Dow Eyes 4th-Straight Triple-Digit Close After More Records

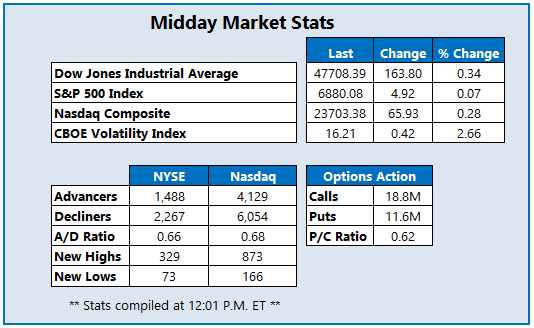

Fresh off three-straight winning sessions, all three major indexes touched record highs once again today. The Dow Jones Industrial Average (DJI) is up triple digits, with help from a batch of strong earnings reports, while the Nasdaq Composite (IXIC) enjoys a modest gain and the S&P 500 Index (SPX) inches higher. Elsewhere, the small-cap Russell 2000 Index (RUT) is quietly lower after yesterday's closing high. Investors are still looking ahead to Big Tech earnings, as well as the Fed's two-day policy meeting that kicks off today.

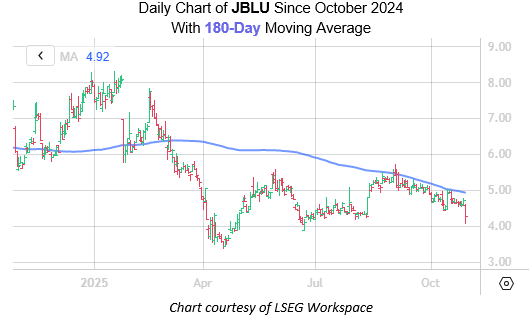

JetBlue Airways Corp (Nasdaq: JBLU) stock was last seen down 10.7% at $4.21, after wider-than-expected third-quarter losses year on year. Options traders are chiming in, with 41,000 calls and 18,000 puts exchanged so far today -- already six times the average daily volume. The January 16, 2026 7-strike call is the most popular, followed by the weekly 10/31 5-strike call, with new positions opening at the weekly 10/31 4.50-strike call. On the charts, JBLU has been struggling to stage a meaningful breakout out of penny stock territory, with recent pressure at the 180-day moving average. Year to date, the equity is down 46.4%.

Bitcoin mining stock Terawulf Inc (Nasdaq: WULF) is soaring to nearly four-year highs today, up 23.7% at $16.87 at last glance, after the company announced a $9.5 billion AI infrastructure joint venture with cloud platform Fluidstack. Google (GOOGL) is backing $1.3 billion of Fluidstack’s long-term lease obligations. Separately, Terawulf posted an upbeat full-year forecast amid its preliminary results. Year to date, the equity is up roughly 197%.

One of the stock's near the bottom of the New York Stock Exchange (NYSE) today is Olin Corp (NYSE: OLN), down13.7% to trade at $20.74 at last look. The chemical name reported mixed third-quarter results, with earnings beating estimates, while revenue came in below expectations amid rising costs and inventory reductions. Mizuho also cut its price target by $3 to $25. Coming up, the fourth quarter is typically a period of weak seasonality for the company. Since the start of the year, OLN is down 38.4%.

More By This Author:

Major Indexes Extend Record Rally On Trade OptimismMajor Indexes Snag More Records As Chip Stocks Climb

Stocks Log Record Closes As Dow Clears 47K