Daily Market Outlook - Tuesday, September 10

"Markets Rebound, China Concerns Linger, US Presidential Debate Eyed”

On Tuesday, Asian stocks experienced a modest advance; however, they were unable to maintain an optimistic rally on Wall Street due to concerns regarding the Chinese economy's decline. Overnight data indicated that China's exports experienced their most significant growth since March 2023 in August. This suggests that manufacturers are expediting the production of orders in anticipation of tariffs from several trade partners. Conversely, imports failed to meet expectations due to lackluster domestic demand. This was in response to the inflation figures released on Monday, which indicated that domestic demand remained fragile as producer price deflation deteriorated. This has prompted requests for additional stimulus from Beijing to support its economy.

The Chinese market was further impacted by the escalating trade tensions that resulted from the U.S. House of Representatives' passage of a bill on Monday. The bill seeks to restrict business with China's WuXi AppTec, BGI, and several other biotech companies on national security grounds. The Hang Seng Mainland Properties Index plummeted to a record low, even though the broader Hang Seng Index in Hong Kong gained 0.4%. China's beleaguered property sector remained a significant drag. The Nikkei 225 of Japan added 0.23% and appeared to be on the brink of reversing five consecutive sessions of losses.

In the UK the Labour Force Survey (LFS) reported a substantial increase in employment levels of 265k 3m/3m up to July, which was higher than the anticipated 123k. However, the August reading from the more recent HMRC dataset indicated a loss of 59k payrolled employees. In contrast, the ex-bonus measure experienced a further moderation in average earnings to 5.1% 3m/y in July, as anticipated, from 5.4% 3m/y. Nevertheless, the median pay growth rate for August increased from 5.5% y/y to 6.2% y/y in the HMRC real-time indicator. The unemployment rate's return to 4.1% was anticipated. What is the underlying message that emerges from this? There does not appear to be sufficient evidence to dissuade the MPC from adhering to the current expectations for a relatively gradual rate-cutting trajectory, despite a few erroneous headlines.

Stateside all eyes will be the first debate between Democrat Kamala Harris and Republican Donald Trump which will take place later on Tuesday, in the lead-up to the Presidential election on November 5. The two candidates are currently in a close contest for the Presidency.

Overnight Newswire Updates of Note

-

Janet Yellen’s Predictions For The US Economy

-

BoE To Sell More Short Gilts To Boost Market Liquidity

-

Starmer Taps New Labour Figures In Hiring Spree

-

Kamala Harris - Donald Trump Debate Ahead

-

Australia’s Chalmers Seeks Support For RBA Reform

-

Aussie Slips On Iron Ore And US Jobs Market Concerns

-

Japan's Foreign Bond Buying Hits Record, Strong Yen

-

China’s Exports Beat, Imports Fall On Weak Demand

-

Dollar Rises As Traders Scale Back Fed Rate Cut Bets

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

-

EUR/USD: 1.1000 (1.9BLN), 1.1015 (354M), 1.1040-50 (2BLN), 1.1060-75 (1BLN)

-

1.1100 (1.7BLN), 1.1125 (2.1BLN), 1.1150 (509M), 1.1175 (1BLN)

-

USD/CHF: 0.8545-50 (411M). EUR/CHF: 0.9425 (422M), 0.9440-50 (450M)

-

GBP/USD: 1.3200 (296M). EUR/GBP: 0.8400-05 (524M), 0.8470 (612M)

-

AUD/USD: 0.6665 (226M), 0.6685-95 (2.4BLN), 0.6700 (337M)

-

AUD/NZD: 1.0940 (300M). EUR/AUD: 1.6520 (505M)

-

USD/CAD: 1.3510 (952M), 1.3540 (270M), 1.3585 (488M), 1.3625 (400M)

-

USD/JPY: 142.80 (378M), 143.00 (400M), 143.50 (340M)

-

EUR/JPY: 160.00 (1BLN), 164.50 (500M)

-

EUR/SEK: 11.50 (486M)

CFTC Data As Of 6/9/24

-

Bitcoin net long position is 108 contracts

-

Swiss Franc posts net short position of -21,882 contracts

-

British Pound net long position is 108,078 contracts

-

Euro net long position is 100,018 contracts

-

Japanese Yen net long position is 41,116 contracts

-

Equity fund managers raise S&P 500 CME net long position by 1,368 contracts to 991,219

-

Equity fund speculators trim S&P 500 CME net short position by 85,360 contracts to 271,561

-

Speculators increase CBOT US 10-year Treasury futures net short position by 88,390 contracts to 1,002,827

Technical & Trade Views

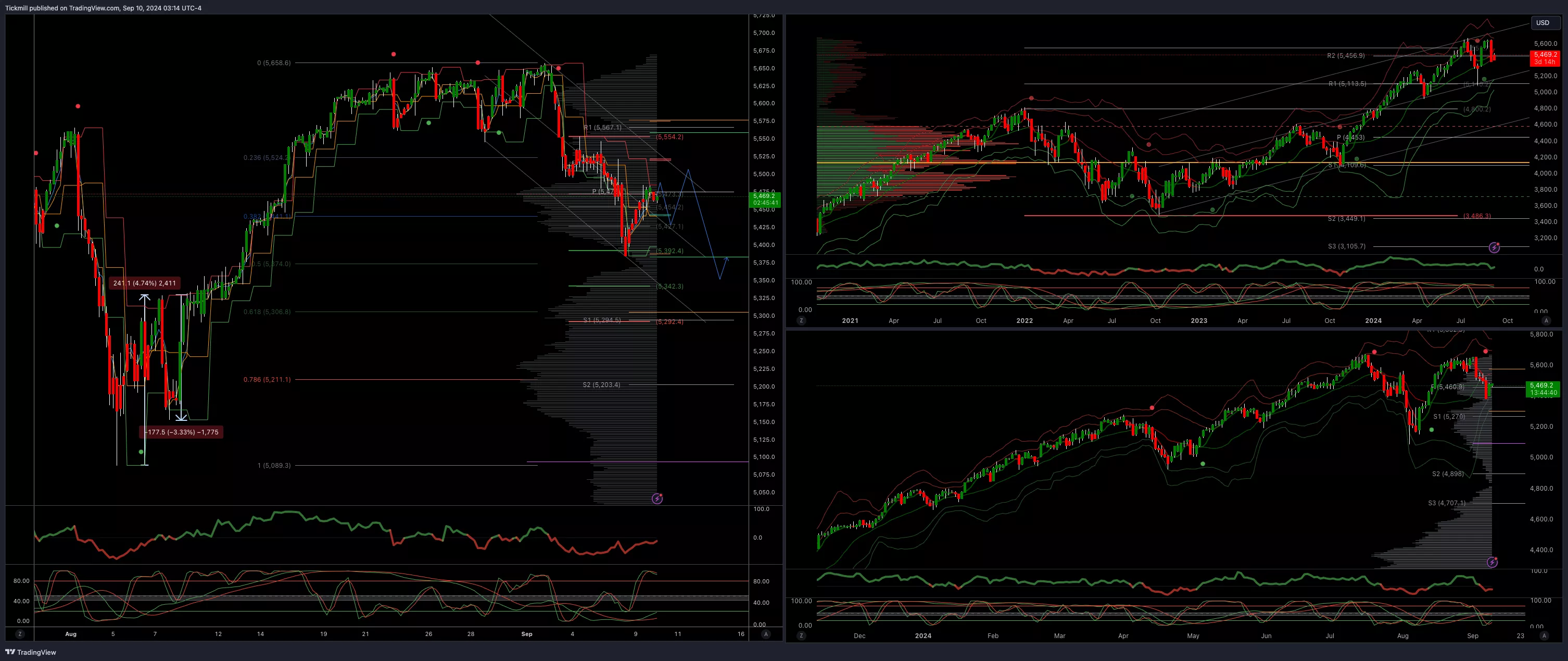

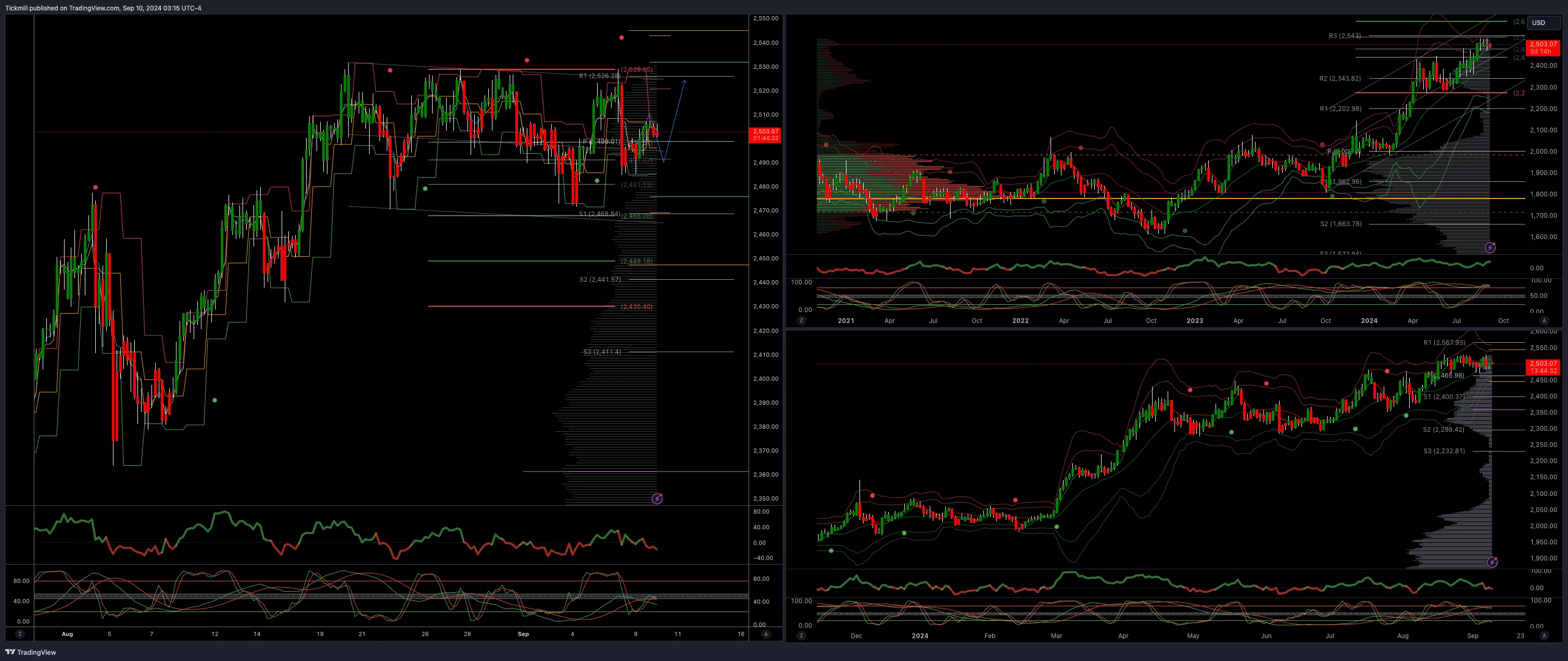

SP500 Bullish Above Bearish Below 5490

-

Daily VWAP bullish

-

Weekly VWAP bearish

-

Above 5510 opens 5555

-

Primary resistance 5525

-

Primary objective is 5325

(Click on image to enlarge)

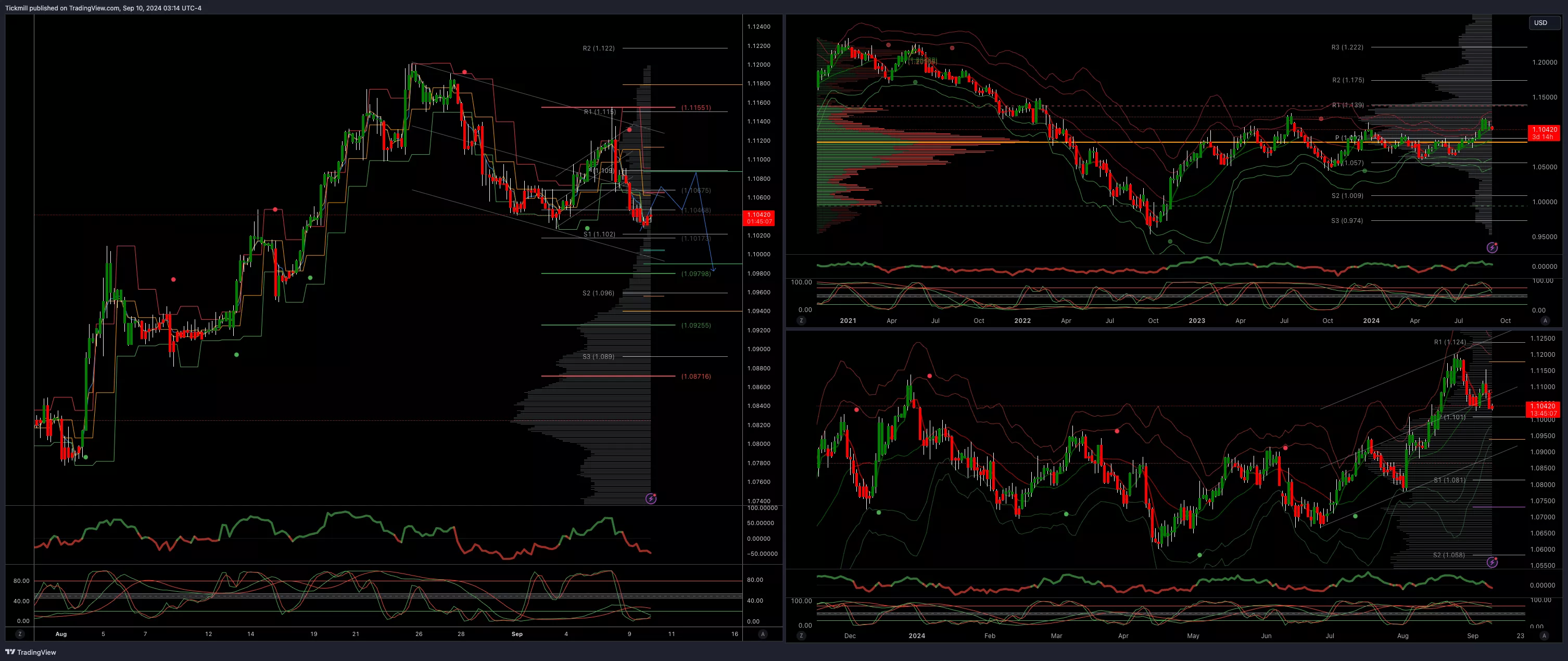

EURUSD Bullish Above Bearish Below 1.1140

-

Daily VWAP bearish

-

Weekly VWAP bullish

-

Below 1.09 opens 1.0850

-

Primary resistance 1.1150

-

Primary objective 1.0950

(Click on image to enlarge)

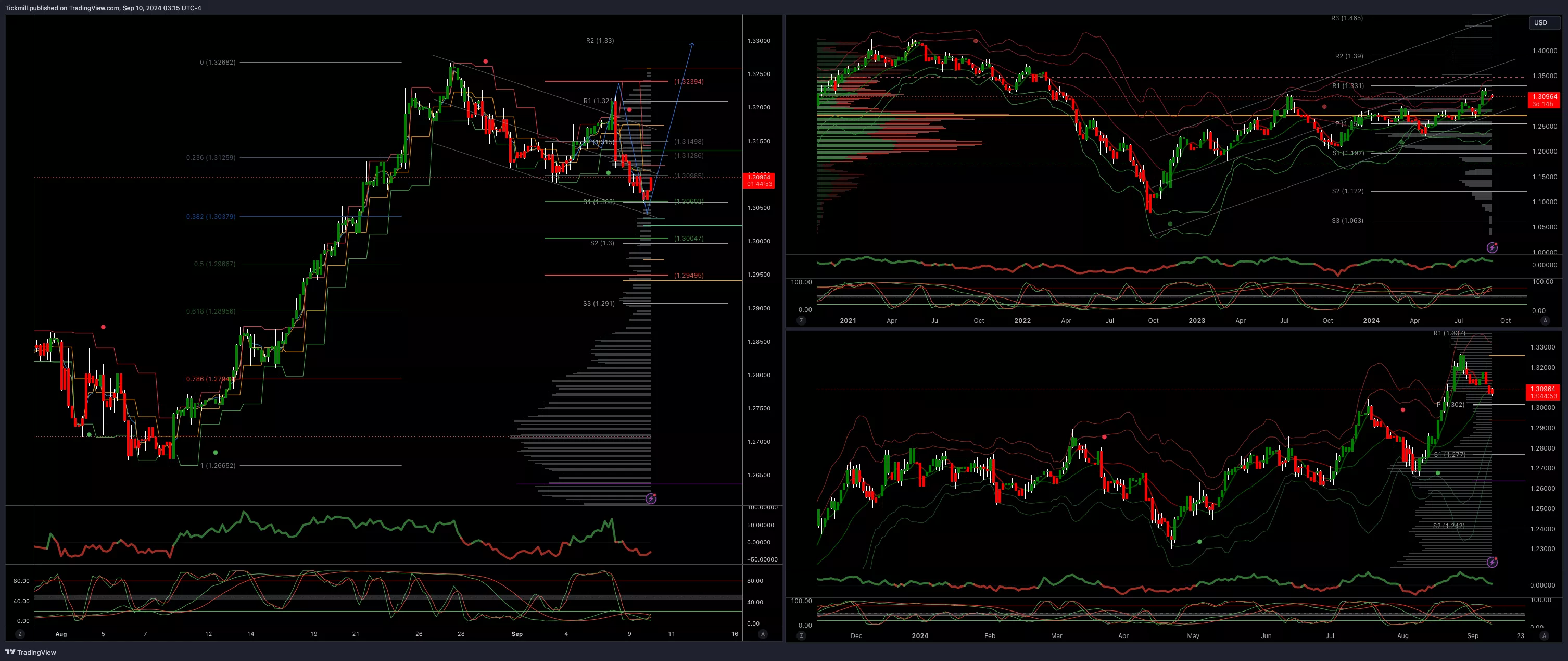

GBPUSD Bullish Above Bearish Below 1.3190

-

Daily VWAP bearish

-

Weekly VWAP bullish

-

Below 1.3050 opens 1.2960

-

Primary support is 1.2730

-

Primary objective 1.3390

(Click on image to enlarge)

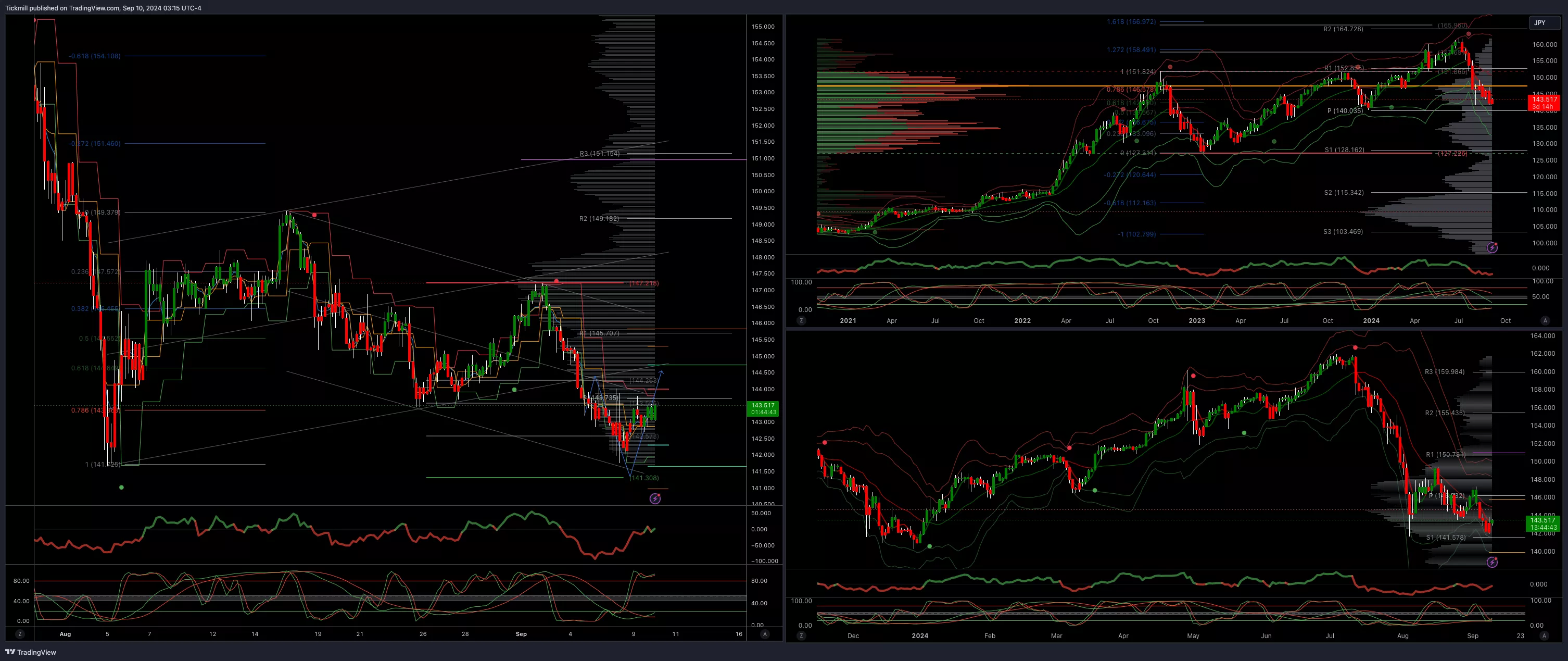

USDJPY Bullish Above Bearish Below 143.70

-

Daily VWAP bearish

-

Weekly VWAP bearish

-

Above 146 opens 150

-

Primary support 140

-

Primary objective is 139.60

(Click on image to enlarge)

XAUUSD Bullish Above Bearish Below 2500

-

Daily VWAP bullish

-

Weekly VWAP bullish

-

Below 2450 opens 2400

-

Primary support 2300

-

Primary objective is 2598

(Click on image to enlarge)

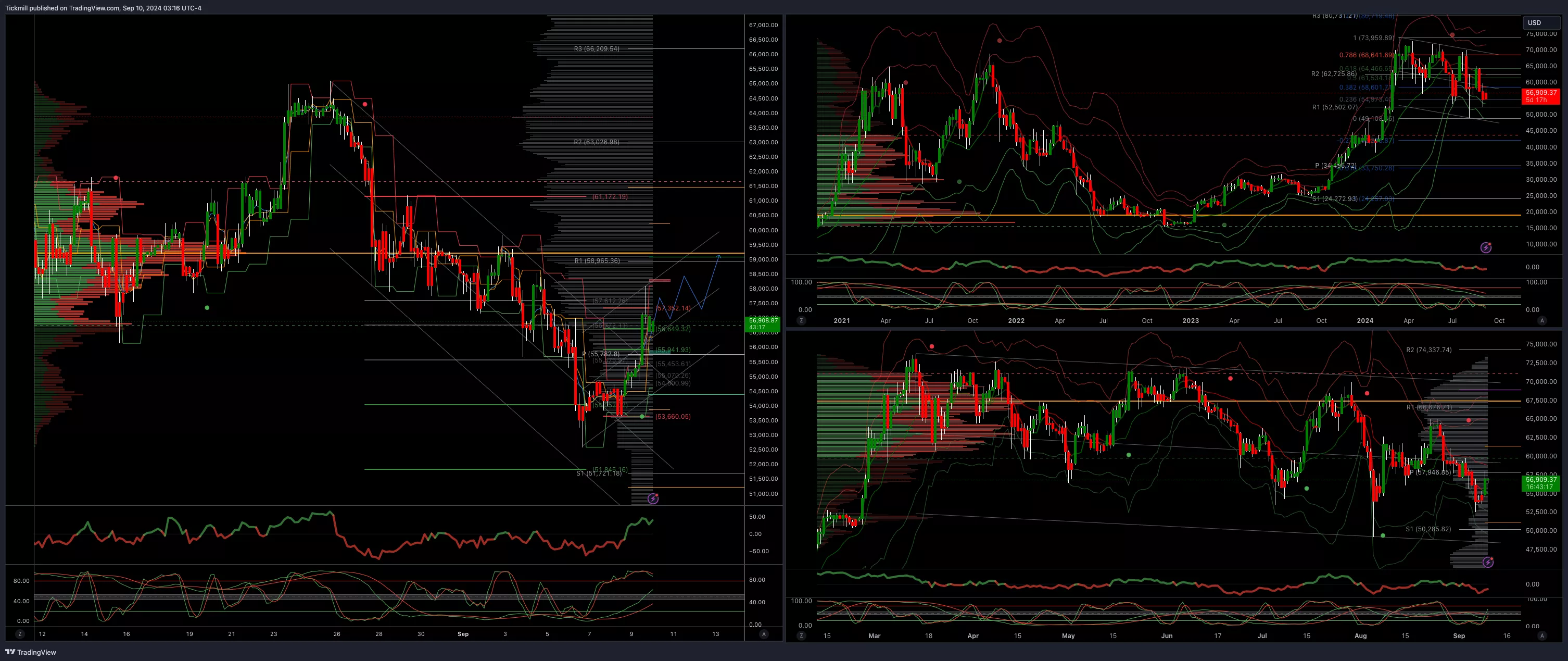

BTCUSD Bullish Above Bearish Below 54000

-

Daily VWAP bullish

-

Weekly VWAP bearish

-

Below 54000 opens 500000

-

Primary support is 500000

-

Primary objective is 700000

(Click on image to enlarge)

More By This Author:

SP500 & US500 Daily Trade Plan - Thursday, September 5Daily Market Outlook - Thursday, September 5

SP500 & US500 Daily Trade Plan