Distractions, Selloff Worries, And The Week Ahead

Image Source: Pexels

Time to Hedge

We’ve been operating with a negative S&P 500 signal for a few days, and we've seen a downward move in the market since the second week of July. The chatter is building that this week will deliver a wealth of selling from the Commodity Trading Advisors (CTA).

Goldman Sachs projected that there isn’t a scenario in which they aren’t net sellers this week. While I typically don’t trust the source, we’re getting into that territory where a few small squeezes can lead us to the Fed meeting—followed by a post-FOMC dump. CTAs are overbought on the equity market, and Syz Group suggests that the selling could total at least $7 billion this week.

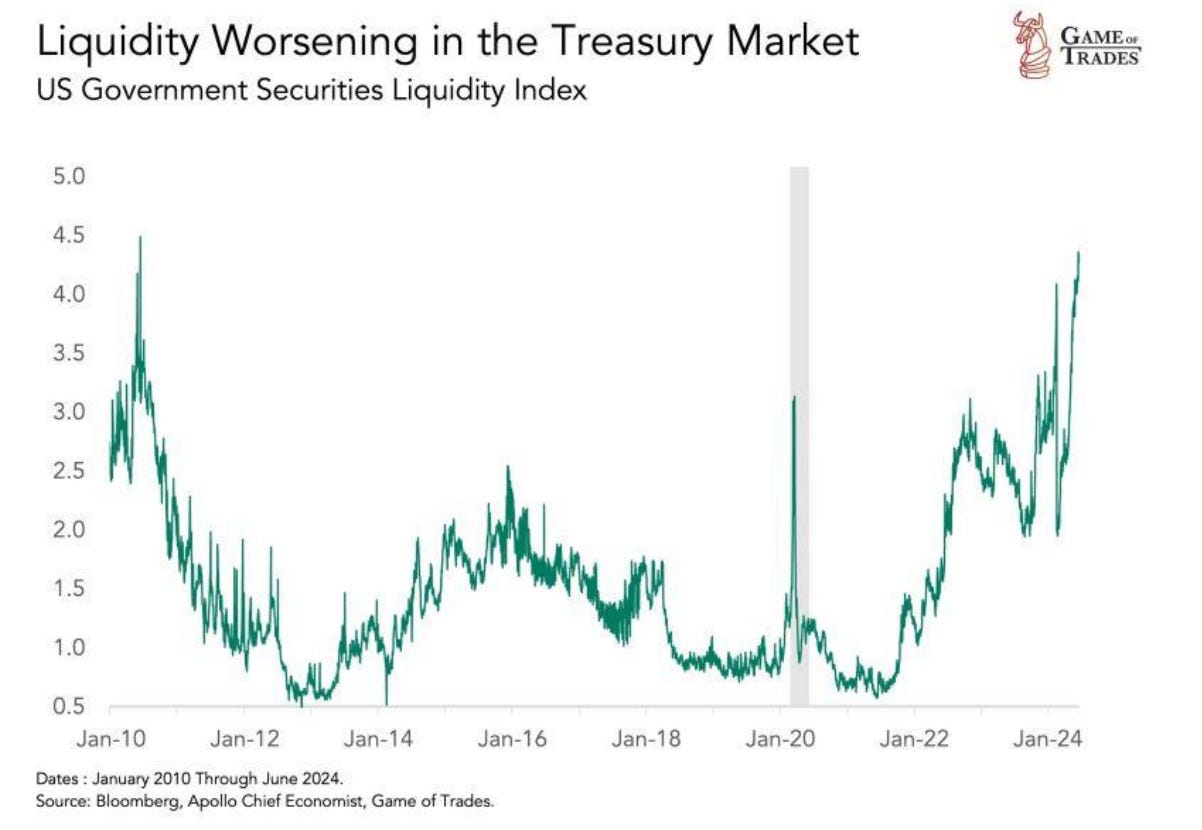

The most important chart this weekend concerns the liquidity issues in the U.S. Treasury market. Should spreads blow out and collateral quality worsen, we’d be in for a little bit of fireworks.

(Click on image to enlarge)

Image Source: Game of Trades

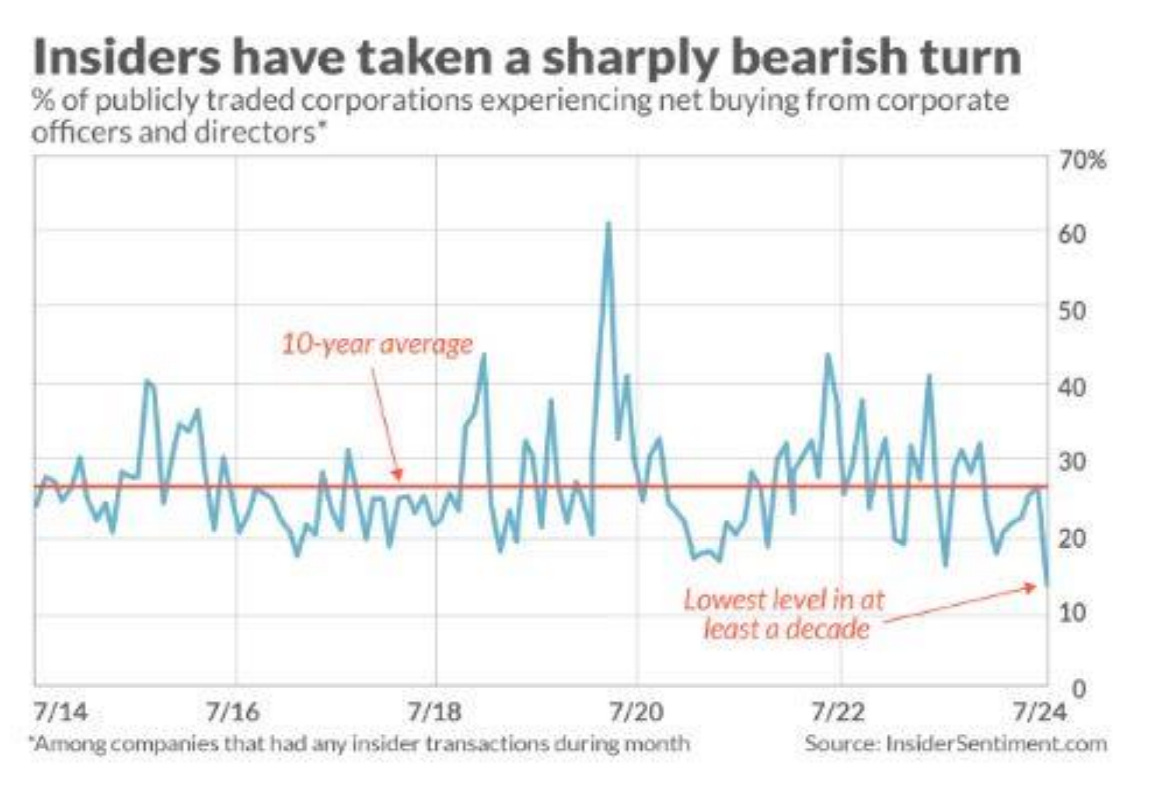

On top of this, insiders just aren’t buying their own stocks. Insider Sentiment notes that we’re seeing the worst levels of corporate net buying in a decade.

(Click on image to enlarge)

Image Source: Insider Sentiment

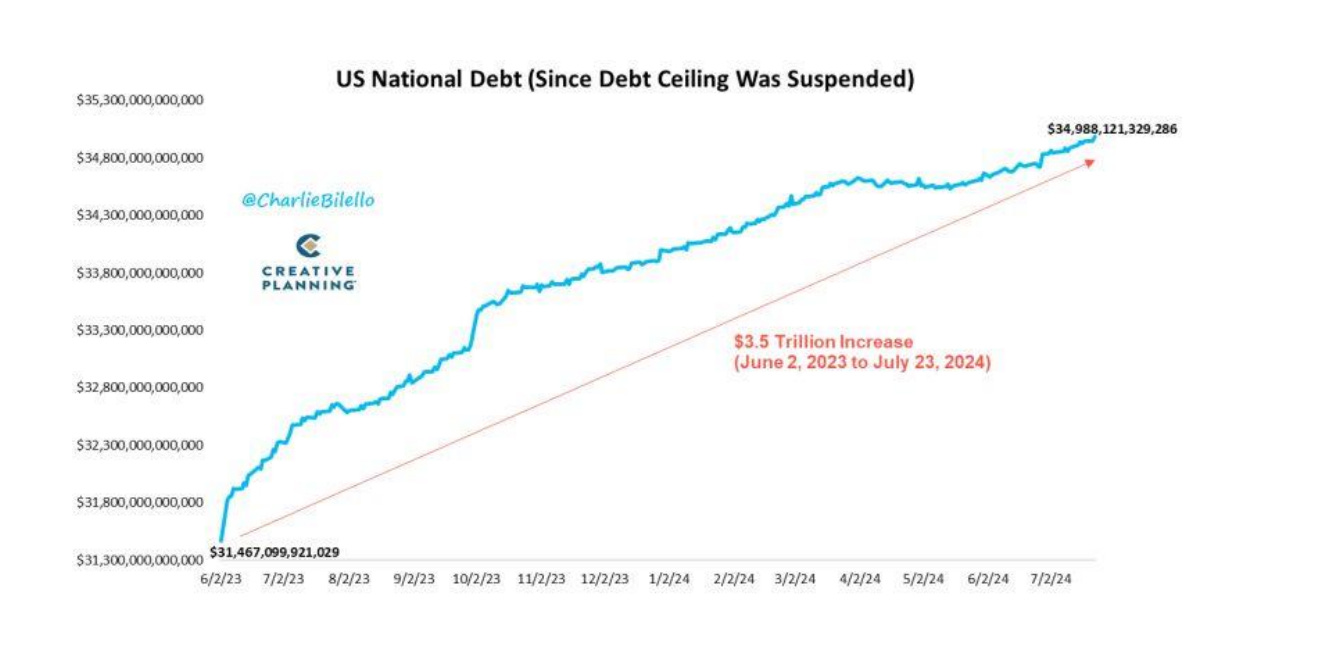

The problems that have manifested are not going away: The economy looks stronger, but we’re borrowing more than $2.00 to print $1.00 in economic growth. The national debt has blown out to roughly $35 trillion, and no serious plan exists to address it.

(Click on image to enlarge)

Image Source: Creative Planning - Charlie Biello

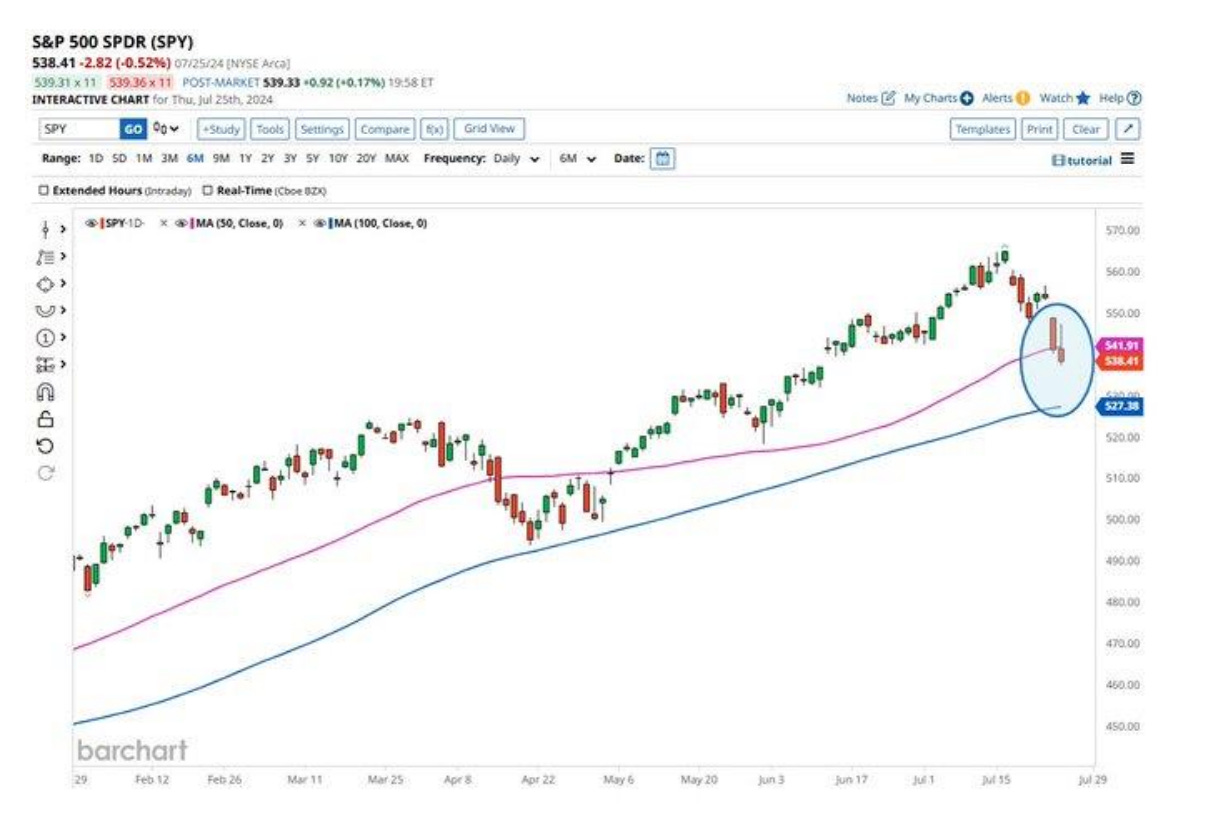

All the while, the S&P 500 is now back under its 50-day moving average -- and the concern is that the next selling point could be around the 100-day moving average.

(Click on image to enlarge)

Image Source: BarChart via Syz Group

We’ve been down about 5% since the selloff started, and I think this can and will lead to the first of the 8% projected downturns that I forecasted for this year. I’ve sold calls on every position I own, and even that doesn’t feel like enough.

This will be a vital week to hedge, but do not panic sell. If you haven’t been paying attention and following the MACD as we’ve advised, you’re in it now.

Event of the Week: Here Comes Jerome

The markets cheered when the CPE numbers came in at expectations, signaling that the Fed’s pursuit of inflation is advancing. Of course, who needs food and energy?

The headline news is a projection of a September cut. But that’s taking us right back into the territory of the Fed aiming to help the incumbent ahead of the election. No?

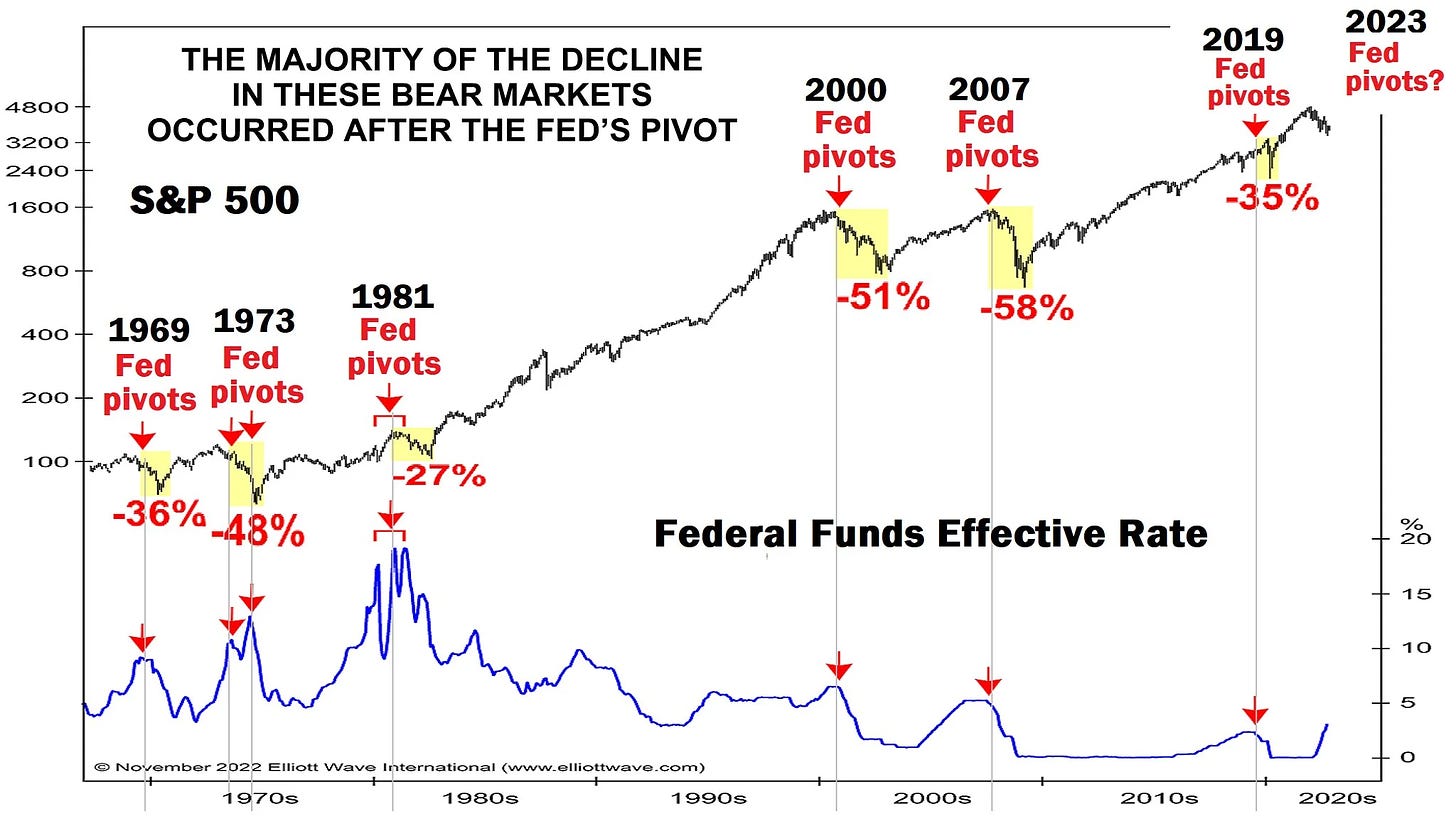

As I’ve said, the Fed is not in a position to cut. Services inflation is still elevated, and there’s real concern that the real economy bottomed in the second quarter. Finally, remember that a pivot has historically not been good for the markets.

Historically, a Fed pivot has led to sharp downturns in the market. That said, something is radically different around this environment. It might be the runaway debt, it might be the liquidity expansion. This market has defied the massive yield curve inversion for a record period. So, I guess anything can happen.

But just be aware that history has said otherwise.

(Click on image to enlarge)

Image Source: Elliott Wave International

Monday, July 29, 2024

- Event: McDonald’s (MCD) earnings

The talk of the town is the McDonald’s $5 Meal Deal, a value play that doesn’t truly align with its history of innovation. The last time they got into a price war, it cost them dearly. However, the company is trying to get people back into the franchises after a difficult two years as inflation increased.

The company reports earnings on Monday, and many analysts wonder how this new Meal Deal will pay off. This week, we’ll get Porter’s podcast out on McDonald’s after a few delays. You’ll want to hear this, as it breaks down where you should target McDonald’s stock as a buyer in the future.

Tuesday, July 30, 2024

- Event: Microsoft (MSFT) earnings

The tech giant has two forces against it this month. First, the ongoing selloff in tech stocks, and second, the CrowdStrike (CRWD) implosion that shut down networks worldwide last week.

It’s impossible to root against Microsoft stock, and it’s a name that you should always be looking to buy in the event of a bigger selloff. It if taps $400, it’s a buy in my eyes. And you’d “position size” on the rest of the way down. There’s so much cash flow on top of increasing cloud demand and its forays into AI.

Wednesday, July 31, 2024

- Event: Fed Statement on Rates, Boeing (BA) earnings

I already discussed the Fed, and I don’t have any real interest in developments at META (META), which also reports earnings. So, let’s focus on the dumpster fire that is Boeing.

Not only is the company struggling with its 737 production, not only has it skipped major air shows, but two Boeing Starliner astronauts are now stuck in space -- and have been for 52 days due to a helium leak. NASA may have to turn to Elon Musk and SpaceX to bring these guys home, as they’re currently on the ISS. The ISS only has so many resources itself -- and worse, there’s no timeline for their return.

Thursday, Aug. 1, 2024

- Event: OPEC+ holds a monthly meeting on production

Will OPEC+ hold the line with their production cuts set for October? That’s the big story as oil prices continue to dip, with Brent pushing $81 on Friday. As I noted recently, the battle between OPEC and the United States is heating up.

U.S. producers, new tech in AI, and fracking all put the focus on declining production costs. The Permian Basin is experiencing its next revolution, which will help bring the U.S. to 14 million barrels per day -- a development that puts America on pace to rely less on OPEC.

Friday, Aug. 2, 2024

I want everyone to pay close attention to Exxon and Chevron's earnings calls. There will be a lot of talk about what’s happening in Texas, and I think you’ll hear some encouraging developments in the cost of oil well production across the Permian. Something significant is happening, and it might take the leaders to bring light.

Meanwhile, the Jobs Report only calls for 185,000 new positions. How many of them will be government and healthcare jobs? Let’s set the odds at 60%. What do you say?

More By This Author:

A Sobering Insider BuyA Dip In Liquidity

How the American Stock Market Ends...

Disclosure: None.