Dow Reverses Gains As Canada, EU Reveal Counter Tariffs

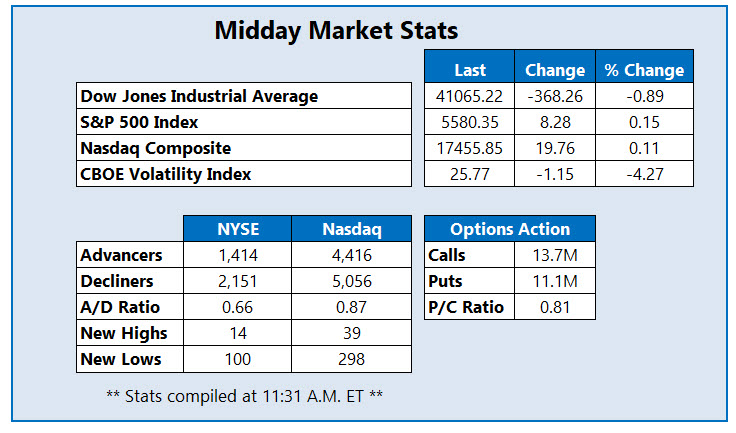

The Dow Jones Industrial Average (DJI) is down 368 points this afternoon, erasing earlier gains that followed a softer-than-expected consumer price index (CPI) reading for February. After President Donald Trump’s steel and aluminum tariffs went into effect, Canada retaliated with 25% duties on over $20 billion of U.S. goods, starting Thursday.

The European Union (EU) also announced it would enact tariffs of its own as soon as April, targeting $28.33 billion in U.S. imports. Nevertheless, the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) both sport modest midday leads, the latter boosted by the tech sector.

Stitch Fix Inc(Nasdaq: SFIX) is getting blasted in the options pits today, with 10,000 calls and 5,902 puts exchanged so far, which is 15 times the volume typically seen at this point. The most popular contract is the June 5.50 call, where new positions are being opened. SFIX is down 8.1% to trade at $3.89 at last check, erasing its earlier lead despite reporting better-than-expected earnings and revenue for the fourth quarter, and raising its annual revenue forecast. Shares slipped into penny stock territory in late February and are facing off with the 40-day moving average, though they sport a 71% year-over-year lead.

Leading the SPX today is Tesla Inc (Nasdaq: TSLA), last seen up 5.5% at $243.19, brushing off a price-target cut from Guggenheim to $170 and JP Morgan Securities to $120. Today's pop comes after Trump said he would buy a brand new Tesla to support CEO Elon Musk amid talks of a boycott, while Morgan Stanley highlighted TSLA as a "buy the dip" play. The shares shed over 39% in 2025, and yesterday fell to their lowest level since October. The equity is a long way from its Dec. 18, record high of $488.54, despite being on track for its best day in nearly three months.

United Airlines Holdings Inc(Nasdaq: UAL) is at the bottom of the SPX, last seen down 6.4% at $71.19, extending yesterday's losses after the airline sector pointed to slowing travel demand. The security also attracted price-target cuts from BofA Global Research and Barclays to $110 and $140 from $125 and $150, respectively. UAL is down 26.3% so far in 2025, and earlier gapped to a five-month low, as Canadians begin canceling U.S. travel plans on the back of tariff tensions.

More By This Author:

Dow Settles At Lowest Level Since SeptemberDow Down 440 Points On Canadian Steel, Aluminum Tariffs

Monday Meltdown: Nasdaq Logs Worst Day Since 2022