DJI, Nasdaq 100, Dax 30 Forecasts For The Week Ahead

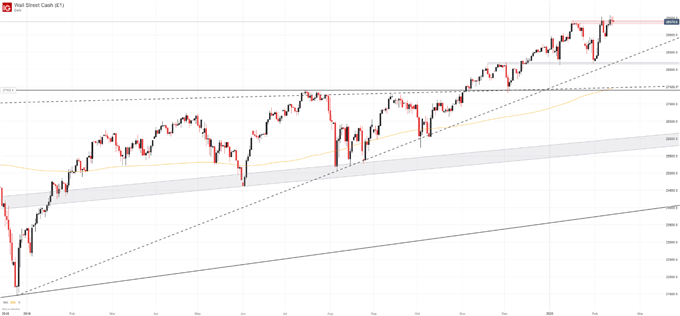

DOW JONES FORECAST OUTLOOK: BULLISH

The Dow Jones posted another rally last week despite resurgent coronavirus fears and profit warnings from companies with operations in China. Rather surprisingly, it seems as though the US equity market is unbothered by the drastic reduction in Chinese economic activity as the three major indices continue to establish new highs. Meanwhile, other growth-sensitive markets like crude oil (OIL) and copper (JJC) have suffered which has left the three markets – ones that typically share some degree of positive correlation – severely disjointed.

DOW JONES PRICE CHART: DAILY TIME FRAME (DECEMBER 2018 – FEBRUARY 2020)

Day Trading the Dow Jones: Strategies, Tips & Trading Signals

With that in mind and without much positive news elsewhere, it becomes increasingly difficult to find evidence for the most recent leg of this record-setting rally. To be sure, many analysts have been eager to point to the expansion of the Federal Reserve’s balance sheet – myself included – as a major factor, but even that fundamental driver was dealt a blow on Thursday when the Fed announced it would slowly scale back repo operations.

Consequently, it seems as though the market is comfortable treading higher without an overwhelmingly bullish backing of fundamentals which could suggest US equities have entered another stage in the bull market cycle. Furthermore, Fed Chairman Jerome Powell’s commitment to “sustain the expansion” is a continuous source of optimism and insurance for US equities that may provide a bullish tailwind until the Fed is pressured to change course. To that end, recent Fed meetings and FOMC minutes suggest Wednesday’s minutes will be largely in line with previous updates from the central bank, leaving the Dow Jones tied to risk trends associated with the coronavirus.

NASDAQ 100 FORECAST OUTLOOK: BULLISH

Like the Dow Jones, coronavirus concerns and the Fed’s policy path are favored to be the main influencers of Nasdaq price action in the week ahead. In the case of the Nasdaq specifically, however, an ongoing Federal Trade Commission review into Amazon (AMZN), Google (GOOGL) and Facebook (FB) could create regulatory headwinds for some of the index’s leaders. In turn, such uncertainty could weigh on future gains and slow the Nasdaq’s ascent, but further progress in the case will likely be required before possible reparations are outlined and serious pressure is applied.

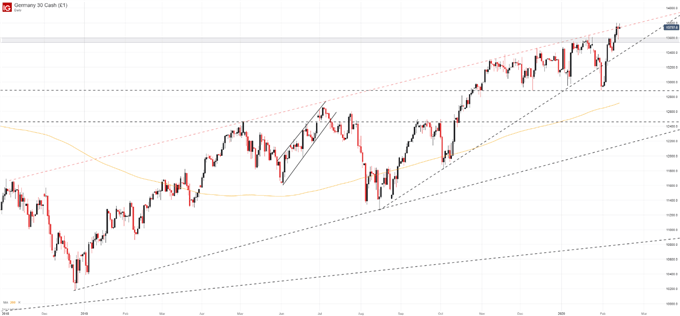

DAX 30 FORECAST OUTLOOK: BULLISH

The DAX 30 also rallied last week despite another string of poor economic data from the Eurozone and the German economy in particular. Coinciding with a steep drop off in EUR/USD, the DAX’s recent price action might suggest investors are anticipating further monetary easing from the European Central Bank in an effort to revive the European economy.

DAX 30 PRICE CHART: DAILY TIME FRAME (NOVEMBER 2018 – FEBRUARY 2020)

How to Trade Dax 30: Trading Strategies and Tips

Whatever the case may be, the DAX 30 will likely continue to trade alongside the Dow Jones, S&P 500 and Nasdaq 100 in the week ahead as broader risk trends look to exert their influence over equity valuations. DAX traders may also be given some insight from Eurozone and German survey expectations due Tuesday, but it is unlikely the data can significantly sway the index by itself.