Dow Jones Industrial Average Hesitates On Thursday After Key Earnings Misses

Image Source: Pexels

The Dow Jones Industrial Average (DJIA) stumbled on Thursday, consolidating just below the 45,000 handle as earnings blunders drag down key overweighted stocks listed on the Dow Jones. Equities remain tilted firmly into the high side with all major indexes testing fresh record highs, but political storm clouds continue to gather as United States (US) President Donald Trump continues his campaign to replace his own pick for head of the Federal Reserve (Fed) ahead of schedule.

IBM, Honeywell, and UnitedHealth in the crosshairs

Key stocks on the Dow declined on Thursday, dragging the overall index lower for the day. IBM (IBM) plummeted 8% in overnight trading despite posting better-than-expected earnings after markets closed on Wednesday. IBM’s revenue, sales, and earnings metrics all continue to rise as the broad-market AI tech rally tide lifts all boats; however, IBM’s software segment growth underperformed its peers, growing at a comparatively sedate 10% annually.

Honeywell (HON) also stumbled following Wednesday’s after-hours earnings dump, falling 5% on Thursday despite a clean beat on earnings. Investors have noted some warning signs of weakening profitability, pushing HON down and punishing the tech conglomerate for only delivering 8% YoY growth and failing to raise forward guidance as much as analysts had hoped.

UnitedHealth (UNH) softened around 4% on Thursday after the insurance provider, with a strong history of leaning into coverage denials as a means of generating profits, admitted it was under investigation by federal authorities. Investigations are underway for both criminal and civil litigation surrounding UNH’s Medicare arm, citing issues with the use of questionable practices in gathering diagnoses from doctors and nurses to deny claims and bolster payments.

Labor data, business sentiment indicators signal still-strong economy

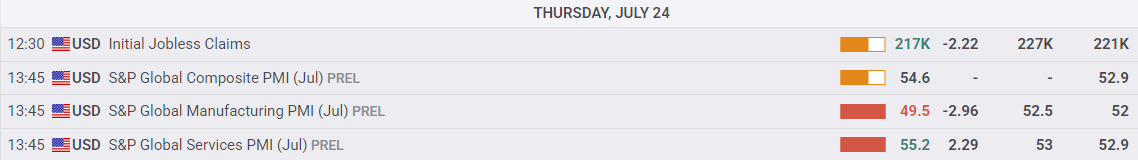

A strong beat in key US economic data also hampered an outright bull run on Thursday. Weekly Initial Jobless Claims eased to 217K, and the Services segment of US Purchasing Managers Index (PMI) aggregated survey results improved sharply in June. A firm labor market and business activity expectations still trucking along strongly make it difficult for the Fed to deliver rate cuts sooner rather than later.

(Click on image to enlarge)

Strong economic data trumps Trump's desire for lower interest rates

According to the CME’s FedWatch Tool, rate traders are still pricing in a 60% chance of at least a quarter-point rate cut on September 17, but hope is waning as the US economy continues to flout expectations of a steepening decline. Regardless, President Trump is still on the warpath as he rails against Fed Chair Jerome Powell. The Trump administration is actively pursuing ways to both replace Fed Chair Powell before the end of his term and force the Fed to arbitrarily lower interest rates.

Dow Jones price forecast

Thursday’s price action has the Dow Jones muddled in near-term congestion levels despite an overall bullish tilt to the major equity index. The Dow is still trapped just south of record highs above the 45,000 handle, but topside momentum continues to struggle with making meaningful progress.

Dow Jones daily chart

(Click on image to enlarge)

More By This Author:

Canadian Dollar Snaps Winning Streak As U.S. Dollar Pares LossesDow Jones Industrial Average Inches Back Into Peaks On Trade Deal Hopes

U.S.-Japan Trade Agreement Poses Accidental Threat To U.S. Auto Sector