Desperately Seeking Yield - Friday, Oct. 29

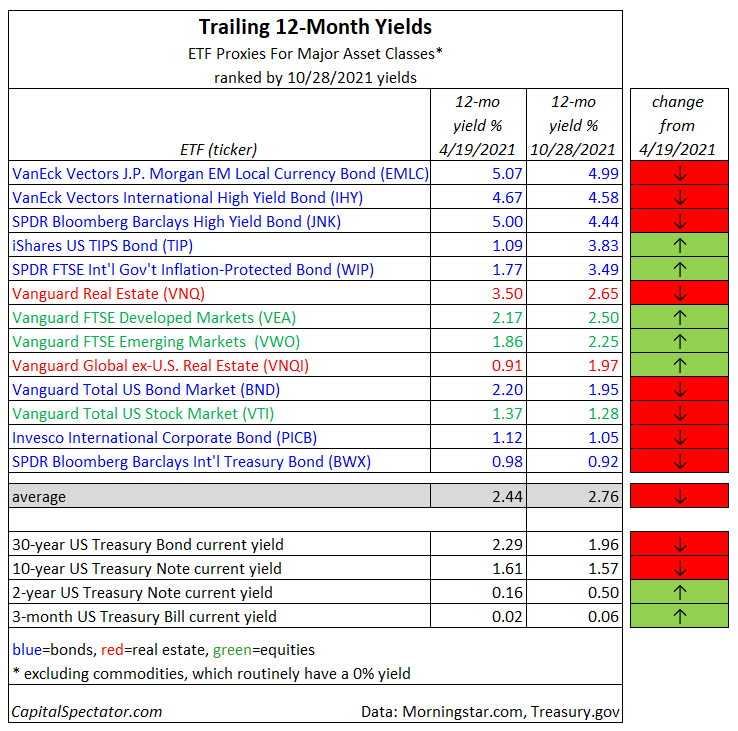

Finding a respectable yield remains challenging, but it’s starting to get easier, if only slightly. As we check in on our standard ETF proxies for the major asset classes, the opportunities for yield-hungry investors is looking up, relative to our previous update in April.

But let’s not get too excited. While some markets are posting higher trailing yields, inflation is higher too – and by more than a trivial degree. Headline consumer inflation was running at a 4.2% year-over-year increase in April; now it’s hotter at 5.4% through September. All else equal, real yields are lower.

But all else isn’t equal and for some markets the yields are higher, based on data through yesterday (Oct. 28). Notably, inflation-indexed bonds are now reporting sharply higher payout rates, based on the trailing one-year yield as reported by Morningstar.com.

The iShares TIPS Bond ETF (TIP) has a 3.83% trailing yield, dramatically higher than the 1.09% in April’s update. The offshore equivalent — SPDR FTSE International Government Inflation-Protected Bond ETF (WIP) – is also enjoying a hefty increase in trailing yield.

Foreign stocks (VEA and VWO) and US real estate (VTI) are also posting higher yields vs. April. Otherwise, lower payouts prevail for the rest of the field. But in a sign of what may be the new normal, the average yield is higher for the ETFs representing the major asset classes: 2.76% vs. 2.44% in April.

That’s low relative to current inflation, but a 2.76% yield still beats what’s available in the “risk-free” world of Treasuries by a respectable margin.

In fact, the Treasury benchmarks are a mixed bunch in terms of yield changes. Rates in longer maturities (10- and 30-year rates) are down vs. April payouts. Meanwhile, current yields on shorter maturities (3-month and 2-year rates) are up.

A key caveat to keep in mind with looking at trailing yields for ETFs: there’s no assurance that you’ll capture these rates. ETFs, after all, aren’t government bonds and so future payout rates ebb and flow at the whim of Mr. Market and other factors.

Nonetheless, recent trends suggest the yield opportunities are improving, at least in nominal terms. Measured in real term, on the other hand, still relies on total returns – yield plus capital gains, if any – to beat the benchmarks.

Disclosures: None.