Dow Futures Pullback May Find Support

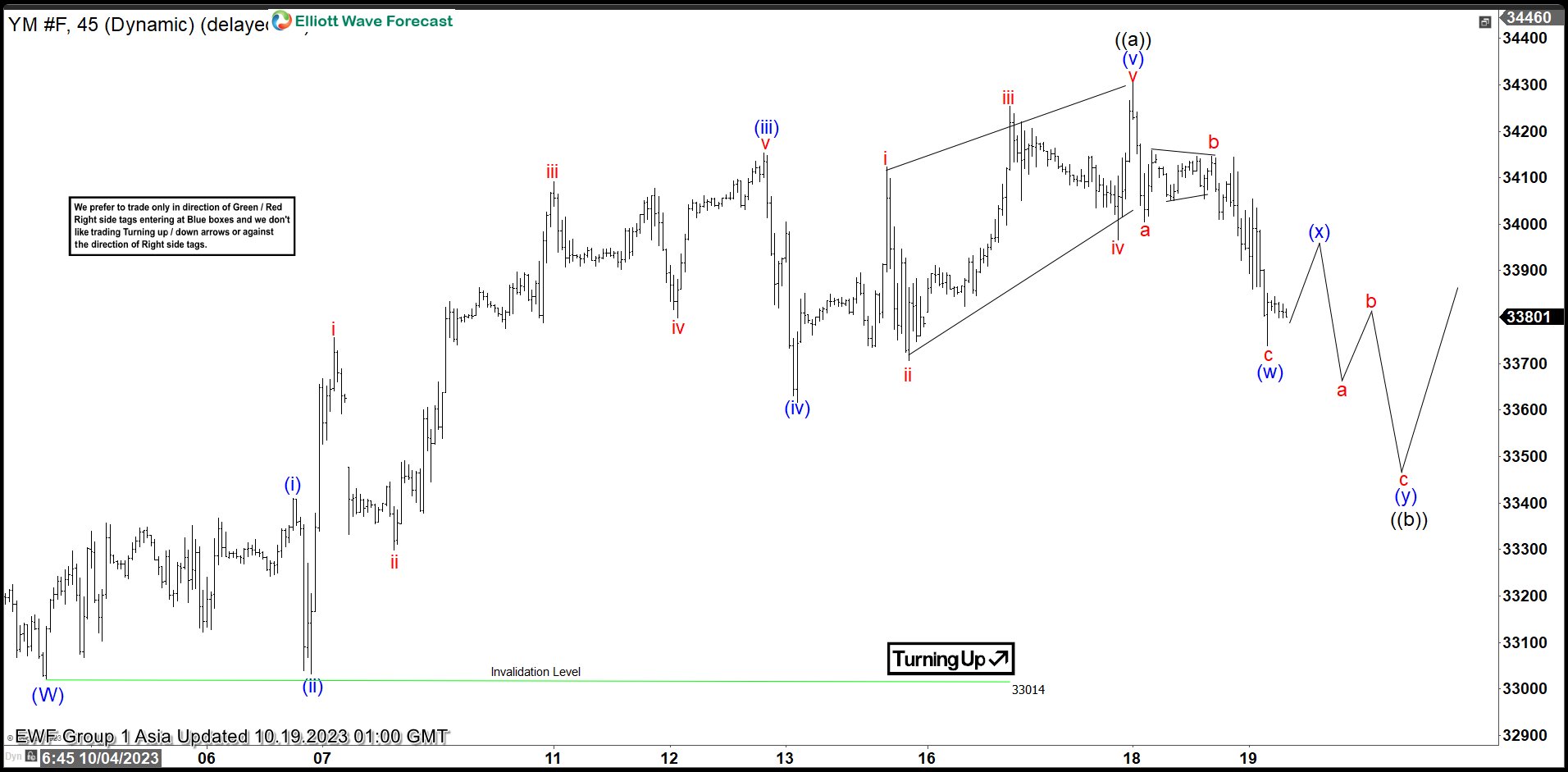

Short Term Elliott Wave in Dow Futures (YM) suggests the decline from 7.27.2023 high has ended with wave (W) at 33014. The Index is now correcting that cycle in wave (X) with internal subdivision as a double three Elliott Wave structure. Up from wave (W), wave (i) ended at 33410 and pullback in wave (ii) ended at 33032. Index then resumed higher again in wave (iii). Up from wave (ii), wave i ended at 33756 and wave ii dips ended at 33298. Index resumes higher again in wave iii towards 34092 and pullback in wave iv ended at 33799. Final leg higher wave v ended at 34153 which completed wave (iii). Pullback in wave (iv) ended at 33617.

Index resumed higher in wave (v) as a diagonal. Up from wave (iv), wave i ended at 34123 and wave ii ended at 33707. Wave iii higher ended at 34254 and pullback in wave iv ended at 33966. Final leg wave v ended at 34305 which completed wave (v) of ((a)). Index is now doing a wave ((b)) pullback to correct the cycle from 10.4.2023 low in 3, 7, or 11 swing. Down from wave ((a)), wave (w) ended at 33738. Expect rally in wave (x) to fail in 3, 7, or 11 swing for another leg lower in wave (y) to complete wave ((b)). Near term, as far as pivot at 33014 low stays intact, expect pullback to find support in 3, 7, or 11 swing for further upside.

Dow Futures ($YM_F) 45 Minutes Elliott Wave Chart

(Click on image to enlarge)

$YM_F Elliott Wave Video

Video Length: 00:08:04

More By This Author:

Pullbacks In Lockheed Martin Remain SupportedNasdaq Futures Reacting From Equal Legs Area

Boeing Looking To End Impulsive Decline Soon

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more