Deficit Spending Main Driver Of American Economy

Wake up America! It is only massive and unsustainable deficit spending that continues driving our economy forward. This is why the President's fixation on the stock market and not the real economy represented by Main Street does a great disservice to Americans. While Trump may have been correct in pinpointing many of America's economic ills his prescriptions for a cure leave much to be desired. How we react to money and the economy is often rooted in our past experience and Trump has never shown himself to be shy to taking on debt to propel himself forward. This is why when the stock market started to wobble months ago President Trump increasingly ratcheted up his attacks on Fed Chairman Jerome Powell for"ruining the party."

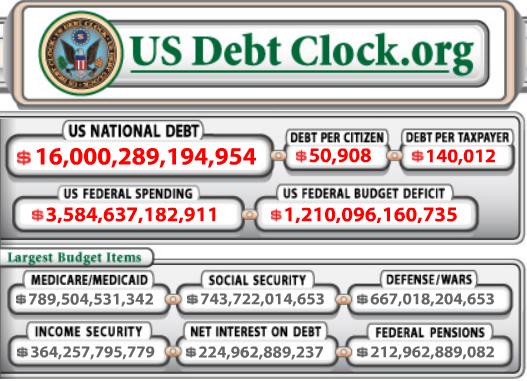

(Click on image to enlarge)

The budget deficit is set to widen significantly in the next few years and in 2020, is expected to top $1 trillion even with healthy economic growth, according to new projections from the nonpartisan Congressional Budget Office. This means the national debt of around $22 trillion will soar to more than $33 trillion in 2028. A trillion dollar deficit translates into America spending $3,333 more than it takes in for every man, woman, and child in the country. This is "each year" and does not include State and local deficits or a slew of "off book" promises and spending that are also being made. This money "percolates" several times through every part of the economy as food stamp recipients buy groceries and government agencies pay their workers and buy new equipment.

The bottom-line is that we are in the midst of a "false economy" and it is only by the grace of this massive deficit spending that we are not languishing at the bottom of a deep economic pit. When a country gorges at the trough of deficit spending it can easily manipulate a big temporary boost in its GDP. In the past I have written about how a country can kick their gross domestic product higher and build a false economy based on infrastructure or war, both these methods of producing economic growth are the result of deficit spending. Ever since the 2008 financial crisis deficit spending has been on a torrid pace that has created the longest bull market in history but no matter what, the economic cycle will end as we are forced to face the massive debt we have created and a slew of bad investments brought upon us because money has been so cheap.

Investors would be wise not to accept America's recent GDP as verification the economy is hitting on all cylinders. In 1962 Kuznets, the father of the GDP formula emphasized that we must keep in mind the difference between quantity and the quality of growth. While economic growth appears robust and a solid GDP number can result in a feel-good moment building consumer confidence it can also mask growing weakness in various parts of the economy. Quantity simply does not make up for the poor quality, we are talking about two totally different animals. The false narrative that simply growing the size of an economy by adding more people into the mix or using deficit spending undercuts the importance of a solid economic and the long-term stability of the financial system.

It is important to note that countries all over the world are playing the same game and spending like drunken sailors and the money being created and poured into the economy has to go somewhere. Often it flows to paying interest on debt already in force or to fill in the hole resulting from endless defaults that occur each day. Needless to say, government debt is building up in many forms including promises that will never be fulfilled but with politicians excelling in perpetuating a short-sighted view of the future and the ability to continually kick the can down the road it is not surprising to see them being complicit or even encouraging central backs to continue down this treacherous path.

Much of what we see today is the result of the so-called "everything bubble" which has allowed loans to be stacked upon other loans because rising water floats all boats. Whether it is intentional misdirection, a case of economic fraud or people simply getting caught up in wishful thinking and euphoria, history shows this is often the forerunner of disappointment and generally results in a hard landing. The fact is, the money we have created and poured into the economy had to go somewhere and we find that it has not only inflated asset prices but it has also inflated promises that tomorrow will be left unfulfilled. These "promises" will prove even far more sinister than the former in that they represent the most pain but are well hidden away in times yet to come.

While we were told tax reform would mark a major shift in companies deciding whether to keep jobs here or even bring them back to America that may not happen. This narrative that helped to win passage of the legislation and the many assertions made by politicians and their allies in the world of economics will not in itself lead to more investment. Several reasons exist for jobs not to come rushing back to America. The structural issues that haunt America's competitiveness far outweigh the benefits brought forth from Trump's tax bill and lower taxes. The ugly truth is American companies have little reason to bring jobs home, the logic that lowering corporate income tax will create a massive flow of jobs to our shore is flawed.

Corporate investment decisions are based upon the cost of capital and the prospective equity returns that new investment can generate, not how much capital is available and in our current cheap and easy money, environment capital is basically free. The problem is not funding new investments, but finding endeavors in which to deploy this capital. The economists who largely control the major central banks in the industrialized nations may be able to manipulate markets and cancel excessive debt through open market operations, but they cannot manufacture attractive investments. Sadly for several reasons stock buybacks has been moved to the front the list of corporate priorities joining other investments that are not productive investments.

The deficit spending propping up our economy has gone far past anything we might have envisioned just a decade ago and now the path forward appears even more difficult as auto sales fall and companies admit they will no-longer manufacture cars in North America. The housing also is a problem with much of the construction now flowing into high-end apartments rather than affordable units. This is the result of government policy and laws that discourage anyone from wanting to invest or deal with housing for the poor. These are two big sectors of our economy but even they have become tired.

(Click on image to enlarge)

Indirectly this deficit spending by our government also fuels our trade deficit, an area in which we have miserably failed in recent years, this is not only evident by our massive trade deficit with Asia but the United States' huge trade deficit with Mexico which becomes even more disturbing when you begin to understand even that money quickly passes through Mexico and flows to Asia. It could be argued that when all is said and done we are still transferring our wealth to the far east only by the scenic route. The idea we will reach a quick fix to the trade problems facing America and is a myth and oversimplifies the problems before us in achieving a sustainable trade balance. Reaching a reasonable solution posses a major difficulty in that China is so entrenched in its ideology it most likely will refuse any change that will throttle back its plans of domination.

History has proven that while government spending can supplement the economy, over the long run government spending is a poor substitute for the free market in allocating capital to where it is most effective. Deficit spending is not economic growth but borrowing from the future. Today late cycle indicators are on the rise, moderating growth, tightening credit, declining earnings, higher interest rates, the peak of consumer confidence, rising inflation and more. The crux of this post is to point out deficit spending is not a silver bullet without consequences and with each step forward we get closer to the end of the road. While those embracing Modern Monetary Theory may argue otherwise Econ 101 teaches that such actions as we have seen always lead to a very bad place.

The only domination I see is American protectionism of inferior and expensive IPhones. Fear of China and tariff wars will lower world prosperity.