Dow Jones Industrial Average Today: Stocks Bolstered After Steep Downside NFP Revisions

Image Source: Unsplash

The Dow Jones Industrial Average (DJIA) tested the high side on Tuesday, bolstered by sharp downward revisions in US job hiring over the past 18 months. Souring labor market data is bolstering investor bets that the Federal Reserve (Fed) will initiate a fresh rate-cutting cycle as the world's largest central bank seeks to bolster the US labor market.

After a brief period of second-guessing, the Dow Jones has risen into the 45,700 region as rate cut hopes bolster sentiment. Equity markets are overall sedate as investors hunker down for the long wait to the Fed’s next rate call on September 17.

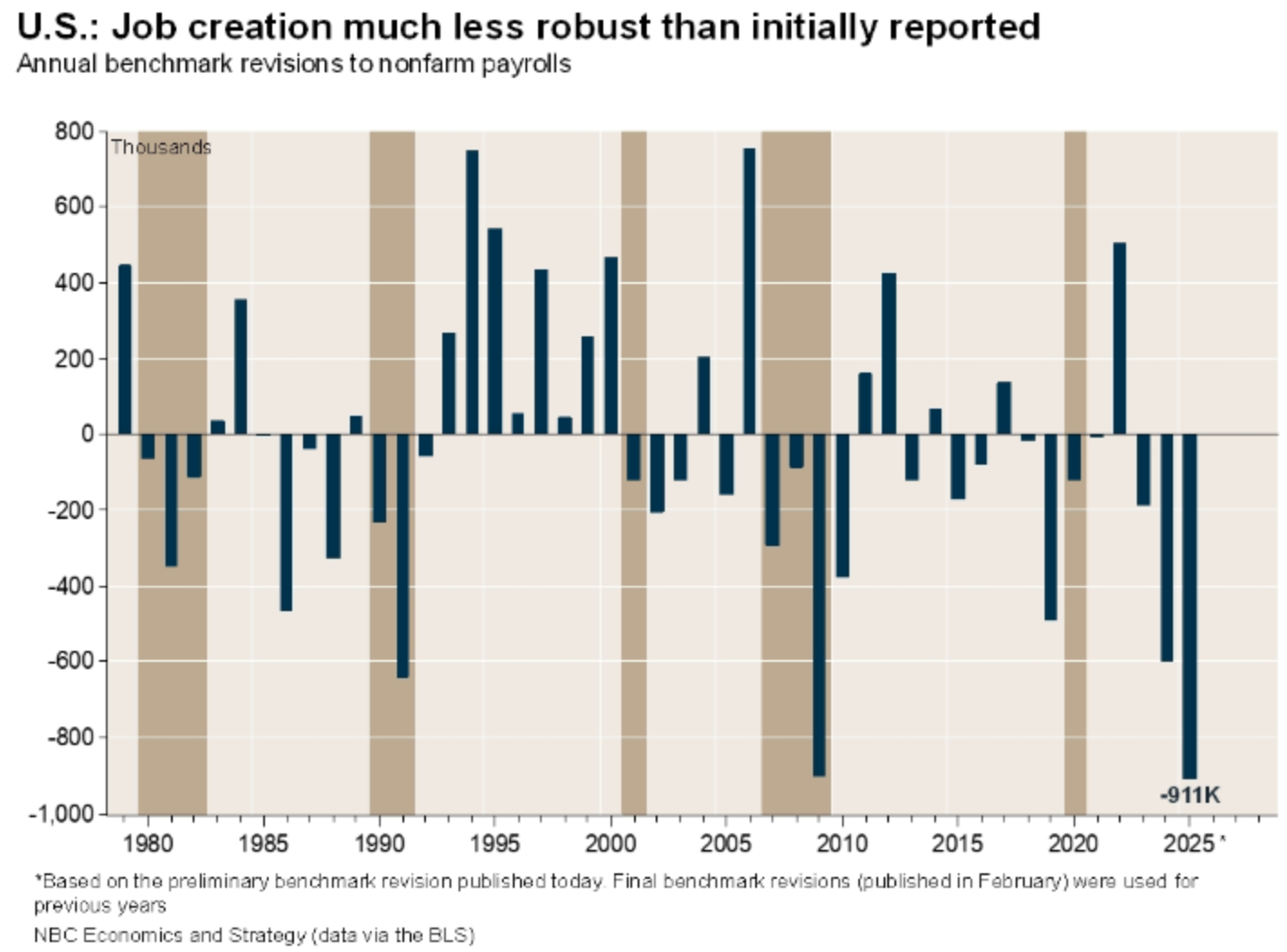

However, markets are growing increasingly concerned that the bottom could be falling out from beneath the US economy. The latest annual adjustment to Nonfarm Payrolls (NFP) showed that the US economy added nearly 900K fewer jobs than previously expected for the March 2024 to March 2025 annual period. Further downside revisions to 2025 employment creation should be expected by data watchers as the current revision window doesn’t include any of the fallout of the post-tariff economy.

(Click on image to enlarge)

Jobs data: deceptively tricky

NFP numbers have taken on significant impact in recent months as the Trump administration moves to politicize the estimation figure. However, deeper accuracy is a difficult ask of a survey sample at a time when the President can cause (or attempt to cause) earth-shifting changes in the business world with the stroke of a pen on a Friday afternoon.

The NFP is an aggregate survey of around 120K private businesses within the US; the response rate frequently changes, and any businesses that cease operations within the response window are simply marked as non-respondents.

The Bureau of Labor Statistics (BLS) uses the Quarterly Census of Employment and Wages (QCEW) to do a large-scale adjustment to NFP data once per year. This data represents 95% of the business operators within the US and is a more accurate measure of labor, as it includes businesses that have either ceased operations or gone out of business. Even now, the “final” benchmark revision for the current review period isn’t expected until next February.

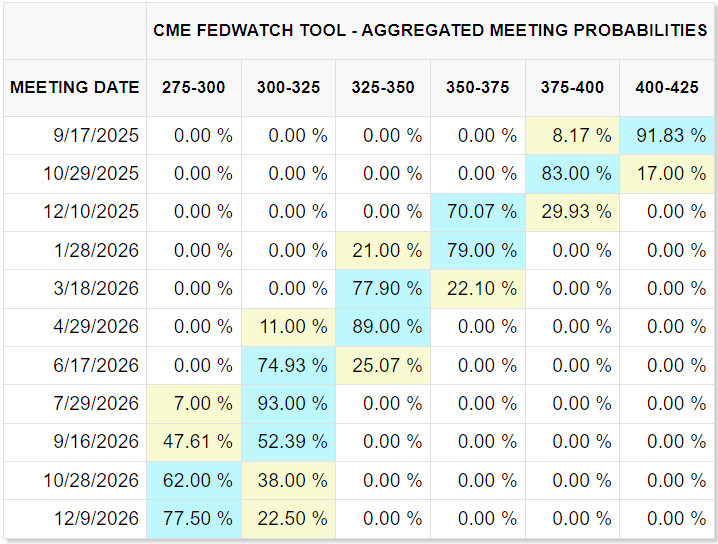

According to the CME’s FedWatch Tool, rate markets have assumed a 25 bps interest rate cut on September 17 is now a foregone conclusion. Some particularly cut-happy rate traders are also pricing in over 17% odds that the Fed will get bullied, either by data or political pressure, into delivering a 50 bps rate cut next week.

While steep downside revisions to labor data is a concern, and points to a US economy that is in a much worse place than many had assumed through the first three quarters of the year, odds of the Fed accelerating interest rate cuts remain slim, albeit not entirely zero.

The latest batch of US Consumer Price Index (CPI) inflation, due on Thursday, is expected to show that inflationary price pressure is still coasting well above the Fed’s 2% annual target. This makes it difficult for the Fed to deliver interest rate cuts at too fast of a pitch, regardless of how far policy rates may or may not be above r-star, or the natural rate of interest.

Dow Jones daily chart

(Click on image to enlarge)

More By This Author:

GBP/USD Continues To Climb Ahead Of Key US Inflation DataUSD/JPY Grapples With Fresh Declines After Japanese PM Resigns

GBP/USD Settles Into Holding Pattern Ahead Of Key US NFP Jobs Data