Defaults Expected To Rise Towards 5.5% In Europe And Reach 6% In The US

Image source: Pixabay

According to Moody’s, (as of August) default rates are now sitting at 3% in Europe and 4.8% in the US. We expect to see a rise of 2.5% in Europe next year and just a 1.2% rise in the US. We have seen more defaults registered in the US thus far, and the landscape in the US is becoming less pessimistic, with a soft landing looking more likely than in Europe.

We expect default rates will rise in both Europe and the US in 2024. For some time now, struggling companies have been kept afloat with the help of cheap funding, large government and central bank support, and economic strength, but we expect many of them will not be able to endure for much longer if this support is taken away.

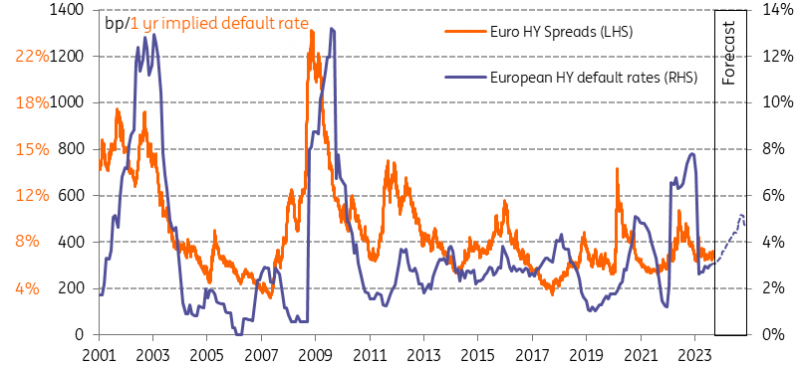

We forecast European speculative grade default rates to rise towards 5.5%

Already we have seen a slow upward trend in defaults in 2023 (along with an uptick in Europe with the realisation of defaults on the back of the Ukraine-Russia war). We expect this trend to continue.

According to Moody’s, (as of August) default rates are now sitting at 3% in Europe and 4.8% in the US. We expect to see a rise of 2.5% in Europe next year and just a 1.2% rise in the US. We have seen more defaults registered in the US thus far, and the landscape in the US is becoming less pessimistic, with a soft landing looking more likely than in Europe.

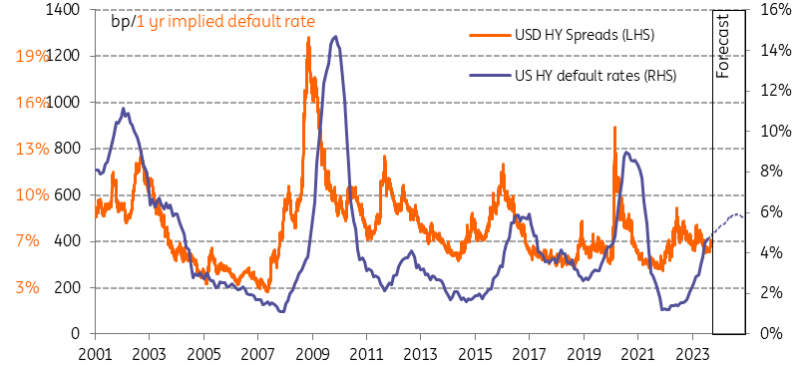

We forecast US speculative grade default rates to reach at least 6%

Naturally, our base case scenario could turn more pessimistic if the elephant in the room – the faltering commercial real estate market – were to prompt an investor stampede.

We believe the following factors will drive this increase:

- Higher for longer rates

- Less availability of credit

- Worsening economic environment

- Lack of government / central bank support

- Changing landscape for certain sectors

- Pressure on metrics

- Delayed reaction to widening and volatile spreads

The charts below show the theoretical compensation for these spreads on the basis of loss, given default calculations that assume a 40% recovery rate for Europe and a 30% recovery rate for the US. In other words, how high credit spreads should be in order to compensate for certain cumulative or annual default rates.

We are somewhat bearish on the spread development for high yield next year, as we see spreads at arguably rich levels, and there is much to be concerned about for the lower-rated debt market. Also noteworthy is that while we are bearish on spreads, we are not negative in our outlook on the segment.

Taking these somewhat rich current spread levels (using the ICE EUR High Yield non-financial index), we see that at a little above 350bp, the implied default rate equates to 7% annually. Similarly in the US (using the ICE USD High Yield non-financial index), with the current spread level of around 400bp, the implied default rate equates to 7%. Naturally, this exercise is only theoretical but does give an indication of direction – particularly as we expect spreads could widen from here.

Implied default rates

ING, ICE, iTraxx

European HY default rates up against HY spreads & implied default rates

ING, ICE, Moody's

US HY default rates up against HY spreads & implied default rates

ING, ICE, Moody's

Why these factors will drive an increase in default rates

Higher for longer rates

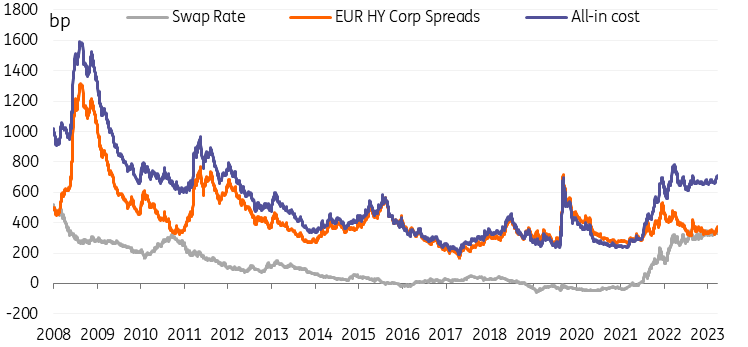

Rates are likely to stay at these elevated levels for some time, and come down slowly. Our rates strategists expect EUR rates to move mostly sideways in the coming year, with EUR 10-year swap rates only dipping towards 3% by the middle of next year from around 3.25% currently. While USD 10-year swap rates have more room to rally, they are also likely to dip below 3% next year, but only temporarily. As such, funding costs remain very high, particularly for lower-rated issuers. This adds additional pressure onto corporates and their debt servicing costs. Furthermore, the significant cash levels on the books of many corporates (due to large funding done in 2019- 2021) have been depleted, and thus the buffer is lower. This means refinancing costs could increasingly become a problem in 2024, particularly for high-yield issuers and real estate issuers.

All-in cost of debt for high yield corporates has reached highest levels in over 10 years

ING, ICE, Refinitiv

Less availability of credit and equity

With tighter lending standards, less available bank liquidity and banks looking to reduce exposure to risk, many corporates will be pushed towards the more expensive bond market. This adds some additional supply pressure, particularly in certain segments of the market. Subsequently, this will be a further negative driver of spreads and once again lead to a higher cost of debt for high-yield corporates. Additionally, there is now a lack of access to IPOs, LBOs and private equity, further putting pressure on corporates' ability to refinance.

Worsening economic environment

The combination of stubborn, sticky inflation and subsequent pressure on the economy adds another ingredient to the melting pot of pressure on corporates. Our economists deem a recession realistic for the US in 2024, while growth in the eurozone is also expected to weaken – from 0.5% to 0.4% year-on-year. While rates are expected to come down over the course of 2024, our economists do expect them to remain substantially higher than pre-pandemic.

Lack of government / central bank support

We think many lower-rated corporates have been kept afloat by the large support seen from governments and central banks. This has included asset purchases and stimulus from central banks as well as more localised support from governments during the Covid crisis, and the very cheap funding environment of the past number of years. Some less-than-sound business plans may not be able to survive the higher funding, quantitative tightening and unsupportive recessionary environment, leading to subsequent failure.

Changing landscape for certain sectors

Furthermore, there have been very significant changes to the landscape in a post-Covid world, whereby we see a notable change in consumer spending patterns, as well as a changing dynamic on the back of high inflation. This changing environment has put some sectors under a substantial amount of pressure. This has also led to a pick-up in high-yield downgrades. Some of the sectors that have been affected include Freight, Travel, Leisure, Retail and the energy-intensive and labour-intensive industrial and manufacturing sectors with competitive but low margins.

Pressure on metrics

Again high inflation, a worsening economic picture, a changing landscape, and the higher cost of debt are all factors that will have a negative effect on corporates. This is being seen in credit metrics, specifically in the negative turn in free cash flow (FCF) numbers, as illustrated below. EBITDA numbers, on the other hand, have seen a positive uptick this year.

FCF numbers have seen a decline in 2023... EBITDA numbers have ticked upwards in the past two years

(Click on image to enlarge)

ING, Refinitiv, iBoxx

Delayed reaction to widening and volatile spreads

When looking at the relationship between spreads and defaults, we observe a rather strong correlation, with increasing default rates and widening (& volatile) spreads, albeit there is a delay. The most recent elevated spread environment, alongside the expected further widening of spreads from here, suggests default rates will rise in the coming months. Additionally, these defaults have been delayed longer than usual, in our opinion, due to the previous low funding levels and large government support (as per above) which have kept some corporates afloat for the time being but merely postponed the inevitable.

S&P and Moody’s are expecting a rise in default rates next year

The below table outlines the default rate expectations from the two rating agencies. We base our forecasts on Moody’s actualised numbers. While the two agencies do indeed expect an increase in default rates, their base case scenarios are not as negative as ours.

S&P's pessimistic forecast is the one we are more aligned with, including a prolonged period of slow growth or recession and persistent inflation, and thus higher for longer rates. The base case accepts the cash flows will be challenged but resistant, while the optimistic scenario includes rates falling quicker than expected.

Moody’s two pessimistic scenarios see one or more of their risks materialising; stress in the financial sector, accelerating inflation, escalation in the Ukraine-Russia war, further pressure from the energy crisis and a slowdown for China's economy. The base case scenario expects that a combination of higher rates and lower growth will only dent corporate earnings and cash flows.

Moody's and S&P default rate forecasts

*Note: The Moody’s EUR optimistic case and USD base & optimistic case both see rates peak in Jan 2024

ING, Moody's, S&P

More By This Author:

Key Events In Developed Markets And EMEA The Week Of Oct. 16Asia Week Ahead: Incoming China Data And Key Central Bank Decisions

FX Daily: Geopolitics May Start To Take Over

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more