has higher costs for extra staff, production expenses etc, but these costs decrease substantially during the raining season.

Share Structure

The current structure is comparable with other junior fertilizer companies on the TSXV except DuSolo has a distinct advantage over the majority of the juniors, being that it has a producing mine that makes a profit.

Once they ramp up production and begin to expand their market share, I will be looking for the management to initiate a share buyback plan. My view on this matter will be influenced by the share price and available cash.

- Shares outstanding: 130,294,385

- Warrants March 31 2016 $0.19: 1,130,042

- Warrants October 1 2016 $0.305: 1,635,811

- Stock Options: 11,465,000

- Fully Diluted: 144,498,238

Costs and Profit

Here is the kicker. The production costs are approximately 40% of the sales price. That means a 60% profit margin. Lets examine these numbers further:

50,000t existing sales contracts: 50,000t x $90= $4,500,000

$4,500,000 x 60% profit margin = $2,700,000 Profit.

Lets put that into perspective with the M&I resource base at Bomfim:

462,000 x $90 = $41,580,000

$41,580,000 x 60% profit margin = $24,948,000 Current Resource Estimate Profit

Lets go further and divide that per share fully diluted:

$24,948,000 / 144,498,238 = $0.173 of Earnings Per Share.

As stated before, management is convinced that the current resource estimate represents only 10% of the resource. I'll be very conservative and calculate the profit on 10x the current M&I resource:

4,620,000t x $90 = $415,800,000

$415,800,000 x 60% profit margin = $249,480,000 profit

249,480,000 / 144,498,238 = $1.73 Per Share

As you can see, if the company is able to further define the resource estimate at Bomfim as per its estimates re: potential, and converts a mere 10% of the inferred high grade resource to M&I, profits expand dramatically.

This valuation does not take into consideration the additional value of the high tonnage/lower grade resource which should prove to be significant. Furthermore, these calculations were done with a base sales price of $90 CAD per tonne.

It is quite certain that the company will be well positioned to raise the price of its products once it has secured market share as they are currently pricing their product at about 33% of the price of their nearest competitor.

Insider Ownership

DuSolo has an institutional ownership of 25%. The largest holders are Tembo Capital Mining Fund and M&G Investment Management Ltd. There has also been recent insider buying.

Competition

The only alternative to the DANF product that DuSolo produces is Phos-rock that has to be imported. By the time it reaches the country, the price is nearly 3 times that of DANF.

MbAC was previously producing DANF however they have now ceased production of the product to focus on SSP, leaving a massive void in the market.

Fertilizer is one of the farmers biggest expenses so DuSolo is well positioned to capture market share with a product that is priced well below the imported alternative.

Another appealing feature is the ability of the local farmers to pick up the DANF directly from the production facility at Bomfim when they need it, reducing transportation and logistical costs.

Margin of Safety

DuSolo has an excellent margin of safety with such a high profit margin and a depressed share price. Global Phosphate prices are hovering around $115 US a tonne, down from a high of $425 US a tonne in 2007. Yet by the time it reaches the Cerrado, one tonne of phosphate (based on current global prices for the commodity) is three times more expensive then that of DuSolo’s products.

Even if the price of Phosphate was to fall to its pre-2007 level of around $50 US a tonne, the company would still be profitable.

In a market where over a third of the participants are literally insolvent and the majority of the remainder are on the way to achieving the same fate, it pays to identify companies that can survive in a lower commodity price environment.

The Catalysts

- Investors are on the sidelines and are waiting for more sales contracts to be announced. These additional contracts, along with the drill results from the recent exploration at Bomfim will serve to increase the value of the company and its projects. Positioning yourself before the announcements (as I have) may reward you when the market picks up the news.

- The weakening Brazilian Real (around 30% to date) will lend additional support to DuSolo's sales efforts as the costs to import fertilizer have risen substantially for local consumers. Being a domestic producer, they are well positioned to benefit from the ongoing currency wars.

- Being a domestic fertilizer producer in one of the biggest agricultural regions and attracts a lot of attention to the business. I'm of the opinion that the company is a massive take-over target. Allana Potash Corp (ALLRF) was just bought out for $137 Million so there is definitely money on the sidelines looking to be deployed.

Summary

For those wishing to provide themselves with exposure to a fundamentally driven bull market in agriculture, DuSolo Fertilizers provides you with the perfect vehicle.

- Strong management and technical team with Phosphate specific experience

- Excellent relationships with the government and local populace.

- No domestic competitors, opportunity to grab a massive market share.

- 60% profit margin.

- Essential product - No substitute.

- 50,000t in confirmed sales contracts, more on the way.

- High-grade deposit with compelling fundamentals for further expansion of resource estimate.

- Excellent margin of safety - Low cost producer trading near 52 week low.

- Cash flow positive, soon to be debt free, self sufficient with no need for financing.

- Ongoing exploration program - Management deploying capital directly into the business.

- Potential take-over target.

- Most importantly - A team comprising individuals who have previously made money in Phosphate.

Disclosure: I'm a shareholder of Dusolo Fertilizers.

Thanks Tom.Some interesting stats here. I'm going to add the ticker to my watch list to see if the stock shows any momentum. Right now it appears to be trading very close to its 52 week low of 0.14 which may or may not be a good sign. Is there a strong seasonal element with this stock ie is it affected by the different agricultural seasons?

Hi Joe,

I've been buying more as its been falling. The company can only produce once the rainy season is over so there may be some seasonality baked into the share price, but I'm of the opinion that the market is waiting to hear more sales contracts announced, along with a revised 43-101 with an expanded resource base.

great article, Tom!

Thanks Tony! Much Appreciated!