Dow, Nasdaq Down Triple Digits; Weekly Losses Loom

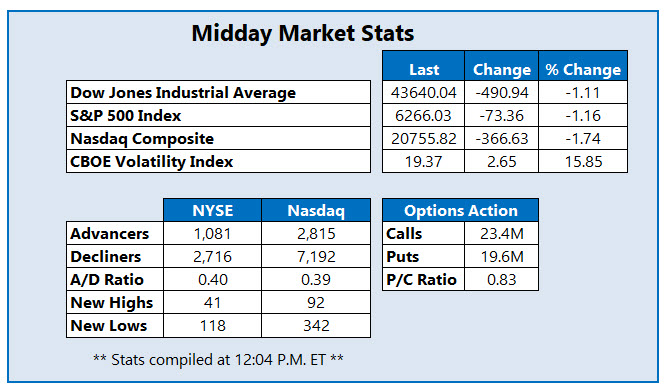

Dismal jobs data for July and sweeping new tariffs are pressuring stocks lower this afternoon. The Dow Jones Industrial Average (DJI) and Nasdaq Composite (IXIC) are sporting triple-digit losses, with the S&P 500 Index (SPX) firmly in the red as well. Bank stocks are gapping lower amid fears of an economic slowdown, sending all three major indexes toward weekly losses.

On the global trade front, President Trump signed an executive order late Thursday updating tariffs on multiple countries. Duties between 10% and 41% are set to go into effect on Aug. 7.

Rocket Companies Inc (NYSE: RKT) stock is seeing unusual options activity today, with 245,000 calls and 54,000 puts traded so far, which is 6 times the volume typically seen at this point. Most active by far is the weekly 8/1 15.50 strike call. RKT is up 13.4% to trade at $16.76 at last check, after the company beat top- and bottom-line expectations for the second quarter and issued an upbeat forecast for the current quarter. In response, both Barclays and Wells Fargo raised their price targets to $16 and $15, respectively. RKT is pacing for its best day since March 2021, and sports a 60% year-to-date lead.

Toward the top of the SPX today is Kimberly-Clark Corp(Nasdaq: KMB) stock, last seen up 4.9% to trade at$130.78. In addition to beating profit and revenue estimates for the second quarter, the personal care giant also reported strong volume growth. Shares are eyeing their best single-day percentage gain since April 2024, as they bounce off their lowest level since January to their highest since June. Despite today's bull gap above the 40-day moving average, KMB still carries a 5.5% year-over-year deficit.

Eastman Chemical Co(NYSE: EMN) is the worst stock on the SPX today, down 20.5% to trade at $57.72 at last check. In addition to a disappointing second-quarter report, the company issued a dismal guidance for the current quarter and remainder of 2025. As a result, both Mizuho and UBS cut their price targets to $80 and $86, respectively. EMN earlier fell to a five-year low of $56.78, breaching a familiar floor at $70 as it paces for its worst day on record. In the last 12 months, shares have shed 43.2%.

More By This Author:

Stocks Finish Stellar July On A Choppy NoteS&P 500, Nasdaq Nab Records On Upbeat Tech Earnings

Dow, S&P 500 Retreat As Fed Fatigue Sets In