Don’t Worry – This Market Is More 2018 Than 2008

The recent stock market declines have many investors fearing a market crash, such as the 2008 – 2009 bear market.

Back then, the major stock market indexes dropped by more than 50%. As I see what is happening in the markets, this recent pullback feels more like 2018. If I am correct, the recent market correction offers a great opportunity, especially for income-focused investors.

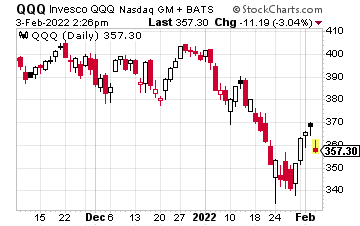

If you look at, say, a five-year stock chart of the Invesco QQQ ETF (QQQ), you can hardly see the 2018 stock market correction. QQQ is the primary ETF tracking the Nasdaq 100 stock index.

From the high for the year in late September 2018 until the correction bottomed at Christmas that year, the QQQ value dropped by 23.5%. That drop was a serious correction, bordering on the bear market territory. For comparison, the recent QQQ value of $354 and change represents a 13.3% drop from the pre-Thanksgiving record high.

From the late 2018 bottom, it took the QQQ just over four months to set a new, record high. More importantly, QQQ has gained 144% in just over three years since the 2018 correction bottomed out.

My stock market strategies focus on dividends and generating cash income. I used the QQQ example to show that, while it can feel scary to do so when in the middle of a steep market decline, investing for the long term allows investors to readily take advantage of shorter-term market dislocations.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more

Yes... for now.