Dow Bounces Back With A 350-Point Pop As Tech Drags Nasdaq

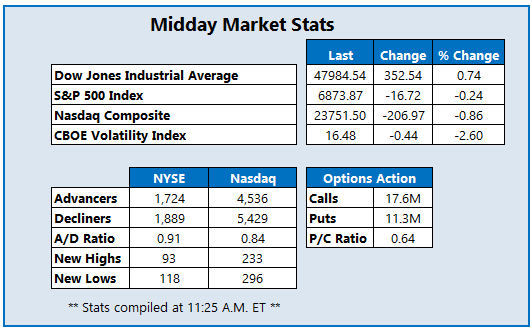

The Dow Jones Industrial Average (DJI) has reversed its premarket deficit, up 352 points at last glance and brushing off broader tech losses. Weighed down by META and MSFT's post-earnings drops, the Nasdaq Composite Index (IXIC) is down triple digits, while the S&P 500 Index (SPX) sits modestly in the red. Investors are still unpacking the latest trade updates, particularly between the U.S. and China, as well as yesterday's commentary from Fed Chair Jerome Powell.

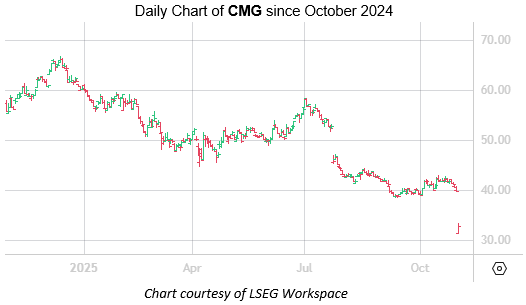

Options traders are targeting Chipotle Mexican Grill Inc (NYSE: CMG), as a disappointing annual sales outlook overshadows a top-line beat for the third quarter. The stock was last seen down 17.8% at $32.66 and gapping to two-year lows, with no fewer than 14 analysts slashing their price targets. So far today, 169,000 calls and 193,000 puts have crossed the tape, which is already eight times the average daily options volume. The December 37.50 put is the most popular, with new positions opening there.

Pharma stock Emergent BioSolutions Inc (NYSE: EBS) was last seen up 32% at $12.40, after the company posted better-than-expected third-quarter results and raised its full-year forecast. Profits of $1.06 per share blew past analyst estimates of -0.12 per share. Breaking above recent pressure at the $10 level, EBS is trading at 52-week highs.

Sprouts Farmers Market Inc (Nasdaq: SFM) stock is down 25.7% to trade at $77.71 and trading at 52-week lows, after sales growth missed Wall Street's expectations. No fewer than eight analysts slashed their price targets, including Jefferies to $110 from $177. Year to date, the equity is down 38.7%.

More By This Author:

Dow Pivots Lower As Fed Casts Doubt On More Rate CutsStocks Nab More Records Ahead Of Fed Decision

Markets Log More Record Closes Amid Rate Cut Enthusiasm