Day Full Of Important Macroeconomic Data And Business Results

Thursday's session was a session in which many companies presented their quarterly results for the second quarter. Among these company results, the highlights included the likes of Intel, Twitter and AT&T.

Just a few days ago, we commented that Intel might be interested in acquiring GlobalFoundries as some rumours and media outlets pointed out and that quarterly results could give impetus to this action. Specifically, Intel (INTC) announced positive results yesterday in which earnings per share reached $1.22 along with revenue of $18.53 billion versus $1.07 per share in revenue of $17.8 billion expected by market consensus.

Twitter (TWTR) also posted positive quarterly results after earnings per share of $0.20 and revenue of $1.19 billion versus $0.072 per share and revenue of $1.06 billion expected. These results are being welcomed by the market, since at the moment during the pre-open the price rises more than 5%.

For its part, the telecommunications giant AT&T (T) also presented positive results that would attract the attention of investors, after signing its agreement with Discovery for the merger of this with WarnerMedia. In these results, we can see that thanks to HBO Max and its streaming services, in addition to the 2.8 million subscribers that WarnerMedia obtained, the company obtained 798,000 new telephone subscribers far exceeding market estimates.

Specifically, AT&T, earned earnings per share of $0.89 and revenue of $44.05 billion versus $0.79 per share and expected revenue of $42.66 billion.

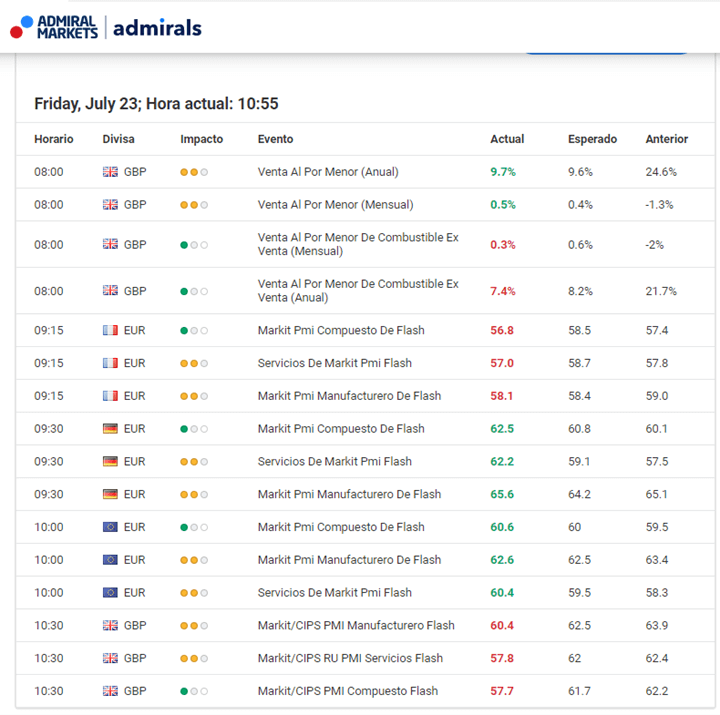

On the other hand, during the beginning of today's session, we learned the preliminary PMI data for the services and manufacturing sector for France, Germany, the United Kingdom and for the euro area as a whole. While Germany and the Eurozone have exceeded market expectations, the UK and France have performed worse than expected.

Source: Admiral Markets Forex Calendar

How is this data interpreted?

We must remember, that the manufacturing PMI is an indicator designed to provide information on the economic activity of the manufacturing sector where a result above 50 indicates expansion and growth of this industry.

For its part, the PMI of the services sector measures economic activity through the purchases made in this sector. As in the manufacturing PMI, a reading above 50 is considered positive suggesting good future prospects, while a reading below 50 is considered negative.

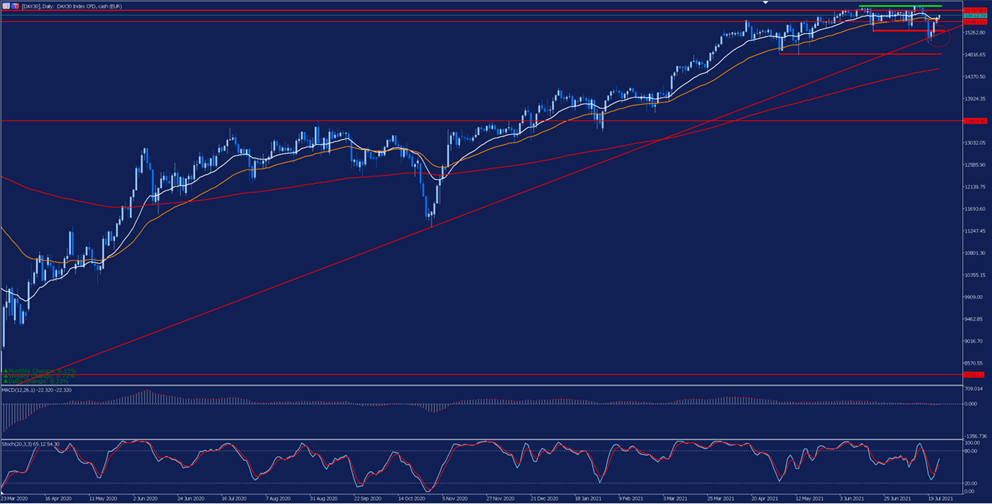

These positive results for Germany, can give a boost to the DAX30, since if we look at the daily chart we can see that after bouncing in the important support area coinciding with the lower band of the side channel and the uptrend line represented by the red circle, the price has obtained a new bullish momentum that has led it to surpass its 18 and 40 session moving averages higher.

(Click on image to enlarge)

Source: Admiral Markets MetaTrader 5. Dax30 Daily Chart Data Range: March 23, 2020 to July 23, 2021. Prepared on July 23, 2021 at 10:50 a.m. CEST. Please note that past returns do not guarantee future returns.

Evolution in the last 5 years:

- 2020: 3,6%

- 2019: 25,48%

- 2018: -18,26%

- 2017: 12,51%

- 2016: 6,87%

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more