Dow Up Triple Digits; S&P 500 Eyes Another Record Close

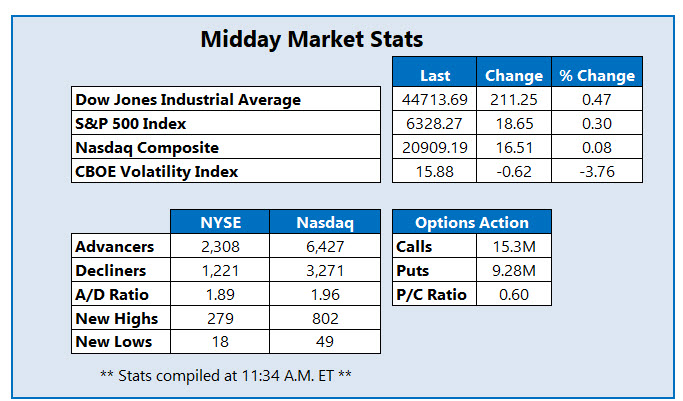

The Dow Jones Industrial Average (DJI) is sporting a triple-digit lead this afternoon, as the trade deal between Japan and the U.S. injects optimism into the market. Investors are also monitoring tariff negotiations with the European Union (EU) ahead of the Aug. 1 deadline. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are firmly higher, too, with the former pacing for another record close and the latter eyeing a seventh gain in eight sessions.

Home sales from the National Association of Realtors showed a drop of 2.7% in June from May to 3.93 million, compared to an expected 0.7% fall. Sales remained unchanged year over year.

Rocket Companies Inc (NYSE: RKT) stock is seeing unusual options activity today, with 182,000 calls and 35,000 puts exchanged so far today, which is 9 times the volume that is typically seen at this point. The most popular contract is the August 17 call, where new positions are being opened. The equity was last seen 0.2% higher to trade at $16.03, but earlier surged to its highest level since October after yesterday seeing a price-target hike from Jefferies to $14 from $11.50. The financial services name is gearing up to report second-quarter earnings after the close on Thursday, July 31, and sports a 51.7% year-to-date lead.

Lamb Weston Holdings Inc (NYSE: LW) stock is leading the SPX today, last seen up 20.5% to trade at $59.20 at last glance, on track for its best single-day percentage gain on record. Today's surge follows the company's fiscal fourth-quarter profit and revenue beat, as well as its strong annual sales forecast. Shares earlier surged to their highest level since February, overcoming resistance from the 20-day moving average, but still carry an 11.1% year-to-date deficit.

Fiserv Inc (NYSE: FI) stock is at the bottom of the SPX, last seen down 17.5% to trade at $136.96, well in its way to its worst day since April 24. The fintech giant beat second-quarter profit expectations and also signed a multi-year agreement with TD Bank Group to expand its presence in Canada, but also lowered its full-year revenue growth forecast. FI is down 33.6% so far in 2025, and earlier gapped to a more than 52-week low of $128.22.

More By This Author:

S&P 500 Nabs Another Record Close Despite Tech PullbackNasdaq Dragged By OpenAI, SoftBank Venture Setback

Wall Street Wavers Despite S&P 500, Nasdaq Record Closes