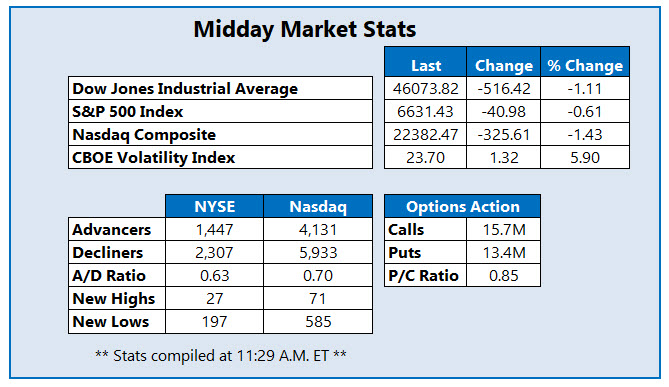

Dow Drops 516 Points On Dismal Home Depot Earnings

Stocks are extending losses this afternoon, with the Dow Jones Industrial Average (DJI) nursing a 516-point deficit following Home Depot's (HD) earnings miss, while the Nasdaq Composite (IXIC) is down triple digits as Big Tech extends its slide. The S&P 500 Index (SPX) is headed for its fourth-straight daily drop amid fading AI enthusiasm, Bitcoin (BTC) weakness, and fears that the Federal Reserve may not cut interest rates in December.

Solaris Energy Infrastructure (NYSE: SEI) stock is among the most heavily traded in the options pits today, with 30,000 puts exchanged so far -- 34 times the amount typically seen at this point -- compared to 141 calls. The most active contract is the November 50 put, with new positions being opened at the December 40 put. The equity is down 5.5% to trade at $43.21 amid the broader market pullback, and now pacing for its worst day since September. SEI is pulling back from a Nov. 3, record high of $57.16, but sports a 48.4% year-to-date lead.

Leading the SPX today is Merck & Co Inc(NYSE: MRK) stock, last seen up 4.1% to trade at $96.66. Today's pop comes after the company's lung-disease drug Winrevair met the primary objective of a mid-stage study in adults with pulmonary hypertension due to heart failure. MRK earlier hit its highest level since February, and has added 24.4% over the past six months.

(Click on image to enlarge)

Meanwhile, Western Digital Corp (Nasdaq: WDC) stock is among the SPX's underperformers, down 5.9% to trade at $152.83 at last check. Reversing yesterday's pop after the company revealed next-generation storage solutions geared toward the AI and high-performance computing (HPC) markets, the shares are taking a breather from a Nov. 11, record high of $178.45. So far this year, WDC has risen over 238%.

More By This Author:

Dow Shed 557 Points; Tech Selloff Back For Another WeekMajor Indexes Gap Lower As Earnings, Jobs Data Stays In Focus

Tech Sends Nasdaq To Biggest Intraday Rally Since April