Dow Climbs Triple Digits Despite Gloomy Jobs Data

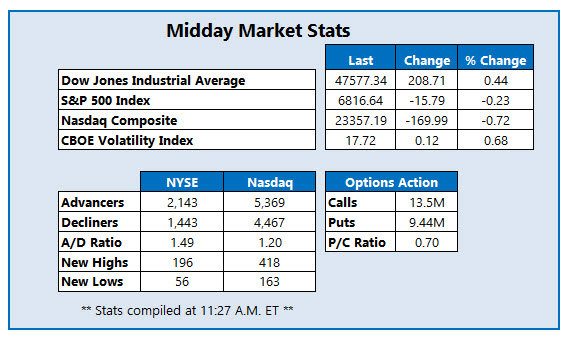

The Dow Jones Industrial Average (DJI) was last seen up 208 points, but the S&P 500 (SPX) and Nasdaq Composite (IXIC) are continuing to slide due to Big Tech pressure. Traders are also unpacking the latest jobs data from ADP, which showed private sector job creation lost an average of 11,250 over the last four weeks, pointing to labor market weakness. Wall Street is also monitoring progress on a bill to end the longest government shutdown in history, which is headed to the House after clearing the Senate.

Hertz Global Holdings Inc (Nasdaq: HTZ) stock is seeing unusual options activity, with 54,000 calls and 51,000 puts traded so far today, or 5 times the intraday average volume. The November 9 call is the most popular contract, followed by the December 9 call. The security was last seen down 1.7% to trade at $6.17, pacing for its fourth loss in the past five sessions, as it pulls back from a rally to its highest level since September. Shares have struggled with overhead pressure at the $7.00 level since July, but still boast a 67.6% year-to-date lead.

DexCom Inc (Nasdaq: DXCM) stock is among the SPX leaders today, last seen up 7.2% to trade at $57.93. While a catalyst for today's pop was not immediately clear, the shares are set to snap a four-day losing streak with their best single-day percentage win since Sept. 3. The security is down 25.4% in 2025, however, and just dropped to a Nov. 7, five-year low of $54.11.

(Click on image to enlarge)

The shares of AppLovin Corp (Nasdaq: APP) are toward the bottom of the SPX's barrel, down 8.4% to trade at $596.87. While the company last week reported a third-quarter earnings and revenue beat, news broke that the U.S. Securities and Exchange Commission (SEC) is probing its data gathering practices. APP still sports an 85.5% year-to-date lead.

More By This Author:

Nasdaq Surges 522 Points For Best Day Since MayNasdaq Up Triple Digits As Big Tech Enjoys Rebound

Stocks Suffer Steep Weekly Drops Despite Last Minute Friday Rally