Debt: The Key Factor Connecting Energy And The Economy

There are many who believe that the use of energy is critical to the growth of the economy. In fact, I am among these people. The thing that is not as apparent is that growth in energy consumption is dependent on the growth of debt. Both energy and debt have characteristics that are close to “magic” with respect to the growth of the economy. Economic growth can only take place when growing debt (or a very close substitute, such as company stock) is available to enable the use of energy products.

The reason why debt is important is because energy products enable the creation of many kinds of capital goods, and these goods are often bought with debt. Commercial examples would include metal tools, factories, refineries, pipelines, electricity generation plants, electricity transmission lines, schools, hospitals, roads, gold coins, and commercial vehicles. Consumers also benefit because energy products allow the production of houses and apartments, automobiles, busses, and passenger trains. In a sense, the creation of these capital goods is one form of “energy profit” that is obtained from the consumption of energy.

The reason debt is needed is because while energy products can indeed produce a large “energy profit,” this energy profit is spread over many years in the future. In order to actually be able to obtain the benefit of this energy profit in a timeframe where the economy can use it, the financial system needs to bring forward some or all of the energy profit to an earlier timeframe. It is only when businesses can do this, that they have money to pay workers. This time shifting also allows businesses to earn a financial profit themselves. Governments indirectly benefit as well, because they can then tax the higher wages of workers and businesses, so that governmental services can be provided, including paved roads and good schools.

Debt and Other Promises

Clearly, if the economy were producing only items for current consumption–for example, if hunters and gatherers were only finding food to eat and sticks to burn, so that they could cook this food, then there would be no need for the time shifting function of debt. But there would likely still be a need for promises, such as, “If you will hunt for food, I will gather plant food and care for the children.” With the use of promises, it is possible to have division of labor and economies of scale. Promises allow a business to pay workers at the end of the month, instead of every day.

As an economy becomes more complex, its needs change. At first, central markets can be used to facilitate the exchange of goods. If one person brings more to the market than he takes home, a record of his credit balance can be kept on a clay tablet for use another day. This approach works as long as the credit can only be used at that particular market. If the credit balance is to be used elsewhere, or if the balance is to hold its value for a period of years, a different, more flexible approach is needed.

Over the years, economies have developed a wide range of debt and debt-like products. For the purpose of this discussion, I am including all of them as debt, broadly defined. One type is what we think of as “money.” Money is really a portable promise for a share of the future output of the economy. It can provide time shifting, if this money is held for a time before it is spent.

Another type of debt is a loan with a fixed term, such as a mortgage or car loan. Such a loan provides time shifting, allowing something to be paid for over a significant share of its life. Equity funding for a company is not really a loan, but it, too, allows time shifting. Those purchasing shares of stock do so with the expectation that they will be repaid in the future through price appreciation and dividends. It thus acts much like a loan, for the purpose of this discussion. There are many other types of promises regarding future funding that are closely related–for example, government loan guarantees, derivatives, ETFs, and government pension promises. All indirectly add to the willingness of people and businesses to spend money now–someone else has somehow made promises that remove uncertainty regarding future income flows or future payment obligations.

The Magic Things Debt Does

It is not immediately obvious how important debt is. In fact, neoclassical economists have tended to ignore the role of debt. I see several, almost magic, ways that debt helps the economy.

- Debt brings forward the date when an individual or company can afford to purchase capital goods. Without debt, the only way to afford such a purchase would be to save up the full price in advance. Using debt, a business can add a new machine to allow it to produce more goods before the business saves up money from its prior operations. A young person can afford to buy a house or car, long before he could save up funds for such a purchase. With the help of debt, the price of capital goods can be financed over much of their working life.

- Adding debt raises the prices of commodities. Commodities, such as lumber, iron, copper, and oil are what we use to make cars, houses, and factories. “Demand” for these commodities rises because more people and businesses can afford to buy capital goods that use these energy products. Often these capital goods also use energy products over their lifetime (for example, gasoline to operate a car), so there is a long-term impact on the demand for energy products, in addition to the demand associated with making the capital goods. Of course, with higher prices, it becomes profitable to extract oil and other energy resources from more marginal areas of production. More companies enter the field. As long as prices remain high, they are able to earn a profit.

- Adding debt stimulates the economy, almost like turning the heat up on a stove. When debt is added for any purpose–even starting a war–it starts a whole chain of purchases, each of which acts to stimulate the economy. If a young person takes out a loan to buy a car, the purchase of the car leads to the salesman having more money to buy goods for his family. The company selling the cars is able to make a bigger profit, which the business can reinvest or pay to shareholders as dividends. The purchase of the car leads to more demand for metals used to make the car, and thus tends to increase the number of mining jobs. Each new worker in turn is able to buy more goods and services, starting a beneficial cycle that gradually radiates out through the economy.

- Adding debt tends to lead to higher asset prices. Clearly, (from Item 2), adding debt can raise the price of commodities. Adding debt can also make it possible for more people to afford real estate and investments in the stock market. For example, Japan greatly ramped up its debt level between 1965 and 1989.

Figure 1. Annual growth in non-financial debt (in Yen), separated into private and government debt, based on Bank of International Settlements data.

During this time, a major price bubble occurred in land prices (Figure 2).

Figure 2. Land Prices in Japan. Figure from Of Two Minds by Charles Hugh Smith.

There is a reason why this bubble could occur. Because of the stimulating effect that debt had on the economy, more people had the wealth to buy real estate, especially if this too was sold on credit. Once private debt levels stopped rising rapidly, price levels crashed both for land and stock prices. TheBubbleBubble.com explains what happened: “By 1989, Japanese officials became increasingly concerned with the country’s growing asset bubbles and the Bank of Japan decided to tighten its monetary policy.” Doing so popped both the home and stock price bubbles.

- Adding debt adds to GDP. GDP is a measure of the goods and services produced during a period. Many of these goods and services are bought using debt, so it is not surprising that adding more debt tends to add more GDP. The amount of GDP added is less than the amount of debt added, even when inflation growth is considered as part of GDP.

Figure 3. United States increase in debt over five-year period, divided by increase in GDP (including inflation) in that five-year period. GDP from Bureau of Economic Analysis; debt is non-financial debt, from BIS compilation for all countries.

The general tendency is toward the need for an increasing amount of debt per dollar of GDP added. This is especially the case when oil prices are high. In the US, the ratio of non-financial debt to GDP added was almost down to 1:1 for a time, back when oil prices were less than $20 per barrel (in today’s dollars).

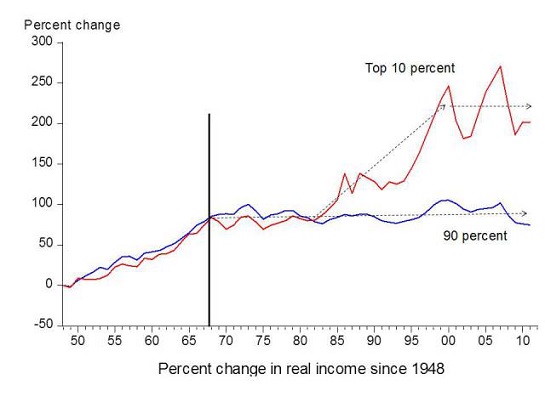

- Adding debt tends to increase wealth disparity. Adding debt tends to increasingly divide an economy into “haves” and “have-nots.” Many of the “haves” own the means of production, including an ever-increasing amount of capital goods, and thus can earn profits and dividends from these capital goods. Others are high-level officials in businesses and the government who earn high salaries. Interest payments also tend to transfer payments from the poor to the more wealthy. We might say that the common laborers are increasingly “frozen out” of the economy that otherwise is heating up. This shift started to take place in the United States about 1981.

Figure 4. Chart comparing income gains by the top 10% to income gains by the bottom 90% by economist Emmanuel Saez. Based on an analysis of IRS data, published in Forbes.

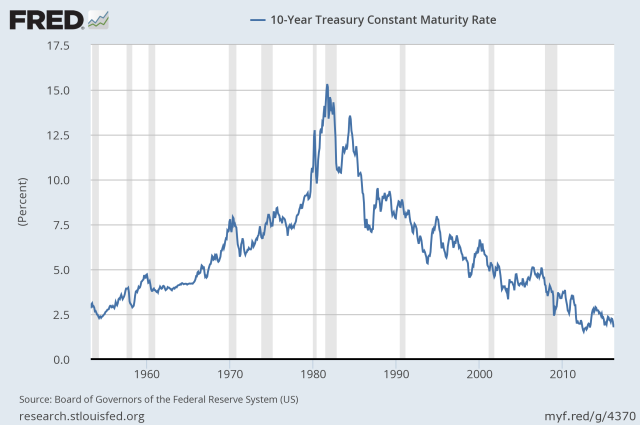

- Adding debt is something that governments can influence, either by lowering interest rates or by borrowing the money themselves. Actions by governments to reduce interest rates can be effective, because they lower monthly payments that borrowers need to make to take out a loan of a given amount. Thus, they tend to encourage more borrowing. In Figure 5, below, note that the decrease in interest rates in 1981 corresponds precisely with the rise in debt to GDP ratios is Figure 3 and the shift in income patterns in Figure 4.

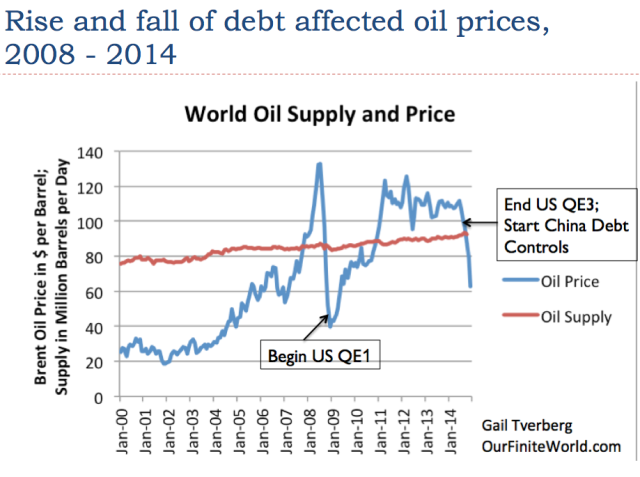

Figure 6 later in this post shows that changes in Quantitative Easing (QE) (which affects interest rates and the level of the US dollar relative to other currencies) also correspond to sharp changes in oil prices. Changes in the level of the dollar also affect demand for oil. See a recent post related to this issue.

What Goes Wrong as More Debt Is Added?

It is clear from the discussion so far that quite a few things go wrong. These are a few additional items:

1. There are limits to government manipulation of debt levels. First, interest rates eventually drop so low that they become negative in some countries. Negative interest rates tend to cause bank profitability to drop and lead to hoarding by those who planned to use savings for retirement.

Second, government borrowing doesn’t work as well at stimulating the economy as investments made by the private sector. A likely reason is that private sector investments are made when the borrower believes that the return on the investment will be high enough to pay back the debt with interest, and still make a profit. Government investments often do not meet this standard. Some reports indicate that Japan’s government has used borrowed money to fund bridges to nowhere and houses with no one home. China’s centrally directed economy seems to lead to similar over-borrowing problems. Chinese businesses also borrow to cover interest on prior loans.

2. Ratios of debt to GDP tend to rise, worrying government leaders. Debt is a way of accessing the benefits of Btus of energy, in advance of the time they are really available. As the amount of easy-to-extract oil depletes, the cost of oil extraction gradually rises. Unfortunately, the amount of “work” a barrel of oil can perform–for example, how far it can make a truck travel–doesn’t rise correspondingly. As a result, the higher price simply reflects increasing inefficiency of extraction, and thus the need to use a larger share of the economy’s output to extract oil. The amount of debt needed to keep GDP rising keeps growing, in part because oil is becoming higher priced to extract, and in part because goods that use oil in their production also tend to rise in cost. As a result, the ratio of debt to GDP tends to spiral upward.

3. Rising debt allows for a temporary false valuation of the benefit of energy products. The true value of oil and other energy products comes primarily from the Btus of energy they provide, such as how far a truck can be made to travel. Thus we would expect that the true value of energy products would remain relatively constant over time. If anything, the value of energy products will tend to rise by a small amount (say, 1% per year) as technology improvements lead to growing efficiency in their use.

What we think of as the magic hand of the economy determines a price for commodities at all times, based on “supply” and “demand.” This price clearly is not very close to the future energy profit that the energy products will actually provide, because it tends to vary widely over time. We don’t know what the true value of a barrel of oil to society is. If the true value is $100 per barrel (in today’s money), then back when oil prices were $10 or $20 per barrel (in today’s money), there would have been $80 to $90 (equal to $100 minus the actual price) of “energy profit” that could be pumped back into the economy as productivity gains for workers, interest on debt, and dividends on stock, tax revenue, and money for new investment. The economy could (and did) grow quickly. There was less need for added debt, because goods made with oil were cheap. Wages for workers could rise rapidly, as they did in the 1950 to 1968 period (Figure 4).

If prices approach the true value of oil (assumed to be $100 per barrel), the extra energy profit would pretty much disappear. The economy would increasingly become “hollowed out.” Productivity gains that lead to wage gains would mostly disappear. Businesses would find it hard to earn adequate profits, and would cut back on dividends. Some companies might need to borrow money in order to pay dividends. World economic growth would slow.

Prices can even temporarily overshoot their true value to the economy, then drop sharply back. This happens because prices are set by demand, and demand depends on a combination of wage levels and debt levels. Oil prices can be high for a while, if borrowing is temporarily high, and then fall back as it becomes clear that profitable investments are not really available if oil is at such a high price level.

4. Wages of non-elite workers tend to drop too low. Workers play a very special role in the economy: they both (a) provide the labor for the economy and (b) act as consumers for the economy. If workers aren’t earning enough, there is a problem with many of them not being able to buy the goods and services the economy produces. This is especially the case for purchases such as homes and cars, which are often bought using debt. Indirectly, this lack of ability to afford the output of the system puts a downward pressure on the price of commodities, particularly energy commodities. Prices may fall below the cost of production, or may not rise high enough.

The reason that wages of the less educated, non-managerial workers tend to lag behind is related to the issue of diminishing returns. A workaround is a more “complex” society, with bigger businesses, bigger government, more capital goods, and more debt. In some cases, manufacturing is shifted to parts of the world with lower wages. Non-elite workers increasingly find themselves with too small a share of the output of the economy. Figure 7 shows some influences that tend to lead to too low wages for non-elite workers.

Figure 7. Illustration by author of why an economy that doesn’t grow leads to falling wages for workers. All amounts are guess-timates, to show a general principle.

When wages for a large share of workers drop too low, there is a problem with workers not having enough money to buy goods like cars and houses. The economy tends to contract. This is a different form of too low Energy Return on Energy Invested (EROEI) than most people think of. In my view, low return on human labor is the most important type of EROEI. Falling wages of a large share of workers can lead to economic collapse, because there are not enough buyers for the output of the system.

5. Eventually, debt defaults become a problem. As the world becomes more divided into “haves” and “have-nots,” falling ability to repay a debt becomes more of a problem. To some extent, this happens at the individual level, with auto loans, student debt, and mortgages. If commodity prices fall or stay too low, it happens to commodity producers, including oil producers. It also happens to countries, especially to those who are dependent on commodity exports.

The rise in the cost of oil extraction is another factor. As the cost of extraction begins to exceed the benefit of oil to the economy (assumed above to be $100 per barrel), the energy profit from oil is no longer sufficient to allow the economy to grow as in the past. Without economic growth, it becomes much harder to repay debt with interest.

Figure 8. In a period of economic decline (Scenario 2), the amount a debtor has left over after repaying debt plus interest is disproportionately large, leaving the debtor with inadequate funds for paying other expenses. In a period of economic growth (Scenario 1), the overall growth in incomes tends to compensate for the need to pay back the debt with interest.

6. At some point, we reach peak debt. The economy acts like a pump. As long as there are sufficient energy profits coming through the system (based on $100 per barrel minus the actual oil price, in our example), wages can rise and corporate profits can rise. Asset prices can rise, and energy prices can stay high. Once these energy profits start falling back, wages stagnate and business profits decline. Businesses cut back on borrowing, because they see fewer profitable opportunities for investment. Individuals cut back on borrowing, because with their lower wages, it becomes more difficult to buy a house or car. Governments try to fight declining demand for debt, but eventually reach limits of the economy’s tolerance for negative interest rates.

Once debt begins contracting, the contraction tends to bring down commodity prices. This is a huge problem for commodity producers, because they need prices that are high enough to cover their cost of production. Ultimately, falling debt, together with falling wages, and lack of energy profit have the potential to bring down the system.

Conclusion

The situation we are facing today is one in which growing debt has been holding up oil prices and other commodity prices for a long time. We are now reaching limits on this process, as evidenced by growing wealth disparity, low commodity prices, and the frantic actions of government leaders around the world regarding slow economic growth and the need for more stimulus. These issues are becoming major ones in the upcoming US political election.

Those studying oil issues from an EROEI perspective tend to miss the connection with debt, because EROEI analysis strips out timing differences. In my view, debt is essential to oil extraction, because it brings forward an estimate of the value of the oil and other energy products, so that businesses of all kinds can make use of the “energy profit” in paying their employees and in paying their taxes. Most people don’t think of the issue this way.

In this article, I suggest a different way of thinking about the limit we are reaching–oil prices can’t rise above some price limit without adversely affecting the economy. It is the savings below this limit that aid productivity growth and government funding. Perhaps researchers should be examining this price limit approach more carefully. This is not the same approach as EROEI analysis, but has the advantage of having fewer “boundary issues.” It also offers a check for reasonableness of EROEI indications developed through conventional analysis. If an energy product needs a government subsidy, it is doubtful that that energy product is really providing an energy profit.

Disclosure: None.

Interesting article, to say the least. So, debt has positives, raising GDP, and negatives, gap between rich and poor increases. That is why, for main street, there is a debt free solution that would mitigate this gap, Gail. Too bad so many people don't understand it: www.talkmarkets.com/.../responsibly-expand-the-monetary-base-before-it-is-too-late