Despite Two Dovish Dissents, Fed Holds Rates As Expected; Upgrades Growth, Lowers Labor Risks

Image Source: Pexels

Tl; dr: Despite two dovish dissents, The Fed is likely on an “extended pause” noting strong activity data and signs of stabilization in the labor market.

However, Goldman "expects easing to resume later in the year as a moderation in inflation allows for two further ‘normalization’ cuts to take rates back to levels seen by the median FOMC member as neutral.”

Christopher Hodge, chief US economist at Natixis, says at the end of the day here the Fed is “on hold until data prompts a move.”

"We have now entered a new phase of policymaking where the Fed views the risks to both parts of its dual mandate are in balance. It will be incumbent on the data to move the Fed from this perch – the days of insurance cuts to slowly approach neutral are likely over."

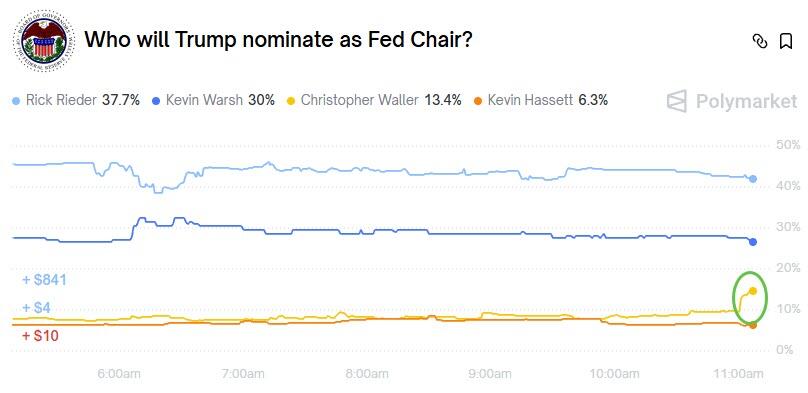

Waller's odds of being the next Fed Chair went up after his dovish dissent.

***

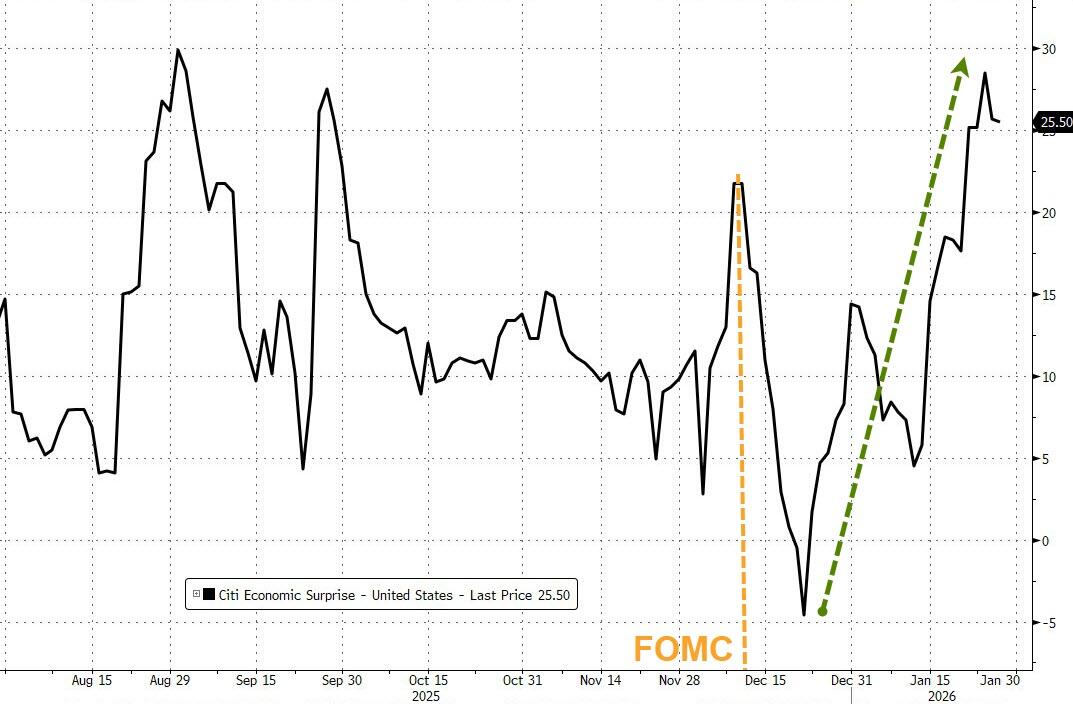

Since the last FOMC meeting on Dec 10th (which resulted in a dovish-er than expected 25bps rate cut and statement), US macro data has surprised significantly to the upside...

Source: Bloomberg

...prompting a plunge in the market's Fed rate-cut expectations (now below 2x 25bps cuts for the year)...

Source: Bloomberg

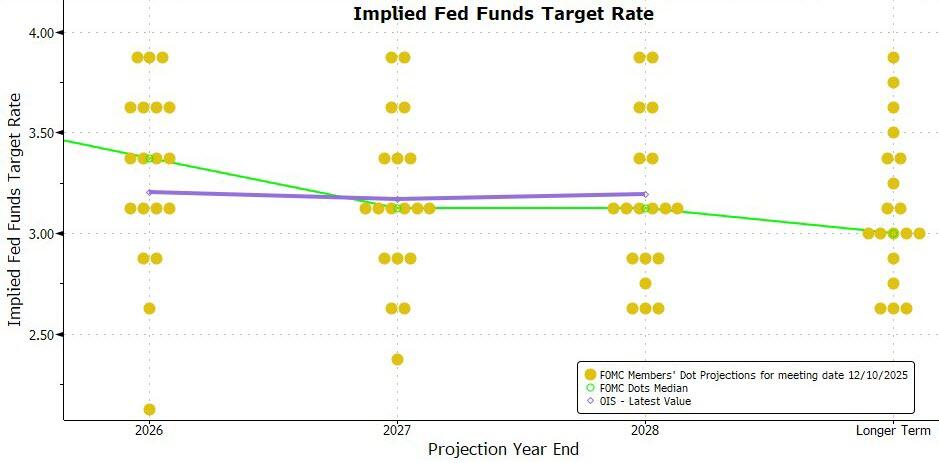

The market is now more only modestly more dovish than The Fed's dots for 2026 (but the market is also not pricing in any more moves from The Fed after that)...

Source: Bloomberg

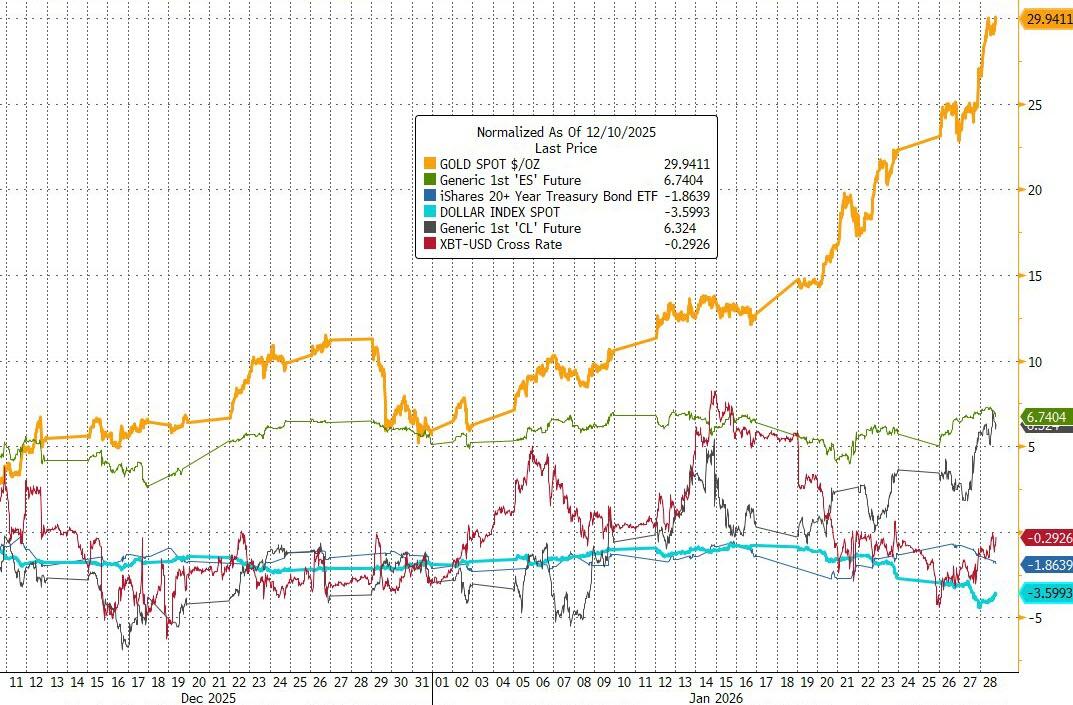

All of which has sent the dollar tumbling and gold exploding higher (while stocks rallied and bonds sold off)...

Source: Bloomberg

Heading into today's FOMC statement (and presser), a dramatically wide consensus expects a "boring" and "uneventful" dovish hold with an upgrade to growth, and less downside risk to employment.

...and that's EXACTLY what we got.

No change in rates...

-

Federal Open Market Committee votes 10-2 to leave its benchmark interest rate in a target range of 3.5%-3.75%

-

Fed Governors Christopher Waller and Stephen Miran voted against the decision in favor of lowering rates by a quarter-point

Which prompted a jump in the odds of Waller getting The Fed Chair job...

Upgrade for growth:

- Fed upgrades view of economy to say available indicators suggest economic activity “has been expanding at a solid pace,”

Inflation-watch:

- Fed repeats inflation “remains somewhat elevated”

Labor market optimism:

-

Fed removes language from statement that had noted “downside risks to employment rose in recent months”

-

Fed tweaks description of the labor market, noting “job gains have remained low” and the jobless rate has “shown some signs of stabilization”

In terms of market reaction, it’s a nothing burger so far as most expect.

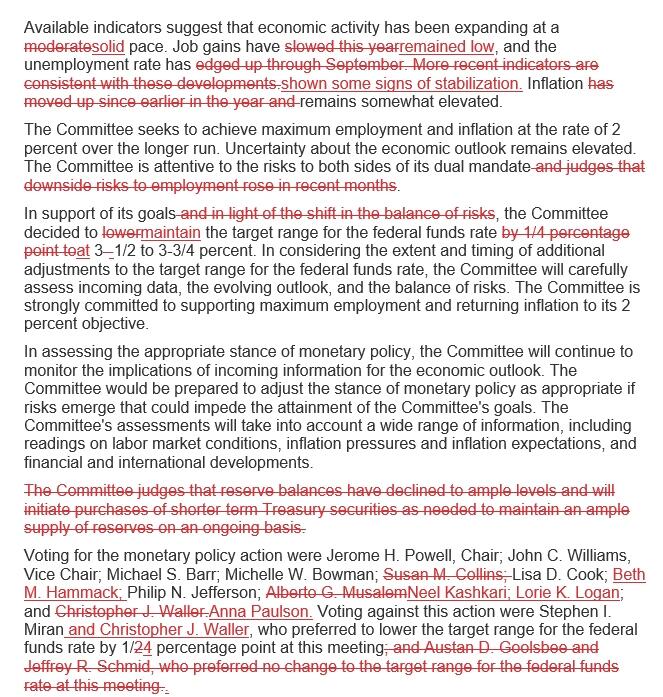

Read the full redline of the FOMC Statement below:

More By This Author:

Amazon Cuts 16,000 Jobs As Tech Layoffs Accelerate In 2026

UPS Won't Resurrect MD-11 Fleet After Deadly Crash, Takes $137M Charge

China's Largest Oil Producer Suspends Purchases Of Venezuela Oil