DAX 30 Testing 38.2% Fib Support In ABC Correction

The German stock index DAX 30 made a bullish bounce within wave E (orange) as expected. This completed a wave 4 (grey) pattern and restarted the uptrend.

Can the bulls keep control or is the uptrend already completed? Let’s review the Elliott Wave patterns.

Price Charts and Technical Analysis

(Click on image to enlarge)

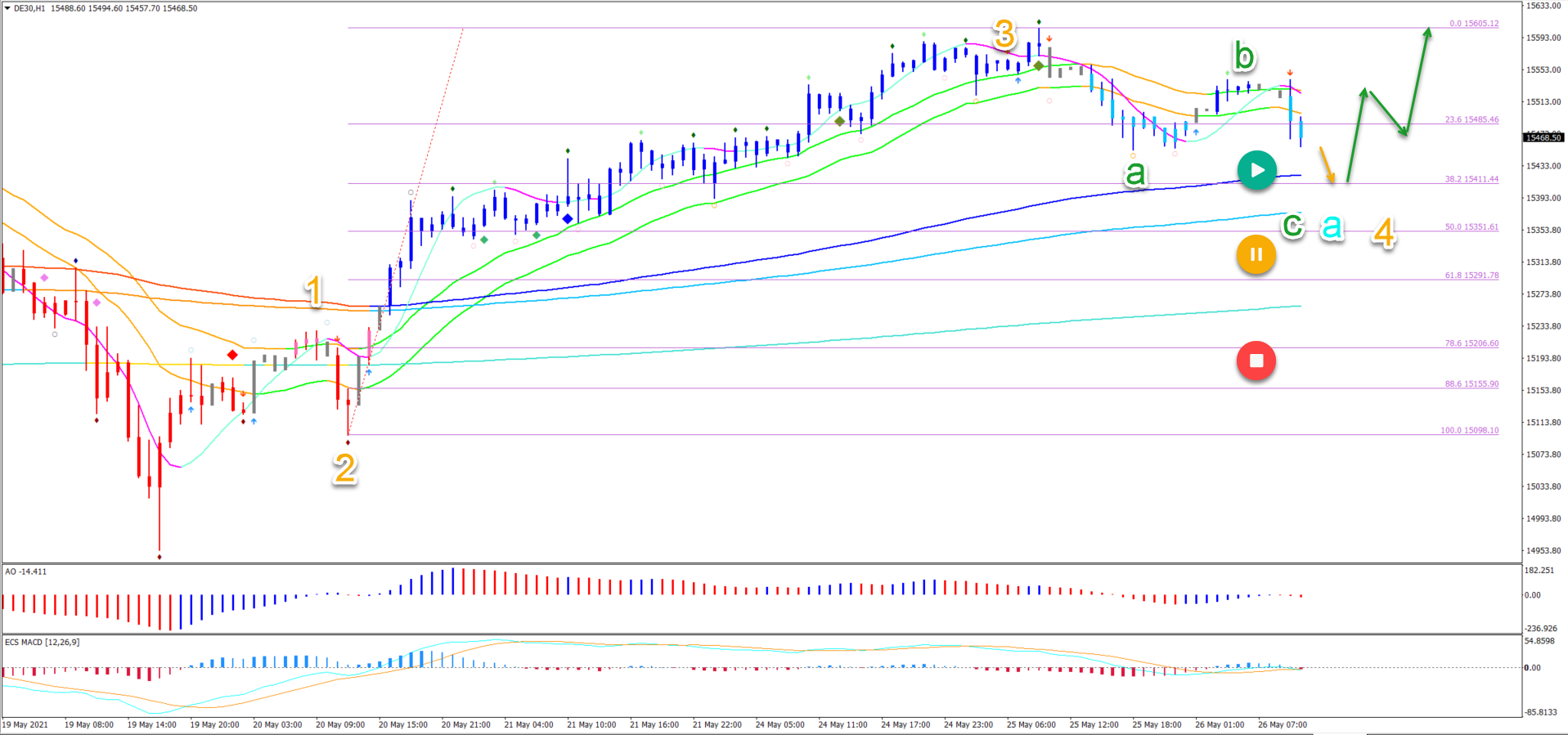

The DAX 30 made a strong bullish breakout above the 21 ema zone:

- The breakout seems to be a wave 3 (orange) if price action is able to make a bounce at the 21 ema zone.

- A bullish bounce around the 21 emas could indicate a wave 4 (orange).

- The waves 4 are usually complex and lengthy so a bearish ABC (blue) pattern is typical.

- A bearish bounce (orange arrow) at the previous top could indicate a wave B-C (blue).

- A bullish bounce at the previous bounce could restart the uptrend (blue arrow).

- A deep retracement invalidates this wave outlook (red circle).

On the 1 hour chart, price action seems to be developing a bearish ABC (green) pattern:

- A bearish push towards the 38.2% Fibonacci retracement level could complete wave C (green) of wave A (blue).

- The outlook remains bullish as long as price action stays above the 50% Fibonacci level.

- A deep bearish retracement could indicate a different wave outlook (red and orange circles).

- The main targets are located at the -27.2% Fibonacci level around $15,743 and the -61.8% Fibonacci target at $15,918.

(Click on image to enlarge)

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!