Friday, December 12, 2014 4:19 PM EST

Better watch out, better not cry, ProTrader Mike is going to tell you why...the Dow is about to take a crashing you know....

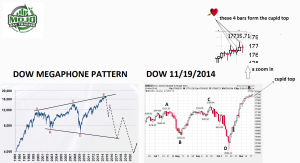

What is the Megaphone Pattern? A megaphone pattern is considered bearish, indicating that the current uptrend may reverse to form a new downtrend. A Megaphone Top is rare and must be played with patience. This develops after a strong advance and can last several weeks. The creation of the megaphone pattern reflects a period of time when bulls and bears are battling to gain control of the market. The pattern occurs after the bulls have been charging and driving the market much higher as we have seen in the last 25 consecutive trading days.

About 2 weeks ago, I called the market top at 17,735 and put a long position on UVXY at $20.92. The markets did retreat a bit today and the Dow did close red. This is a sign of the Cupid Top forming, which is a foreshadow that the Love is over. During the formation of the Megaphone Top bears are exerting increasing influence on the market, causing it to set a series of lower lows. The increasing volatility eventually creates a sense of uncertainty, leads to profit-taking, and deters some of the bulls from making any further commitments. This should result in UVXY rising, as on 10/16 just one month ago it set a high of $56.28. Last Price as close today 11/19 = $22.43

Watch Video Bellow:

Video Length: 00:02:30

The following analogies describe the current market condition:

1. Hey the party is over guys, it's 3:00am and the bar is closing. Time to go home, everyone's drunk...

2. You're about to go over the waterfall in a barrel, really...

3. The Speed Limit is 65mph; you've been driving 90mph for over two hours now, better slow it down, you're pushing it now...

4. You're walking the plank, blindfolded and there is no step in front of you, ooops....

Disclaimer: MOJO Day Trading, or any of its employees, contractors, or shareholders or affiliates are NOT an investment advisory service, nor a registered investment ...

more

Disclaimer: MOJO Day Trading, or any of its employees, contractors, or shareholders or affiliates are NOT an investment advisory service, nor a registered investment advisor or broker-dealer and does not purport to tell or suggest which securities customers should buy or sell for themselves. The analysts and employees or affiliates of Company may hold positions in the stocks or industries discussed here. You understand and acknowledge that there is a very high degree of risk involved in trading securities. The Company, the authors, the publisher, and all affiliates of Company assume no responsibility or liability for your trading and investment results. Factual statements on the Company's website, or in its publications, are made as of the date stated and are subject to change without notice. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable or that they will not result in losses. Past results of any individual trader or trading system published by Company are not indicative of future returns by that trader or system, and are not indicative of future returns which be realized by you. In addition, the indicators, strategies, columns, articles and all other features of Company's products (collectively, the "Information") are provided for informational and educational purposes only and should not be construed as investment advice. Examples presented on the Company's website are for educational purposes only. Such picks, alerts, set-ups are not solicitations of any order to buy or sell. Accordingly, you should not rely solely on the information in making any investment. Rather, you should use the Information only as a starting point for doing additional independent research in order to allow you to form your own opinion regarding investments. You should always check with your licensed financial advisor and tax advisor to determine the suitability of any investment.

Please note: Hypothetical computer simulated performance results are believed to be accurately presented. However, they are not guaranteed as to accuracy or completeness and are subject to change without any notice. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Since, also, the trades have not actually been executed; the results may have been under or over compensated for the impact, if any, of certain market factors such as liquidity, slippage and commissions. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any portfolio will, or is likely to achieve profits or losses similar to those shown. All investments and trades carry risks.

Copyright C MOJO Day Trading, LLC. 2012-2015. All Rights Reserved. No part of this email, newsletter, video, website or any of its contents may be reproduced, copied, modified or adapted, without the prior written consent of the author, unless otherwise indicated for stand-alone materials.

less

How did you like this article? Let us know so we can better customize your reading experience.

Nice.