Dow Rallies To Best Start In 55 Years As Earnings, Economic Data Collapse

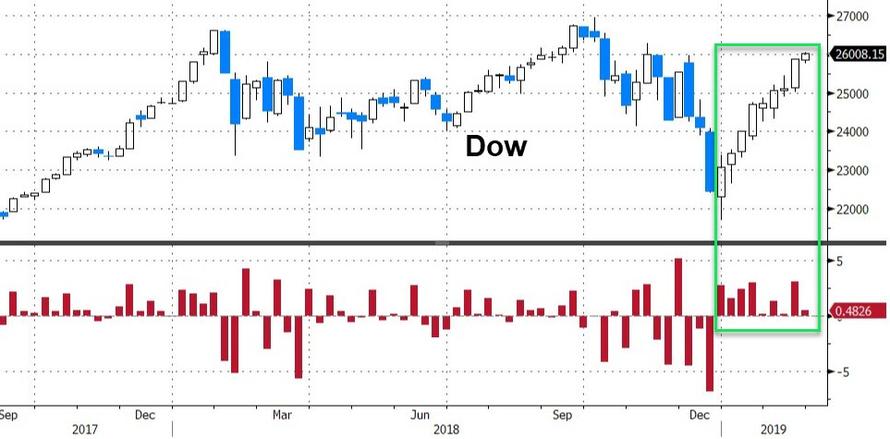

The Dow is up 9 weeks in a row (longest win streak since 1995) and is up 8 straight weeks to start a year for the first time since 1964.

(Click on image to enlarge)

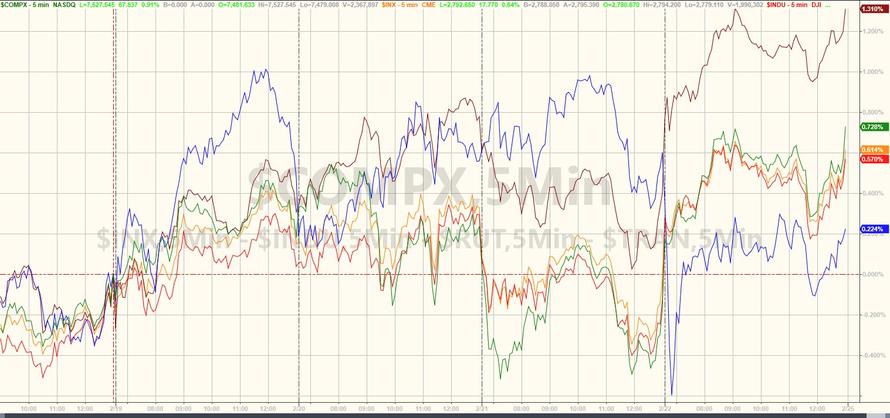

The S&P 500 is having its best start to a year since 1987

(Click on image to enlarge)

Both of which are odd given that earnings are collapsing...

(Click on image to enlarge)

And macro data is crashing...

(Click on image to enlarge)

China had another huge week...

(Click on image to enlarge)

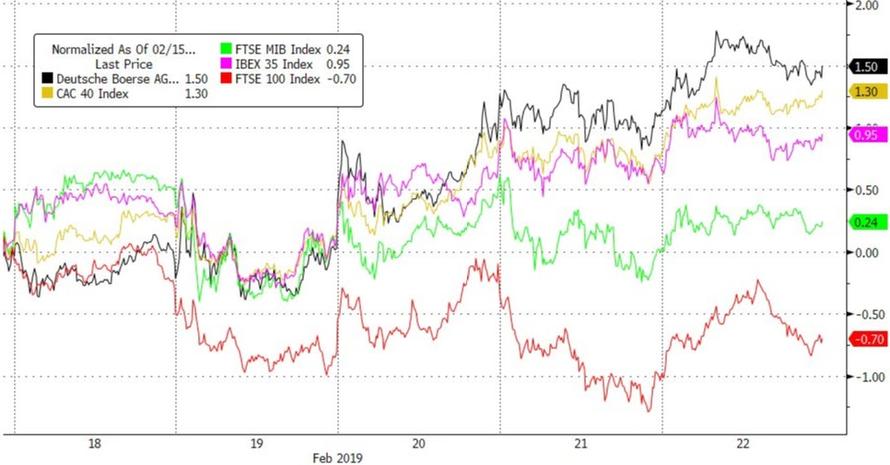

But Europe was mixed with the FTSE lower and Dax higher...

(Click on image to enlarge)

Another (holiday-shortened) week of gains for US equities led by Small Caps...

(Click on image to enlarge)

Buybacks dominated the week once again...

(Click on image to enlarge)

But today saw a huge short-squeeze...

(Click on image to enlarge)

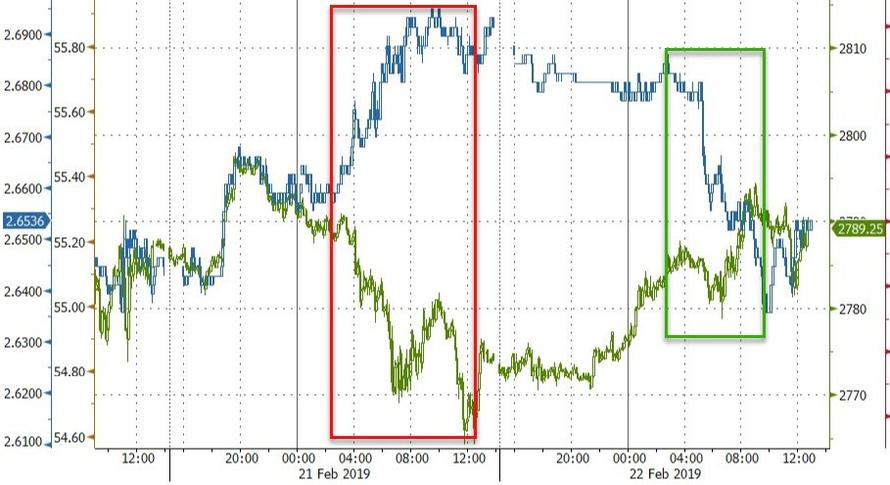

Seems like RP strategies are back in control as Stocks and Bonds are bought and sold together...

(Click on image to enlarge)

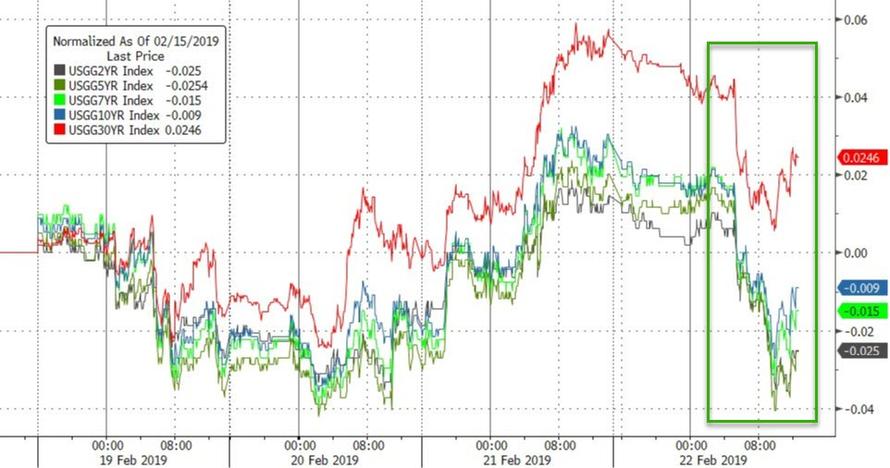

Treasury yields were mixed this week with the long-end higher (30Y +2bps) and the rest of the curve lower in yield...

(Click on image to enlarge)

The dollar weakened on the week

(Click on image to enlarge)

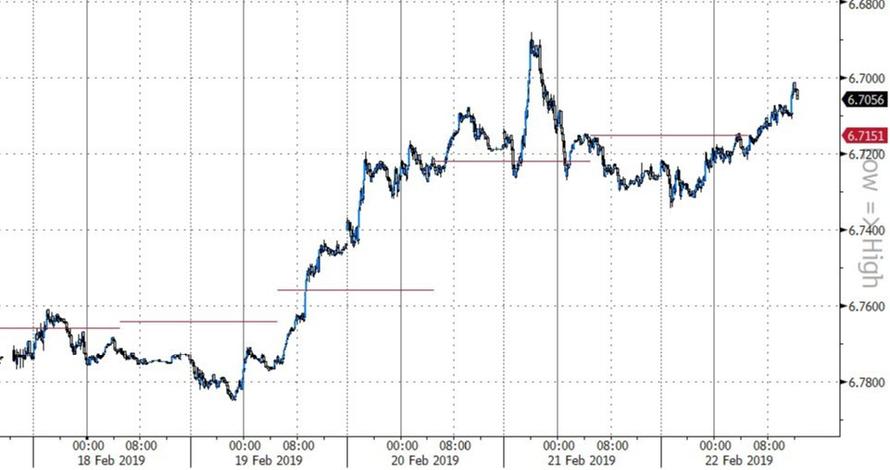

Strong week for Yuan again...

(Click on image to enlarge)

Huge week for cryptos with Ether up over 20%, Bitcoin up over 10%...best week for Bitcoin since Mid-Dec 2018.

(Click on image to enlarge)

Copper gained the most on the week - amid China optimism - but all the major commodities gained on the week...

(Click on image to enlarge)

Copper is at its highest since July 2018...

(Click on image to enlarge)

But Baltic Dry is collapsing...

(Click on image to enlarge)

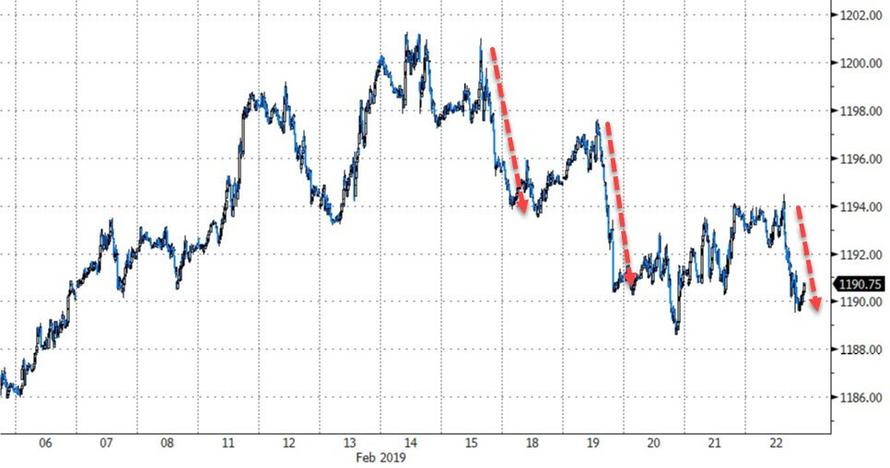

Gold gained in USD terms but was weaker in Yuan terms...

(Click on image to enlarge)

We give the last word to The Onion, who seemed to sum things up perfectly:

Attributing the gains this morning to them being “just kinda in the mood,” top Wall Street investors confirmed the U.S. stock market soared in early trading Friday after they decided it would be a fun thing to make happen.

“Often, you’ll see the S&P 500 rise because of a jobs report or international trade news, but other times it happens just because making the market go way up is what we felt like doing that day,” said veteran fund manager Jack Malcolm, who, like hundreds of his colleagues nationwide, reportedly woke up “feeling sorta blah” and chose to send all major U.S. indices climbing as a “nice little pick-me-up.”

“To be sure, the catalysts for strong market performance can be complex, and it’s not always easy to put your finger on the factors pushing growth. But this morning we made the Dow rise, like, hundreds of points for no particular reason beyond wanting to see a big spike go way up to the top of the chart. And it did! It looked pretty awesome.”

At press time, sources confirmed the entire global economy had entered a major recession after investors thought it would be cool to do that for a while.

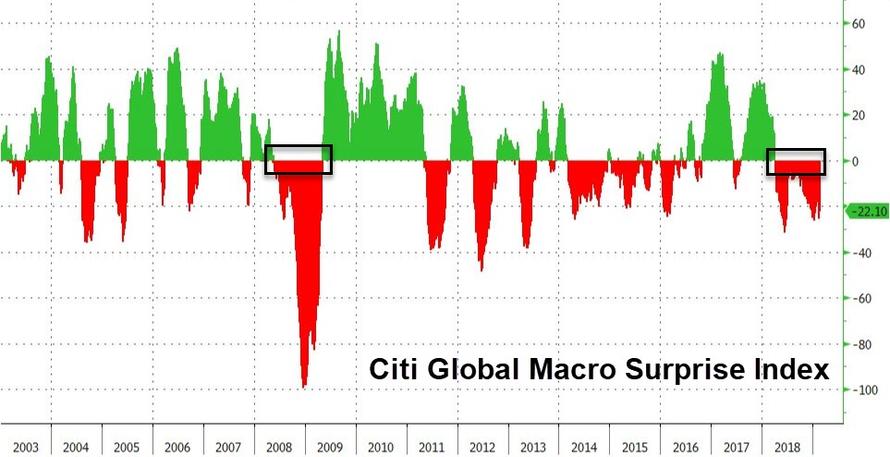

As Gluskin Sheff's David Rosenberg notes, the Citi Global Economic Surprise index, at -21.6, is nearly the same as it was at the Dec 24th market low. It's now 227 days below zero -- only exceeded by the Great Recession of 2008-09.

(Click on image to enlarge)

"Markets are totally devoid of economic realities."