Durable Goods New Orders Dive 5.4 Percent On Top Of Big Negative Revision

Durable Goods data from the commerce department, chart by Mish.

Understanding the Big Swings

Big swings in durable goods are due to wild swings in aircraft orders.

I don’t show aircraft orders because they would dwarf everything else. For example, nondefense aircraft orders fell nearly 50 percent this month after rising nearly 100 percent last month.

It’s best to focus on the other numbers.

I added two new columns this morning. The first is Core Capital Goods defined as Nondefense Capital Goods Excluding Aircraft. The second is Shipments. It’s primarily shipments that impact GDP.

Advance Report

Today’s Advance Durable Goods Report is a subset of the Factory Orders report that follows with a lag.

The full report contains nondurable goods and other data points not included in the advance report.

New Orders: New orders for manufactured durable goods in October, down three of the last four months, decreased $16.0 billion or 5.4 percent to $279.4 billion. Excluding transportation, new orders were virtually unchanged. Excluding defense, new orders decreased 6.7 percent. Transportation equipment, also down three of the last four months, drove the decrease, $16.0 billion or 14.8 percent to $92.1 billion.

Shipments: Shipments of manufactured durable goods in October, down three of the last four months, decreased $2.4 billion or 0.9 percent to $280.4 billion. Transportation equipment, down four of the last five months, led the decrease, $2.1 billion or 2.3 percent to $88.4 billion.

Inventories: Inventories of manufactured durable goods in October, up three consecutive months, increased $1.5 billion or 0.3 percent to $525.1 billion. Transportation equipment, also up three consecutive months, led the increase, $1.1 billion or 0.6 percent to $165.9 billion.

Capital Goods: Nondefense new orders for capital goods in October decreased $15.8 billion or 15.6 percent to $85.3 billion. Shipments decreased $0.2 billion or 0.3 percent to $82.9 billion.

Durable Goods New Orders in Millions of Dollars

That’s a much better way of looking at things but it is still hard to read. Let’s hone in on the key details month-over-month.

Shipments, motor vehicles and parts, and core capital goods are all down two consecutive months. Excluding transportation new orders were flat.

Shipments, which feed GDP, were down 0.6 percent in September and another 0.9 percent in October.

This was not a great report, or even a good one, but it isn’t as bad as the -5.4 percent headline number.

Motor vehicles and shipments were the worst part or the report. But it’s hard to say how much of an impact the UAW strike had on those items.

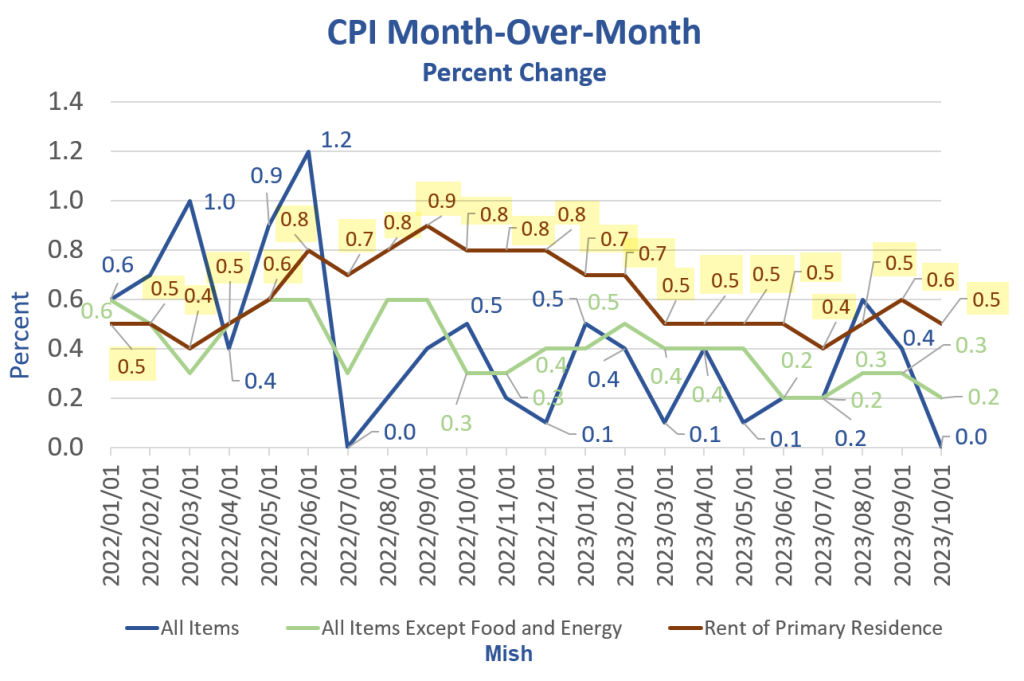

Inflation Keeps Taking a Toll

Elsewhere, inflation is worse than Biden wants you to believe, especially rent and food.

For discussion, please see Falling Rent is Extremely Rare, Yet Economists Keep Expecting That

Also note The Average Increase in the Price of Food Every Month for 32 Months is 0.6 Percent

Food and rent explain the polls that show consumers are in a bad mood.

More By This Author:

Powerful Stock Market Rally Leaves Four Stacked Gaps But They Will CloseExisting Home Sales Sink 4.1 Percent, Down 19 Of The Last 21 Months

Argentina’s New President Wants to Adopt the U.S. Dollar, How Would That Work?

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more