Dow Jones Industrial Average Mixed As Software Selloff Deepens, U.S. House Approves Temporary Budget

Image Source: Unsplash

The Dow Jones Industrial Average (DJIA) traded in mixed territory on Tuesday, dipping around 166 points, or 0.3%, after briefly touching a new intraday record of 49,653.13 earlier in the session. The S&P 500 fell 0.8% as investors dumped technology stocks, while the Nasdaq Composite shed 1.4%. Despite strength in defensive sectors and select earnings winners, a deepening selloff in enterprise software stocks and a sharp decline in PayPal Holdings Inc. (PYPL) weighed heavily on sentiment. Markets shrugged off political uncertainty as Congress moved to end the partial government shutdown.

House passes $1 trillion spending package, ends shutdown

The House voted 217-214 on Tuesday to approve a more than $1 trillion spending package, bringing an end to the partial government shutdown that began after midnight on Saturday. Twenty-one Democrats joined Republicans in support of the measure, which funds the Pentagon, the Department of Health and Human Services, the Department of Transportation, the Education Department, and Housing and Urban Development through the end of the fiscal year in September.

The legislation separated funding for the Department of Homeland Security, which will receive only a two-week extension through February 13 as lawmakers negotiate Democratic demands for reforms to Immigration and Customs Enforcement operations. President Trump endorsed the plan and is expected to sign the bill into law. Markets largely brushed off the shutdown's end, having already priced in a swift resolution.

Software stocks extend brutal selloff on AI disruption fears

Enterprise software stocks extended a punishing decline on Tuesday as investors continued to reassess the sector's long-term growth prospects amid rising concerns that artificial intelligence could disrupt traditional business models. International Business Machines Corporation (IBM) sank 9%, dragging the Dow lower as a price-weighted index, while Salesforce Inc. (CRM) and ServiceNow Inc. (NOW) each fell around 7%.

The iShares Expanded Tech-Software Sector ETF dropped 5%, pushing the software industry deeper into bear-market territory with a decline of more than 22% from recent highs. The selloff accelerated after Anthropic's automation tools heightened concerns that AI could eat into software companies' core businesses, prompting investors to slash exposure to names once considered defensive growth plays.

Walmart becomes first traditional retailer to reach $1 trillion

Walmart Inc. (WMT) rose as much as 1.6% to hit an intraday record of $126 per share, pushing its market capitalization past $1 trillion for the first time. The Arkansas-based retail giant became only the tenth US company to reach this milestone, joining an exclusive club previously dominated by technology firms including Nvidia Corporation (NVDA), Alphabet Inc. (GOOG), and Apple Inc. (AAPL).

The achievement caps a remarkable two-year rally in which Walmart shares have more than doubled, fueled by robust e-commerce growth, expansion of its Walmart+ membership program to 28.4 million members, and market-share gains as budget-conscious consumers continue to seek value. The milestone arrived during the first week under new CEO John Furner, who succeeded Doug McMillon after more than a decade at the helm.

PayPal plunges on CEO exit and disappointing outlook

PayPal Holdings Inc. (PYPL) tumbled nearly 19% after the payments company reported fourth-quarter earnings and revenue that missed expectations while simultaneously announcing that CEO Alex Chriss would be replaced by HP Inc. (HPQ) CEO Enrique Lores, effective March 1. PayPal posted adjusted earnings of $1.23 per share on revenue of $8.68 billion, falling short of estimates for $1.28 and $8.80 billion, respectively. The board stated that the pace of change and execution under Chriss was not in line with expectations.

PayPal's weak 2026 profit outlook, projecting flat to slightly declining earnings, further rattled investors already concerned about market share losses in branded checkout to rivals, including Apple Pay, Google Pay, and newer fintech competitors.

Palantir surges on blockbuster earnings beat

Palantir Technologies Inc. (PLTR) jumped 7% after reporting fourth-quarter results that crushed analyst expectations across the board. The Denver-based software company posted adjusted earnings of 25 cents per share on revenue of $1.41 billion, handily beating estimates of 23 cents and $1.33 billion, respectively. Revenue surged 70% year-over-year, with US commercial revenue jumping 137% as demand for AI-powered data analytics tools accelerated.

CEO Alex Karp called the results "indisputably the best results in tech in the last decade." The company's fiscal 2026 revenue guidance of $7.18 billion to $7.20 billion came in well above Wall Street's $6.22 billion estimate, implying 61% growth and underscoring Palantir's dominant position in enterprise AI software.

Gold and Silver rebound after historic selloff

Gold and Silver prices staged a sharp recovery on Tuesday following last week's brutal selloff that saw Silver post its worst single-day decline since 1980. Spot Gold climbed more than 5% to around $4,900 per ounce, while Silver surged roughly 10% to approximately $87 per ounce.

The preceding collapse was triggered by a stronger US Dollar following President Trump's nomination of Kevin Warsh as the next Federal Reserve chair, combined with margin requirement increases at the CME. Analysts at Deutsche Bank and JPMorgan maintained bullish outlooks, with Deutsche Bank reiterating its $6,000 Gold price target and noting that Gold's thematic drivers remain positive. Mining stocks rallied in sympathy, with London-listed producers Fresnillo and Anglo American both posting gains.

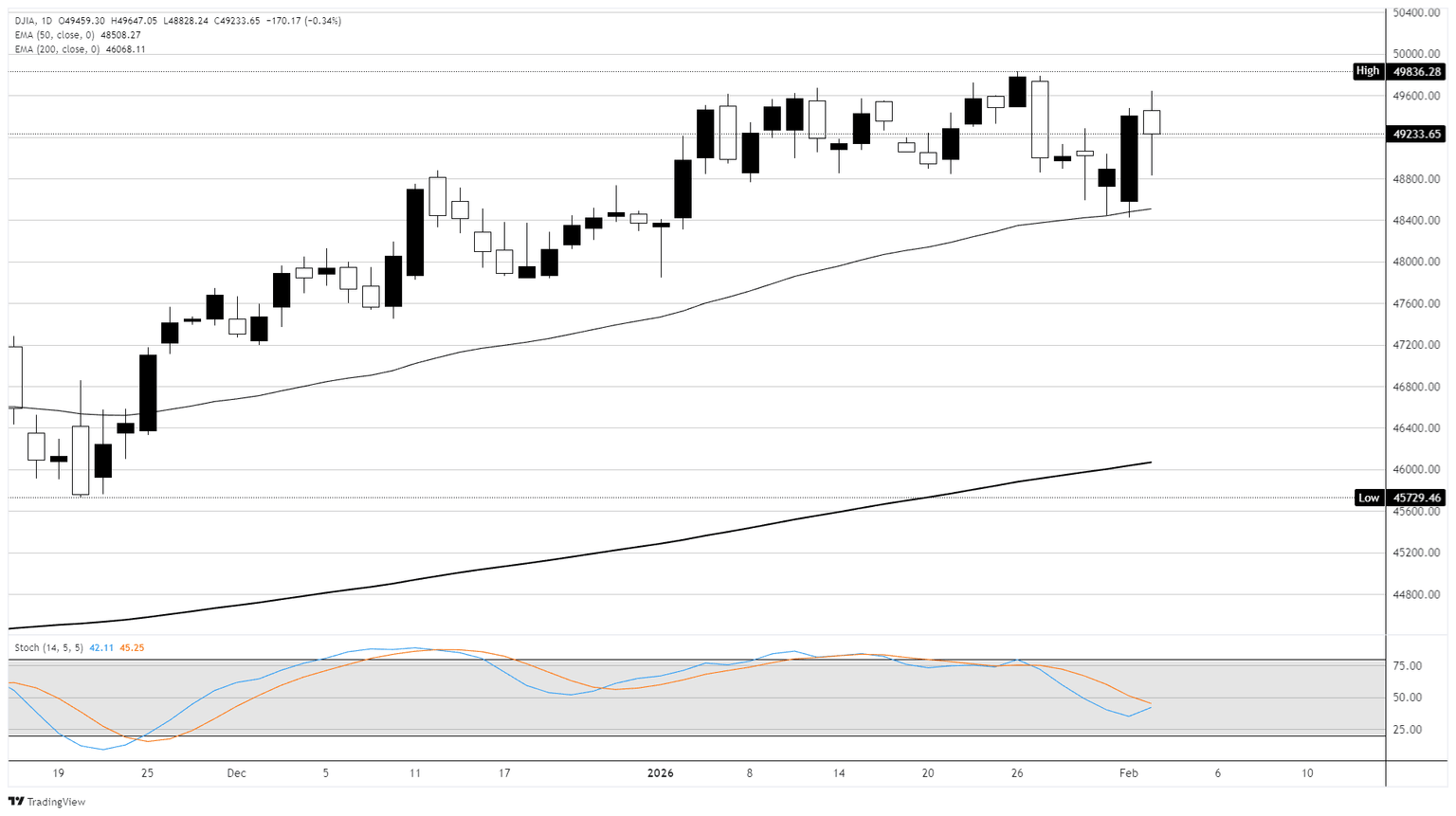

Dow Jones daily chart

(Click on image to enlarge)

More By This Author:

Canadian Dollar Crimps Two-Day Losing Streak On TuesdayPound Sterling Losses Slow As BoE Rate Decision Looms

Canadian Dollar Churns Near Multi-Month Highs As U.S. Shutdown Suspends NFP Release