Do Treasury Yields Rise During Economic Expansions?

Yes, at least sometimes, and this is one of those times – big time!

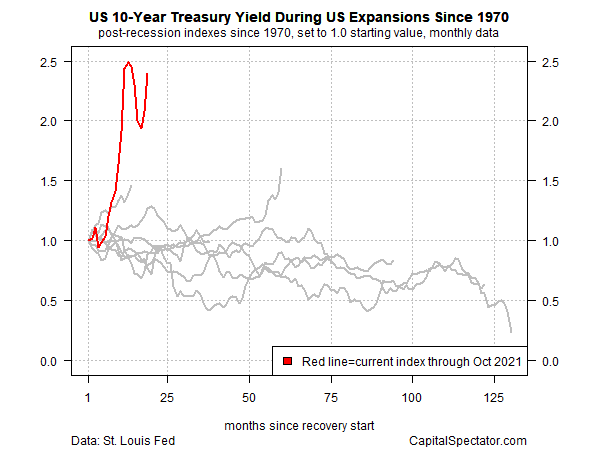

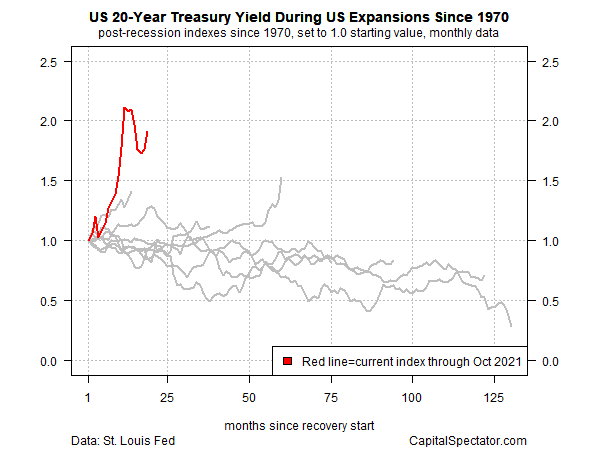

Comparing several maturities on the Treasury yield curve during US economic expansions since 1970 shows that rates have exploded higher – relatively speaking — since the current recovery began in May 2020. Unusual circumstances explain much of this outlier performance, but the sharp change from historical norms over the past half century is certainly worth a closer look.

For benchmarks, we’ll look at the 5-, 10- and 20-year maturities. As a preview, all three show similar behavior in the current economic recovery: sharp upward spikes.

Let’s start with the 5-year yield. Note that the rates in all the charts have been indexed to 1.0 at the start of recoveries for easier visual comparison. For the 5-year rate, for instance, the index rise from 1.0 to 2.8 reflects the actual rate increase from 0.39% in April 2020 to 1.11% in October 2020 (using monthly average rates).

A similar surge has been recorded for the 10-year yield.

Ditto for the 20-year rate.

The common theme in all three cases: the relative shift higher has been unusually stark relative to previous economic recoveries.

There are, of course, unusual circumstances to consider. First, interest rates generally fell sharply going into the recession. As the threat of the pandemic became clear in March 2020, the Federal Reserve acted swiftly to cut interest rates. As it turned out, the recession was unusually short. Soon after the Fed cut rates, the economic recovery began – the sharpest, strongest rebound on record, following the equivalent on the downside. In turn, market yields responded, dramatically.

The extreme volatility in economic conditions has a parallel in interest rates, at least in relative terms. On that front, it’s certainly different this time. Deciding if there’s a meaningful difference for the economic outlook, by contrast, remains a work in progress.

Disclosures: None.