Dow Tumbles Into 10% Correction As Futures Crash, 10Y Yields Plunge To Record Lows On Pandemic Panic

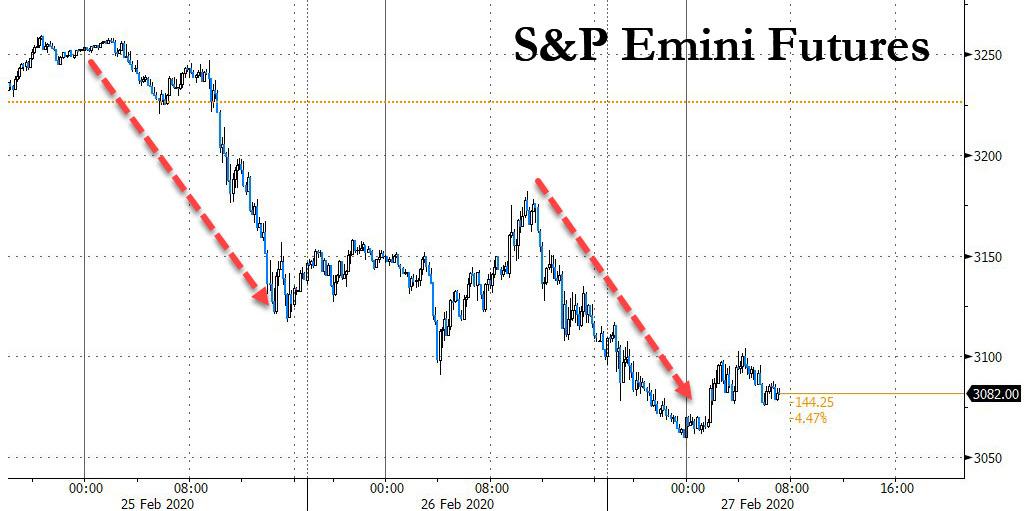

After three days of tentative attempts to BTFD in the overnight session, on Thursday for the first time, the puke in futures and global markets was so widespread that "pajama traders" did not pass go and proceeded to sell without prejudice...

(Click on image to enlarge)

... as S&P 500 futures dropped as much as 1.6% and threatened to slide below 3,000 today, while Dow Jones futs were down more than 375 points lower, sending the broad index into correction territory, down 3000 points from its last week highs.

(Click on image to enlarge)

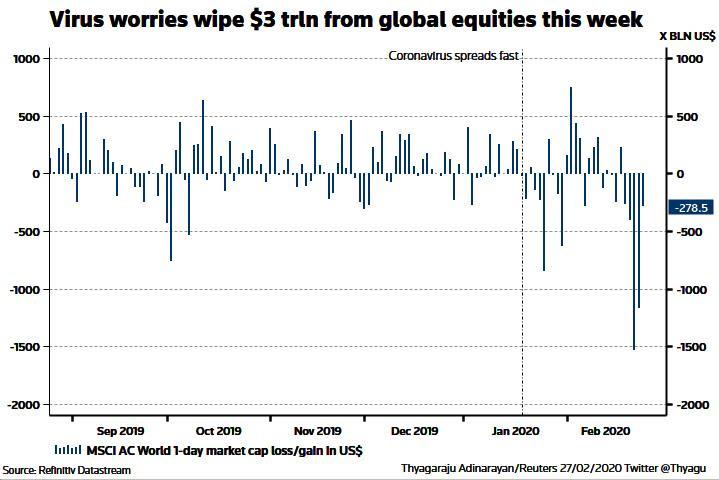

The MSCI All-Country World Index fell for a sixth straight day, with Japan’s Topix and the Stoxx Europe 600 leading declines among major indexes.

The same risk aversion that was sparked in recent days by a growing pandemic panic, drove global stocks lower on Thursday, increasing their drop in value this week alone to more than $3 trillion...

(Click on image to enlarge)

...and U.S. Treasuries yields hit record lows just below 1.28% after the Centers for Disease Control and Prevention reported the first U.S. coronavirus case of unknown origin.

(Click on image to enlarge)

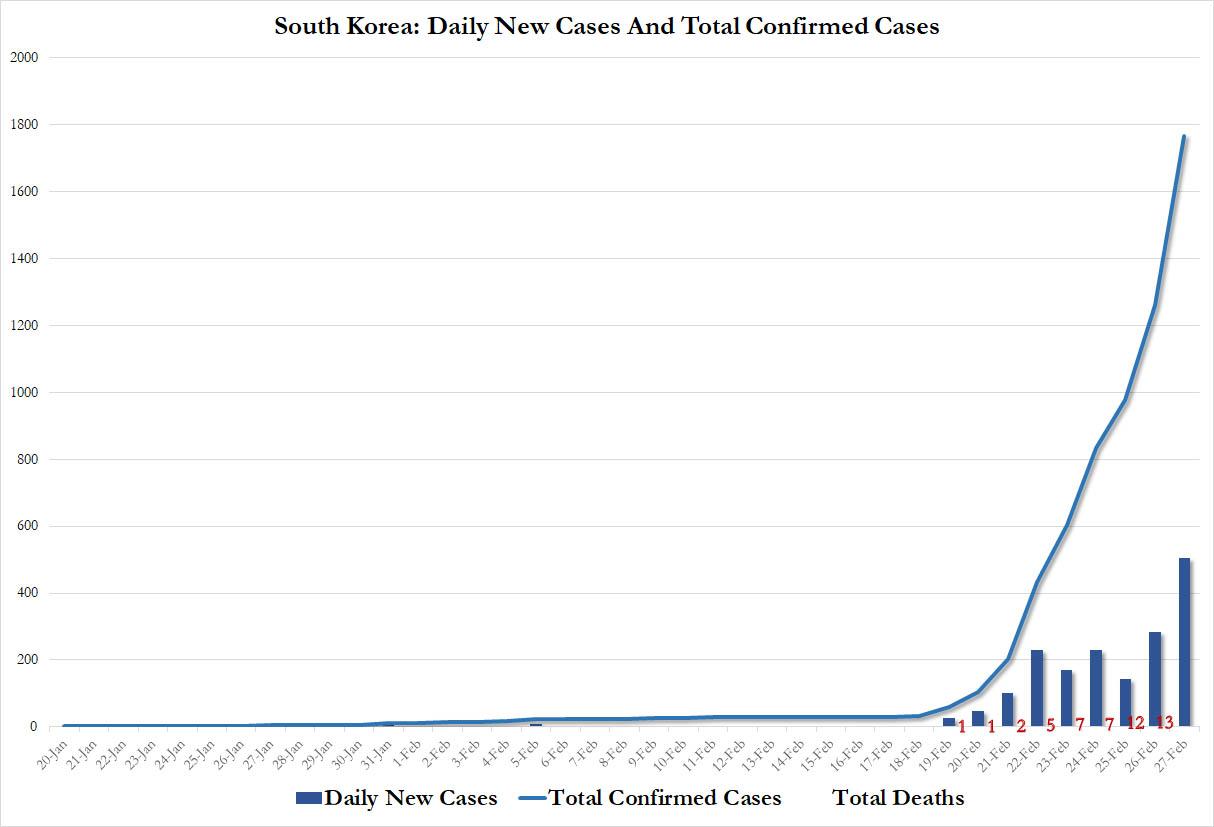

... as the coronavirus spread faster outside China than in, with South Korea reporting a whopping 505 new cases, nearly double the 284 on February 25, pushing total cases to 1766 and a 13th coronavirus-related death reported. Overnight President Trump named Vice President Mike Pence to lead the government’s preparations to tackle the virus outbreak and sought to reassure the public that the authorities are ready to handle the situation; at the same time California reported the first US coronavirus case which had been the result of "community transmision", and whose origin was unknown.

(Click on image to enlarge)

“The fact that, not only is there no sign yet of the pathogen being contained, but rather we now also face the specter of it spreading through the U.S., will continue to weigh on the global macro outlook for the coming months,” Simon Ballard, chief economist at First Abu Dhabi Bank, wrote in a note. “Buckle up for continued high volatility and escalating risk aversion.”

Meanwhile, next door Japan's ruling party is reportedly considering an extra budget to tackle the virus outbreak, according to Nikkei, as Germany reported 9 new cases of coronavirus so far on February 26, whilst Denmark reported its first case.

As traders scrambled for some clarity amid the panic, global equities have now fallen for six straight days, and Wall Street’s volatility gauge was near its late-2018 highs.

European stocks were pummeled from the open, with the STOXX 600 index falling 3%, the lowest level since Oct 22, 2019, and the blue-chip index in Italy - the worst-hit country in Europe - sinking as dozens of European companies issued warnings about potential damage to their profits. Travel stocks underperformed, down ~12% since the start of the week, with all sectors in the red. Anheuser-Busch InBev NV was among the worst performers in Europe after a dismal forecast. Several large companies on the benchmark, including HSBC Holdings Plc, are today trading without the right to dividends, potentially exacerbating declines.

In the United States, Microsoft became the second trillion-dollar company to warn about its results after Apple. Its Frankfurt-listed shares were down 3%.

Earlier in the session, Coronavirus fears sent Asian stocks toward their biggest six-day losing streak since August, with the IT and energy sectors falling the most. Markets in the region were mixed, with the Jakarta Composite Index and Japan’s Topix falling, while Thailand’s SET and Hong Kong’s Hang Seng Index climbed. The U.S. urged travelers to reconsider trips to South Korea as cases there rose above 1,500. While Bank of Korea left its key interest rate unchanged, it lowered its annual growth forecast on mounting evidence of an economic hit from the coronavirus. The Topix declined 2.4%, with PIA and Sanix falling the most. The Shanghai Composite Index rose 0.1%, with Tianjin Songjiang and Shanghai Shenhua posting the biggest advances.

Goldman Sachs said the equity market sell-off would create opportunities to add risk eventually and that it did not expect a deep bear market or U.S. recession. “However, near term we feel that positioning and valuations are not yet depressed enough and uncertainty on the global growth impact from the coronavirus is likely to remain high,” Goldman Sachs said in a note to clients.

“Safe-haven currencies are doing very well and gold is heading back higher, and unless we see a slowdown in the coronavirus cases outside China, risk sentiment will continue to be undermined,” said Peter Kinsella, global head of FX strategy at UBP in London

Yields on U.S. Treasuries, which fall when prices rise, dropped to a record low 1.28 for 10-year debt and the yield curve continued to send recession warnings. German 10-year debt fell to -0.5140%. Italian debt underperformed as the spread of the virus there raised fears of a recession. Australia’s 10-year yield dropped to a record low on accelerated demand for haven assets as the nation initiated an emergency pandemic plan.

Meanwhile, as the market begs for a Fed bailout, fed funds futures are now pricing a quarter-point rate cut by the end of April, while the benchmark three-month London interbank rate for dollars fell Thursday by the most since January. The May 2020 fed funds contract has an implied rate of 1.305%; that’s more than a quarter of a percentage point below the fed funds effective rate, currently 1.58%. The January 2021 fed funds future shows close to three quarters of a percentage point of easing by year end. The three- month U.S. dollar Libor rate fixed lower by 3.287bp on Thursday, ICE data show, the largest decline since Jan. 8.

In FX, the dollar fell against most major currencies as investors worried over the U.S.’s vulnerability to the spread of the coronavirus. The pound reversed gains to lead G-10 losses after the U.K. said it would prepare for a no-trade-deal exit if negotiations with the European Union did not proceed swiftly.

“The dollar is being broadly sold as risk-off sentiment heightens on the report of the infection in the U.S.,” said Takuya Kanda, general manager at Gaitame.com Research Institute Ltd. in Tokyo. “The currency is also under pressure because Trump’s speech may have disappointed the market.” The yen enjoyed support from purchases by local banks, rising nearly 2% on the week; it pared gains after Japanese Prime Minister Shinzo Abe reportedly called for all elementary, middle and high schools in the country to close from Monday through to the end of the spring holidays as part of measures to combat the virus spread. The safe-haven Swiss franc also gained on Thursday. Sweden’s krona advanced against all major peers, supported by flows from the Norwegian krone, and after retail sales data and an economic tendency survey surprised to the upside.

Predictably safe haven gold rose 0.8% to $1,652 per ounce, just shy of the seven-year high it hit on Monday, and silver gained 1% to $18.03 an ounce. Meanwhile oil - sensitive to global growth - fell more than 2% to its cheapest in 14 months

To the day ahead now, there’s an array of data in the US, including the second reading of Q4’s GDP, the preliminary January readings for durable goods orders and non-defence capital goods orders ex-air, weekly initial jobless claims, the Kansas City Fed’s manufacturing activity index for February, and January’s pending home sales. From central banks, we’ll hear from ECB President Lagarde, as well as the ECB’s Panetta, Schnabel, Lane, de Guindos and Lane. In addition, the Fed’s Evans and the BoE’s Cunliffe will also be speaking. Autodesk, Best Buy, Dell Technologies, and VMware are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.6% to 3,092.50

- STOXX Europe 600 down 1.5% to 398.54

- MXAP down 0.7% to 159.60

- MXAPJ up 0.01% to 524.89

- Nikkei down 2.1% to 21,948.23

- Topix down 2.4% to 1,568.06

- Hang Seng Index up 0.3% to 26,778.62

- Shanghai Composite up 0.1% to 2,991.33

- Sensex down 0.3% to 39,760.00

- Australia S&P/ASX 200 down 0.8% to 6,657.90

- Kospi down 1.1% to 2,054.89

- German 10Y yield fell 0.9 bps to -0.514%

- Euro up 0.5% to $1.0934

- Italian 10Y yield rose 0.5 bps to 0.827%

- Spanish 10Y yield rose 1.3 bps to 0.263%

- Brent futures down 1.9% to $52.44/bbl

- Gold spot up 0.3% to $1,645.04

- U.S. Dollar Index down 0.2% to 98.78

Top Overnight News

- More coronavirus cases were reported in countries other than China for the first time, the World Health Organization said, a significant development as new cases spread around the globe

- Vast swathes of the Lombardy and Veneto regions of Italy, stretching from Milan to Venice, remained in a virtual lockdown. Spain kept about 700 guests confined to a Canary Islands hotel as they undergo tests, while France announced four new confirmed cases, including a 60-year-old Frenchman who died in a Paris hospital overnight. Greece reported its first case

- The ongoing coronavirus epidemic is causing a significant challenge to U.S. businesses in China due to travel disruptions and reduced staff productivity, according to the results of a survey by the the American Chamber of Commerce

- The rapid spread of the coronavirus has prompted the Bank of Japan to ask major banks about their readiness for a worsening of the outbreak, people with knowledge of the matter said

- U.K. Prime Minister Boris Johnson told the European Union he’ll walk away from the negotiating table in June if it’s not clear he’s going to get a Canada-style free trade agreement for Britain. The U.K. is setting a tough timetable for the negotiations, saying it wants the broad outline of an agreement by June, so the deal can be finalized by September

- Saudi Aramco is starting early preparations for an international listing, just months after the oil giant turned its record initial public offering into a domestic affair and sidelined global banks, people with knowledge of the matter said

- There’s a good chance that U.K. companies will unleash spending this year with a double boost from an expansionary budget and more clarity over Brexit, according to Bank of England Chief Economist Andy Haldane

- Norway’s sovereign wealth fund boosted its South Korean government debt holdings in 2019 to $5.6 billion from $5.1 billion in the previous year, according to data published on its website

- Spain’s vicious start-and-stop cycle of bad jobs has become one of Europe’s most chronic economic dilemmas, a problem unresolved by its post-crisis boom

Asian equity markets traded mostly lower following a mixed Wall Street handover, as major indices faded gains heading into the latter part of the US session before the Dow and S&P dipped into negative territory – with the former’s losses tallying over 2000 points this week thus far. Furthermore, US equity futures trickled lower since reopen amid the rising virus cases outside China and with the first “community spread” reported in the States. ASX 200 (-0.8%) is mostly weighed on by its banking and base-metal miners, while some earnings-related movers were scattered across the index. Nikkei 225 (-2.1%) underperformed with downside led by manufacturing, automakers, and financials, whilst Panasonic shares slid over 4% after ending its solar partnership with Tesla. KOSPI (-0.7%) hit levels last seen in October last year as the index continued to be weighed on by the surging number of coronavirus cases in the country, alongside the surprise hold on rates by the BoK. Elsewhere, Hang Seng (+0.3%) joined the regional stock rout as the energy and entertainment names added further to the losses seen this week, whilst Shanghai Comp (+0.1%) showed resilience and bucked the trend despite yet another PBoC inaction, as the rate of virus deaths in the country eased, the rate new cases steadied, and with further pledges from China to cushion the virus impact and stem the contagion.

Top Asian News

- China May Cut Deposit Rates So Battered Banks Can Keep Lending

- Hong Kong Property Tycoon Peter Woo to Take Wheelock Private

- South Korea Reports 505 More Coronavirus Cases, 1 Death Feb. 27

Once again, it’s been a tough start to the session for European equities (Eurostoxx 50 -2.3%, FTSE 100 -1.9% and now in correction territory) as market sentiment is dictated by incremental newsflow surrounding COVID-19. Focus continues to reside on developments external to China with the further selling pressure being brought about by multiple updates including the potential first “community spread” case in the US, the mounting case count in South Korea and government’s across the globe lifting their threat levels over the virus. Despite comments from the WHO that the coronavirus case count might have been inflated in Italy by testing errors, markets have not been able to stage anything close to a meaningful recovery. From a sector standpoint, as has been the case throughout the week, selling has been relatively broad-based with only utility names holding up marginally better than their peers following earnings from Engie (+4%). Travel names continue to remain the ugly duckling in Europe with recent- cost-cutting measures across the sector unable to stop the rot; Tui -6.3%, easyJet -7.5%, Lufthansa -7.5%, RyanAir -7%, IAG -8%. Elsewhere, it’s been a busy morning of corporate updates with WPP (-14%) at the foot of the Stoxx 600after a disappointing Q4 sales outturn, Belgian Heavyweight AB Inbev (-9.5%) are lower after warning on Q1 profits in the wake of COVID-19, whilst UK homebuilder Persimmon (-4.5%) lag peers after posting an annual decline in profits. To the upside, Carrefour (+3.5%) are firmer after announcing increased cost savings targets alongside earnings, Reckitt Benckiser (+2.5%) have reversed losses seen at the opening after taking a GBP 5bln impairment on Mead Johnson Nutrition and British American Tobacco (+1.5%) are showing mild gains after showing pretax profit and sales growth in its latest earnings update. Stateside, focus will be on Microsoft (-2.5% pre-market) after the Co. cut its Q3 personal computing segment revenue guidance due to coronavirus.

Top European News

- Danske Bank Cuts Hundreds of Jobs in Effort to Rein In Costs

- Reckitt Benckiser Takes $6.5 Billion Charge Over Formula Deal

- Boris Johnson to Put U.K. on Collision Course With EU Over Trade

- Norway’s Wealth Fund Returns Record $180 Billion in 2019

In FX, the Greenback has unwound all and more of its gains vs most G10 peers amidst ramped up Fed rate cut expectations on the ever-increasing spread of China’s COVID-19 epidemic to the point of pandemic proportions. The Buck’s retreat coincides with a marked rise in the number of suspected US cases and one confirmed in North Carolina from unknown origin that the CDC contends may constitute a community spread. In response, the DXY has reversed further below the 99.000 level to a 98.658 low and not far from Fib support at 98.550 that virtually coincides with another strong technical mark in the form of a late November 2019 high. Ahead, multiple US data releases and more Fed rhetoric, but for the time being it’s all about coronavirus and contagion.

- EUR/NZD/CHF/AUD - The major beneficiaries of the aforementioned US Dollar demise, with the Euro embarking on a firmer recovery rally through 1.0900, 1.0926 resistance and a 1.0937 Fib before pulling up just ahead of 1.0950, a decent 1.0955 option expiry (1 bn) and another Fib at 1.0958. Meanwhile, the Kiwi and Aussie have both pared losses from sub-0.6300/0.6550 lows even though the RBNZ and NZ Finance Minister have warned of near term downside economic effects from the nCoV, with the former estimating a 0.3% point q/q hit to Q1 GDP, and Australia’s PM expressed concerns about a global pandemic that warrants action. In similar vein, the Franc has shrugged off latest dovish SNB commentary to a certain extent, as Usd/Chf slips closer to 0.9700 in contrast to Eur/Chf remaining above 1.0600 on the relative common currency strength noted above.

- JPY - Volatile trade for the Yen around 110.00 vs the Greenback and within a 120.56-119.96 range against the Euro, as underlying safe-haven demand alongside dovish BoJ remarks propelled the Japanese unit to best levels before key chart support and psychological levels held. However, a raft of looming Japanese economic indicators should provide some fundamental direction, including CPI, jobs, IP and retail sales.

- CAD/NOK/GBP/SEK - The Loonie is meandering either side of 1.3325 ahead of Canadian current account data and capped by another marked decline in crude, but showing a bit more resilience than the Norwegian Crown that has fallen below 10.2750 vs the Euro in wake of much weaker than forecast retail sales. Conversely, the Swedish Krona has been cushioned by encouraging sentiment indicators and wider trade surplus, with Eur/Sek retreating towards the bottom of 10.6125-5570 extremes. However, Sterling is back under pressure on a combination of bearish factors, as Cable reverses from around 1.2950 to 1.2870 or so and Eur/Gbp tests 0.8500 on heightened no deal Brexit prospects, more month end cross flows and elevated BoE easing expectations rather than actual MPC guidance via Cunliffe.

- EM - Losses across the board on broad risk aversion, but with the Try also subject to further Syrian related angst as Russia refutes any meeting in early March and the Lira breaches a key mark (circa 6.1600 vs the Usd) that had been providing a buffer.

In commodities, WTI and Brent prices are, once again, subdued on virus demand concerns as cases continue to rise and spread globally; currently, front-month futures are lower by around USD 1.0/bbl and remain just below the USD 48/bbl and USD 52/bbl marks. WTI is currently on track to post a weekly loss in excess of 10%, a loss which would be the largest weekly decline since December 2018 on a percentage term. Crude specific newsflow, away from the virus has been light, with the only pertinent comments stemming from Russian Energy Minister Novak that he wishes to increase co-operation with both Saudi Arabia and OPEC+; further pushing back on the talk of a rift within the cartel. In terms of notably commentary Gazprom have remarked that, because of the lack of clarity over demand, OPEC+ should wait a while longer before making a decision around adding to or extending production; which comes ahead of next week’s OPEC+ gathering. Turning to metals where spot gold is little changed on the day and has seen a much less volatile session than has occurred over the last few weeks; interestingly, the precious metal is currently little moved from the unchanged mark on a weekly basis in-spite of a range just shy of USD 65/oz at present. Elsewhere, copper prices are modestly softer and continued to be afflicted alongside other base metals on demand-side fears.

US Event Calendar

- 8:30am: GDP Annualized QoQ, est. 2.1%, prior 2.1%

- 8:30am: GDP Price Index, est. 1.4%, prior 1.4%

- 8:30am: Core PCE QoQ, est. 1.3%, prior 1.3%

- 8:30am: Cap Goods Ship Nondef Ex Air, est. 0.0%, prior -0.3%

- 8:30am: Durable Goods Orders, est. -1.45%, prior 2.4%

- 8:30am: Durables Ex Transportation, est. 0.2%, prior -0.1%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. 0.1%, prior -0.8%

- 8:30am: Personal Consumption, est. 1.7%, prior 1.8%

- 8:30am: Initial Jobless Claims, est. 212,000, prior 210,000

- 8:30am: Continuing Claims, est. 1.72m, prior 1.73m

- 9:45am: Bloomberg Consumer Comfort, prior 65.6

- 10am: Pending Home Sales MoM, est. 3.0%, prior -4.9%; Pending Home Sales NSA YoY, est. 2.05%, prior 6.8%

- 11am: Kansas City Fed Manf. Activity, est. -1, prior -1

DB's Jim Reid concludes the overnight wrap

News-flow surrounding the COVID-19 Coronavirus continues to take on a fairly predictable path given all that our expert epidemiologist said earlier this week on the conference call (link here for replay details). It‘a been a 24 hour period where markets initially wanted to buy the dip but after a series of constant mini blows the S&P 500 fell -0.38% last night and futures are down a further -1.34% this morning.

The latest on the virus overnight is that a case has been confirmed in Northern California of unknown origin as the person hadn’t travelled to any foreign country recently or had contact with any of the confirmed cases. This could be a sign that the virus is spreading in a local area. The new case brings the total of known infections in the US to 15, not counting repatriated Americans. Meanwhile, South Korea reported another 334 cases (307 in Daegu) overnight bringing the total to 1,595 with fatalities at 13. Also, as the number of patients rise in Daegu, the city authorities are saying that they don’t have enough hospital beds to treat patients. The US State Department issued a level 3 advisory, the highest being level 4, for South Korea overnight asking Americans to “reconsider” travel to South Korea. In what could be termed as a surprising move, the BoK shied away from cutting rates at its meeting today against expectations of a 25bps cut. President Trump also addressed the US last night and tried to reassure the public that they face limited risk from the spread of the virus but it didn’t feel as bullish as some of his previous pronouncements on the virus.

Risk off is continuing to dominate Asian markets this morning with the exception of China where the bourses are up (CSI +0.81% and Shanghai Comp +0.53%). The Nikkei (-2.09%), Hang Seng (-0.82%) and Kospi (-0.85%) are all down alongside most other indices in the region. As for Fx, the Japanese yen is up +0.30% overnight. Elsewhere yields on 10y USTs are down another -3.4bps to 1.305%. The Australian 10y is also down by -6.4bps to a record low of +0.850%. In commodities, crude oil is extending declines after hitting 13 month lows with brent crude prices down -1.33% this morning while gold prices are up +0.53%.

In other overnight news, the IMF and World Bank said overnight that they may reconsider the meetings scheduled for mid-April in Washington amid the coronavirus’ spread. The meetings typically draw about 2,800 delegates from 189 member countries, plus hundreds of other observers and journalists.

The WHO are now reporting over 80,000 cases worldwide and an increasing number of countries confirming the presence of the virus. Indeed new cases are now higher outside of China than inside. Yesterday we saw the virus spread into new parts of Europe and the last untouched continent (if you exclude Antarctica). South America saw its first confirmed case in Brazil, where an older man who had just returned from a trip to Northern Italy tested positive. Greece and North Macedonia similarly saw their first cases yesterday following a pair of women returning to their respective homes from a recent trip to Italy. Staying with Italy many of the Serie A matches this weekend will be played behind closed doors with no fans and the Ireland vs. Italy Six Nations rugby game for next weekend was be called off. Italy now has 453 cases with 12 deaths. The ECDC said in its risk assessment report yesterday that “It is likely that Europe will see similar developments like in Italy, varying from country to country". Germany’s Health Minister Jens Spahn said yesterday that Germany is at the beginning of a coronavirus epidemic after new cases sprung up in the country which can no longer be traced to the virus's original source in China. Germany has 27 confirmed cases now vs. 16 the day before.

Against the backdrop of all this, the US has updated its travel advisory for Italy to “Exercise Increased Caution”. Later in the day Delta cut the number of flights to South Korea and Nestle SA, the world’s largest food company, has told employees to avoid traveling for business reasons until mid-March to keep from contracting or spreading the coronavirus. These actions are only likely to increase over the next few days. Meanwhile, Microsoft reduced its quarterly outlook yesterday due to the virus impact.

Elsewhere, Iran has imposed travel restrictions and suspended Friday prayers in areas hit by the virus after the country announced 19 Iranians have died due to the disease compared to 139 case, which is now the most deaths recorded outside of China though there are worries about the transparency and thereby accuracy of the reporting there. Overnight, Saudi Arabia has decided to temporarily halt religious visits that include stops in Mecca and Medina, which draw millions of people a year to Islam’s holiest cities, to prevent spread of virus in the country. The move comes amidst spread of virus in neighbouring countries including Kuwait, Bahrain, Iraq and the UAE. Saudi Arabia has not reported any cases so far. Meanwhile, Pakistan also reported its first two cases yesterday.

There initially looked like there would be some respite for risk markets yesterday, with the S&P 500 trading higher through the NY morning (+1.73% at the peak). Then markets headed lower later in the session as the reports of new cases built and after an unsubstantiated report that there may be an outbreak of the virus just outside of New York City. The MSCI All-Country World Index sank -0.6%, reaching 16 week lows on its fifth straight decline, and the S&P 500 index joined it ending down -0.38% lower, also the fifth day lower in a row, which is the longest such streak since August. The large intraday swings continue to support a high VIX index level, which was relatively steady above 27 points. The US 10yr Treasury continues to its slide into fresh record lows down -1.8bps, finishing at 1.333%. Oil joined equities in a move higher while Europe was open and then reverting lower in the US afternoon session as risk assets were hit across the board, Brent finished down -2.80%.

The 3M/10Y yield curve threatened to invert further throughout the day, before finishing unchanged near 5 month lows. Yesterday we highlighted that the WIRP Bloomberg page showed the chance that the Fed would cut rates again ahead of their April meeting was 66.5%, up from 24.5% a week earlier, but now the market is pricing in an 84.5% chance. In a report (link here) out yesterday, our US economists estimated that a cumulative equity decline of around 16% would exert a drag on US growth equivalent to nearly a 25bp rate hike. As such, they note that a continuation of the deterioration in risk sentiment could materially raise the risk of Fed rate cuts in the coming months. That is 16% from highs, which means we are nearly half way there already, with the S&P -7.96% off highs!

Before that European equities stabilised yesterday, with the Stoxx 600 paring back losses earlier in the session to close unchanged, just before headlines really started to turn around. European stocks did end their run of four successive moves lower for the index though. Italian assets outperformed, in spite of the country being at the centre of the coronavirus cases in Europe, with the FTSE MIB advancing 1.40%. 10 year yields were higher in Germany (+0.7 bps), France (+1.3bps), and Italy (+0.6bps). iTraxx Crossover index of credit-default swaps climbed by +4.45bps to 258bps, its highest level since 8th October. The Dollar strengthened through the day with the DXY dollar index now up for 14 of the last 18 sessions. With investors in search of havens in the second half of the day, gold resumed its march higher after the ‘big‘ -1.46% drop yesterday and is now up over +4.5% over the last 2 weeks

Elsewhere in the US, former Vice President Biden received a crucial endorsement from Jim Clyburn, South Carolina state representative and highest ranking African American in congress. Biden who was already leading with Black voters across the country, had not performed well in the first two primaries and finished a fairly distant second in Nevada. He needs to do well in South Carolina on Saturday in order to build momentum into Super Tuesday and have a path to the nomination. Clyburn said on Sunday political talkshows that he was worried about having a candidate with the title ‘socialist’ on the ticket and many party leaders have commented on what it could do to House and Senate races. Clyburn might be the first signal that party leaders are going to more forcefully back a moderate alternative.

In terms of data, US new home sales gave a rush of good news, even if slightly backward looking at this point. New home sales surged to its highest level since 2007 in January, reaching an annualized rate of 764k, significantly above consensus expectations of 718k. It was the best month-on-month change since last summer. This reflects on the record low levels of long term rates in the US coupled with strong consumer sentiment.

To the day ahead now, and economic data releases out include the Euro Area’s M3 money supply for January, along with consumer and economic confidence readings for February. Meanwhile there’s an array of data in the US, including the second reading of Q4’s GDP, the preliminary January readings for durable goods orders and non-defence capital goods orders ex-air, weekly initial jobless claims, the Kansas City Fed’s manufacturing activity index for February, and January’s pending home sales. From central banks, we’ll hear from ECB President Lagarde, as well as the ECB’s Panetta, Schnabel, Lane, de Guindos and Lane. In addition, the Fed’s Evans and the BoE’s Cunliffe will also be speaking.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more