Dramatic Corn And Soybean Seeding Changes

Market Analysis

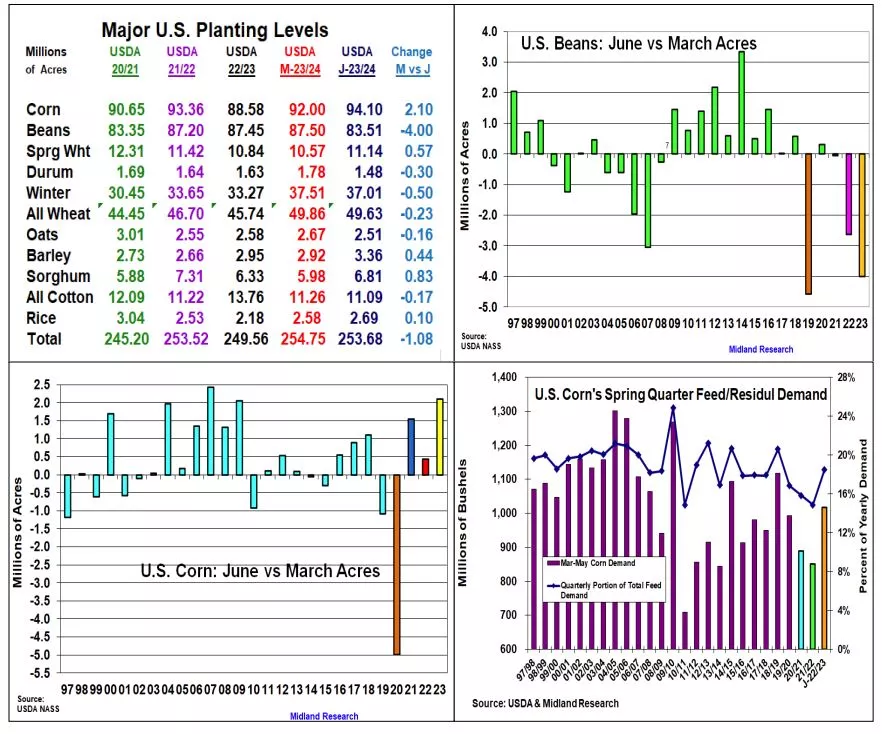

The USDA’s June acreage report again provided some dramatic surprises in US plantings. Some shifting between regions were expected, but 2023’s June changes across the Midwest were unprecedented. This year’s 5.2 million rotation with corn up 1.53 million & soybeans down by 3.67 million acres was the largest in memory for this report. Nationally, June’s corn seedings are 2.1 million larger while beans are 4.0 million acres lower vs March. A strong US cash corn price & a generally unencumbered planting season except for ND’s wetness kept the planters rolling while Brazil’s big crop & aggressive sales left bean prices defensive during US planting.

In soybean, the high producing states of IL, IN, & OH dipped their seeding by 1.35 million while IA & NE sliced their plantings by 650,000 acres. KS & ND producers also slipped 850,000 from their 2022 seedings. Overall, these lower plantings in higher yielding states should curtail 2023’s US average yield. However, the current rally will also jump double crop soybean plantings in US soft red wheat country.

Despite US corn producers projecting a 3.42 million jump in March plantings, the June survey added another 2.1 million acres. Overall, IL, IN, OH increased their area by 1.05 million while IA, MN & NE increased their seedings by 800,000. However, the lower yielding states of ND, SD & TX also jumped their planting by 1.75 million. Overall, 2023’s 5.5 million increase in US area could still produce 15 billion bu 2023 crop even with a 176 bu yield.

June’s quarterly US corn & bean stocks were also lower than expected. Corn’s 4.1 billion bu level was 150 million below expectations & 250 million below last year. With corn’s exports & ethanol demands generally known, this unexpected disappearance is shifted into feed/residual This bumps corn’s spring usage to 1.0 billion bu. or 150 million higher than 2022. With feedlots numbers down 2-3% and pork & poultry slaughters slightly higher, this stock level suggests 2022’s crop could be 150 or more overestimated. Bean’s 796 million stocks were 20 million below the trade & increases its residual to 171 million, highest ever, suggesting a lower 2022 crop.

What’s Ahead:

This year’s US June seedings & quarterly stocks have added some production unknowns for both old & new-crop corn and soybeans. Weekend storms have lessened the Midwest drought in various areas, but timely rains will be needed to keep yields strong.

Hold new-crop bean sales at 35-40% and looking to sell final old-crop corn & 30-40% of new-crop at $5.45-$5.60 basis Sept & Dec.

More By This Author:

U.S. Plantings Advanced Normally Except In The N Plains This YearSmaller Supply & Stronger Dollar have Impacted US Demand

Record US Crush & Solid Exports, But Focus On US Midwest Weather

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more