Dow Jones Industrial Average Rebounds After PCE Inflation Print Keeps Rate Cut Hopes Alive

Image Source: Unsplash

The Dow Jones Industrial Average (DJIA) rebounded on Friday, paring away the midweek’s losses and recovering footing as investors self-soothe over odds of a follow-up interest rate cut in October. US Personal Consumption Expenditures Price Index (PCE) inflation came in about where median market forecasts predicted, keeping market hopes for an October rate trim on the high side.

Inflation holds steady, keeping rate cut bets on balance

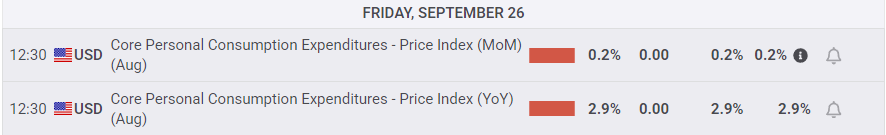

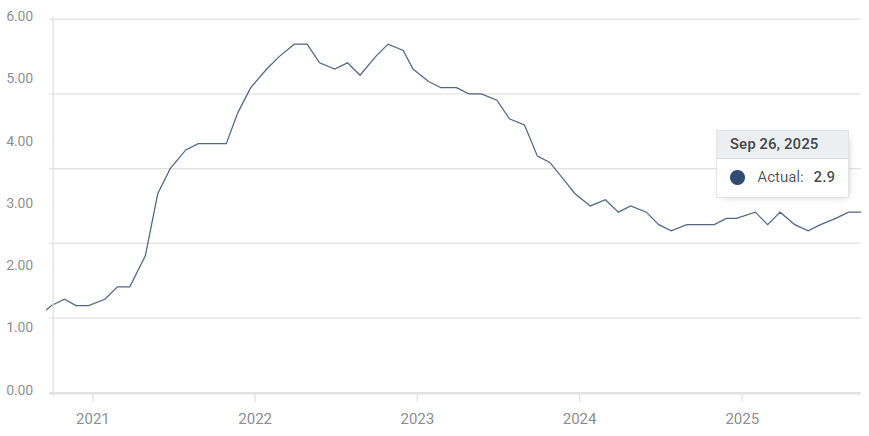

Core PCE inflation held steady at 2.9% on an annual basis, meeting market forecasts. The monthly figure also held flat at 0.2% MoM, while headline PCE inflation accelerated to 0.3% MoM and 2.7% YoY. The US economy is now eight months into its “one-time inflation passthrough” from the Trump administration’s tariffs, and core annual PCE inflation metrics are at the same level they were nearly 18 months ago in March of 2024.

(Click on image to enlarge)

Despite the lack of meaningful progress on inflation, markets are still leaning into the bullish side as Friday’s PCE inflation print was not high enough to spark any concerns about the Fed falling back into hawkish territory. Amid a slumping labor market, the Fed is still on track to deliver a second straight quarter-point interest rate cut on October 25th. According to the CME’s FedWatch Tool, rate traders are pricing in nearly 90% odds that the Fed will deliver a 25 bps rate trim to match the opening rate cut from September’s rate meeting.

Core PCE inflation, YoY

Personal Income and Personal Spending both rose in August, climbing to 0.4% and 0.6%, respectively. While rising income and consumption metrics are positive signs for the US economy, accelerating wage pressures could bolster inflation metrics in the future, complicating the Fed’s path to a fresh rate-cutting cycle.

Consumer sentiment eases slightly, but plenty of work still on the cards

September’s University of Michigan (UoM) Consumer Expectations and Sentiment Indexes both declined slightly from the previous month, but again, the data was mostly in line with market expectations. UoM 5-year and 5-year Consumer Inflation Expectations also ticked lower in September, but the topline figures are still riding high at 4.7% and 3.7%, respectively.

Consumers have a strong tendency to overshoot realistic outcomes, but such consistently high figures over time could be a warning of overly price-sensitive consumers’ inflation expectations becoming entrenched in a self-fulfilling prophecy. As long as consumers continue to expect above-pace inflation, businesses will be more inclined to meet those expectations.

(Click on image to enlarge)

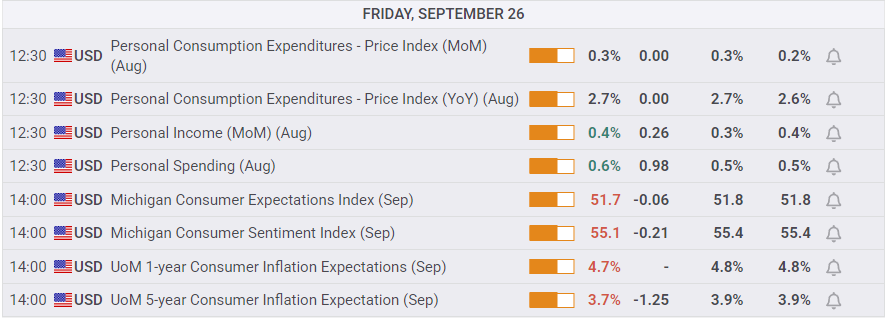

Dow Jones daily chart

(Click on image to enlarge)

More By This Author:

Dow Jones Industrial Average Loses Ground Despite Upbeat GDP Print

Dow Jones Industrial Average Falls As Downside Momentum Accelerates

GBP/USD Flubs Bullish Recovery, Falls Back Below Key Technical Levels