Dash For Cash Intensifying

More than a decade of near-zero interest rates spawned a generation of bonkers financial decisions. Now, we are in the reveal and clean-up phase.

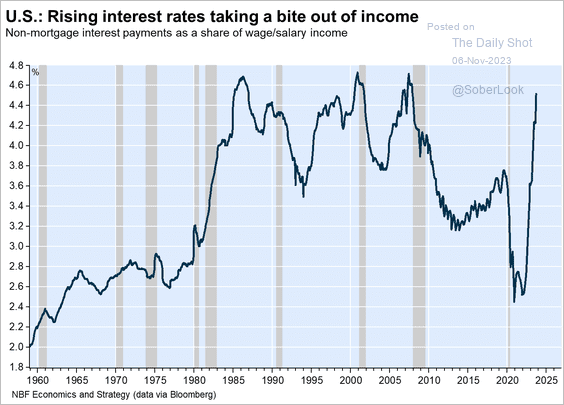

Unlike fixed-term mortgages, other forms of credit quickly change with overnight policy rates set by central banks. As shown below, since 1960, courtesy of the Daily Shot, non-mortgage interest payments now suddenly consume 4.5% of employment income–the highest share in 15 years.

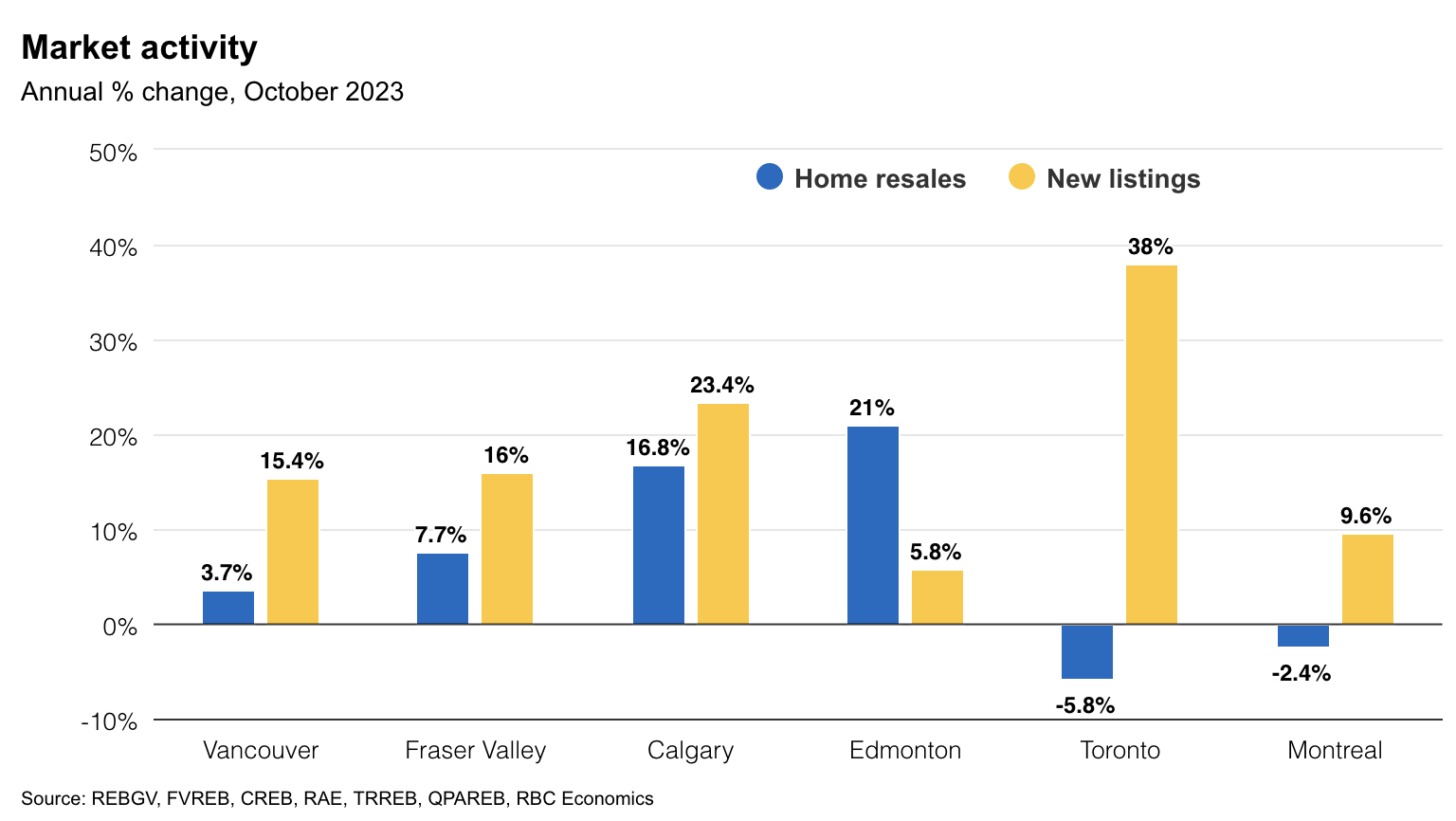

Inventory for sale is spiking across most assets as available credit and able buyers contract.

Home sales (in blue below) in the Greater Toronto and Montreal areas outright contracted year-over-year in October, while new listings (in yellow) have leapt in all major cities. See more in Fall housing market stuck in a low gear across Canada.

(Click on image to enlarge)

Prices are naturally moving lower as initial denial by owners and lenders shifts to terror and liquidation mode.

🚨🇨🇦 Have we hit the bottom?

— Jason G. (@jasongofficial) November 7, 2023

🤯 Toronto sales have dropped for 5 consecutive months..

🏠 Inventory continues to grow… but where are the buyers? Scared, and many unable to qualify.

💰As we see prices come back to 2020 levels, how much lower can we go?

🙏 Let me know your… pic.twitter.com/jKrBwWkiEM

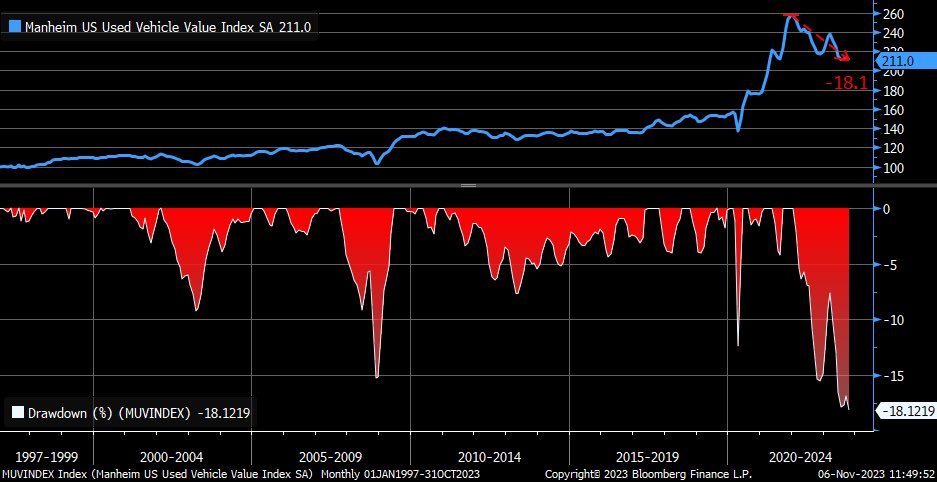

Used vehicle prices (Manheim US Used Vehicle Value Index) in October were 18% below their 2021 peak (in red below since 1997). This is the largest drawdown on record, but prices are still 33% higher than in 2020. Mean reversion is only started here.

(Click on image to enlarge)

Delinquencies and bad debts are mounting. It is hard to imagine the madness that has been. The segment below offers a taste.

Here is a direct video link.

More By This Author:

What Interest Rates Say About Home Prices

China’s Real Estate Bust Has Global Implications

Stock Market Likelihood Is Lower For Longer