Dividends By The Numbers In September 2017 And 2017-Q3

After a mixed month for dividend-paying stocks in the U.S., September 2017 proved to be somewhat brighter, especially when measured year over year against September 2016. Ditto for comparisons between 2017-Q3 and the year-ago quarter of 2016-Q3.

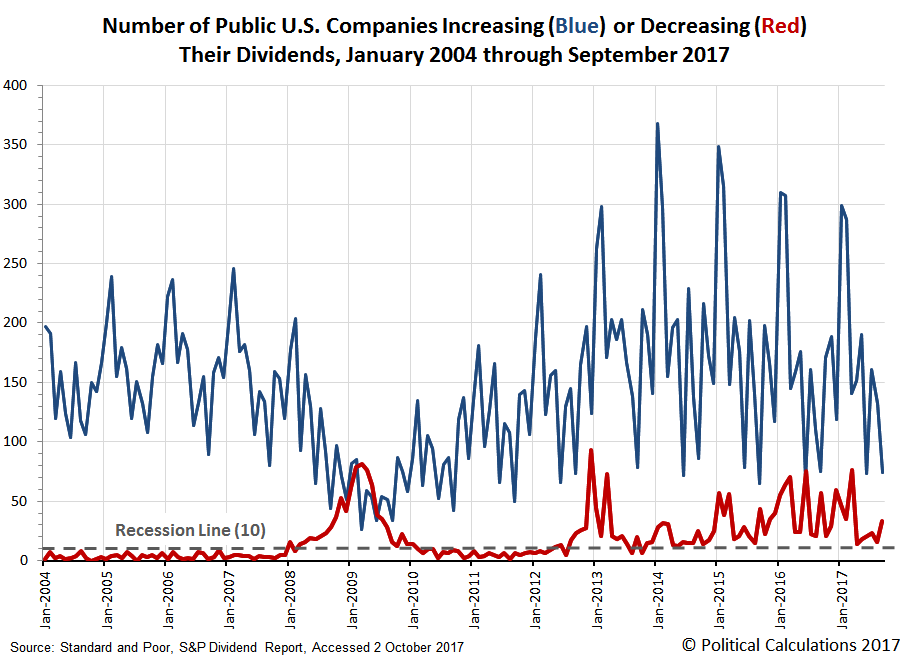

The following chart shows the number of dividend rises and cuts announced each month from January 2004 through September 2017.

(Click on image to enlarge)

Let's get straight to the dividend numbers for the month of September 2017 (and also for the third quarter of 2017!)

- During September 2017, 3,533 firms issued declarations regarding their dividend policies. While that is up from the 3,454 that made such announcements in August 2017, it is down from the 3,572 that declared dividends in September 2016.

- It was a lackluster month for U.S. firms announcing they would pay special, or extra, dividends during the month, with just 17 doing so, which is down from 25 in August 2017 and also down from 21 in September 2016. To get a sense of just how lackluster, the last time the U.S. stock market saw so few firms announce that they will pay out an extra dividend was back in September 2009, which is the fourth-lowest monthly figure for this dividend statistic going back to January 2004.

- The number of dividend increases in September 2017 was 74, which is a decline from 132 in August 2017, and a slight drop from the 75 that did back in September 2016. Comparing 2017-Q3 with the year ago quarter of 2016-Q3, we see that the 367 U.S. firms that announced higher dividends during 2017-Q3 slightly outpaced the 346 firms that boosted their dividends in 2016-Q3.

- With September 2017 marking the last month of 2017-Q3, the 33 announced dividend cuts during the month marked an increase over the 16 that were announced in August 2017, but were well below the 57 that were recorded a year earlier in September 2016. For 2017-Q3, a total of 73 firms declared that they would cut their dividends, falling from the 100 that announced that intention during the year-ago quarter of 2016-Q3.

- Finally, September 2017 saw the number of firms omitting their dividends drop to zero, following the 15 that did in August 2016 and falling below the 5 that omitted their dividends in September 2016.

On the whole then, the dividend numbers for the third quarter of 2017 suggest that the private sector of the U.S. economy has rebounded over the same quarter in 2016, where some of the data for the month of September 2017 is at levels that indicate some cause for concern as recessionary conditions continuing to affect certain sectors and regions within the U.S. economy.

Sampling the dividend cuts recorded by Seeking Alpha and the Wall Street Journal during 2017-Q3, we confirm that most of those conditions are concentrated in the oil and gas sector of the economy, with the finance and Real Estate Investment Trust sector also showing a notable level of distress.

(Click on image to enlarge)

Oil and gas firms accounted for 28 of the 42 dividend cuts that captured by our sample during 2017-Q3 (67% of the sample), with finance and REITs accounting for 10 (24%). One firm in each of the manufacturing, consumer goods, services and techology industries made up the rest of our sample.

Disclosure: None.

Comments

No Thumbs up yet!

No Thumbs up yet!