Do You Own The Wrong Kind Of High-Yield Dividend Stock?

In this article, Tim Plaehn reveals a major red flag that investors should learn to recognize within any potential high-yield investment. It’s something that many people could easily overlook, but so important that this one thing makes the stock an instant do not invest. If you invest for income, learning this strategy could help save your portfolio.

During my presentations at the Orlando MoneyShow during the first week of February, I fielded several investor questions on how I analyze and select the dividend stocks I recommend. While I am open to sharing my process, the topic is more appropriate for a longer book or an all-day seminar than it is during a half hour speech.

For this article I’ll show you a high yield stock with factors that would cause me to reject the stock as a recommendation and should give you pause, too.

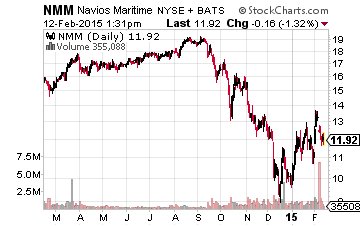

For its economic sector –dry bulk shipping, Navios Maritime Partners LP (NYSE:NMM) is an above average company and has paid steady dividends to investors since it went public in early 2008. The quarterly distribution rate has never been cut and the current yield is an eye-popping 14.6%. As a final bonus, the Navios management has committed to pay the current distribution rate through at least the end of 2016. These facts make NMM look like a pretty attractive high-yield investment.

Now for the analysis that shows me that NMM is not a good fit for the dividend stock goal of high-yield combined with sustainable distribution growth that’s an integral part of The Dividend Hunter.

Companies that use pass-through business structures like publicly traded partnerships – PTPs and MLPs – and REITs generate growth capital by selling more units or shares into the market. The goal is to take that newly raised capital and invest it into business assets to generate a rate of return that allows the company to grow the dividend rate for all investors who own shares. Corporate management refers to this as accretive use of growth capital. The number of outstanding shares increases, but so does the dividend rate paid to investors.

With Navios Maritime Partners, I start my review with company numbers for the second quarter of 2011. This was the last time the company announced a meaningful increase to its quarterly distribution. Since the middle of 2011, the distribution has been flat for 15 quarters. (OK, there was a 0.6% increase for the 2012 second quarter. I view that small increase as a token effort to maintain a distribution growth record: a goal since abandoned.). Yet, since 2011, Navios Maritime Partners has gone to the market to sell additional common units five times. At the end of 2010, NMM had 54.51 million common and subordinated units outstanding. After the most recent secondary common unit offering this month, NMM now has 81.96 million units outstanding. The unit count has grown by 50% in the last 3 1/2 years. Navios has not generated accretive distribution growth from this new equity capital.

However, over the same period the number of general partner units has grown by 40%, increasing the payments to Navios Maritime (NYSE:NM) which controls the partnership. For the second quarter of 2011, the management fees listed on the income statement were $6.46 million for the quarter. For the 2014 fourth quarter, management fees were $13.47 million, a 108% increase! The bottom line is that over the last 4 years, the NMM management team has not been able to increase the dividends paid to investors but has basically doubled the cash it pulls out of the company for itself.

Navios Maritime Partners is somewhat unique in that it has operated in a very difficult economic sector, and the company may have been forced to use equity capital to buy more ships to counteract falling vessel lease rates and maintain the distribution rate. But for me as an income investor, the telling fact is that NMM has dramatically increased the number of units outstanding, exploded the money going to management fees and the general partner, and yet has not been able to increase the dividend rate for common unit investors. At this time, those facts keep NMM off my list of recommended high yield investments.

These are the kinds of details you’ll want to dig into any time you’re considering a dividend stock for your portfolio. Often these pieces of data are obscured by a slew of other information, whether intentional or not.

The Monthly Dividend Paycheck Calendar is set up to make sure you’re getting ...

more

greedy bastards!