Daily Market Outlook - Thursday, September 5

Following mixed signals from Wall Street overnight, Asian stock markets are generally flat on the session with the exception of the Nikkei 225, extending the losses in the previous two sessions; the Japanese market is notably lower on Thursday; the Nikkei 225 has fallen below the 36,9K handle, with weakness in some index heavyweights and technology stocks. Traders are being cautious ahead of the release of the more carefully watched US monthly jobs report on Friday. Although there has been a significant increase in stocks recently, they are nonetheless hindered by persistent worries about the direction of the economy.

Raphael Bostic, the president of the Atlanta Fed, made remarks that suggested the US Fed would lower interest rates this month. Bostic's statement that the Fed should not stick to a tight policy for too long fueled rumors that the bank would soon switch to an easy policy. There is some dispute on the speed of rate cuts, but it is nearly a given that the Fed will drop interest rates at its next meeting later this month. A quarter point rate cut is 63% likely, and a half point rate cut is 37% likely, according to CME Group's FedWatch Tool.

The British Chamber of Commerce (BCC) released its most recent quarterly estimates this morning, with the press highlighting its above-target inflation outlook in particular. The BCC's prediction that CPI inflation will grow gradually to 2.6% by the end of 2024 is not particularly surprising—the Bloomberg average for Q4 CPI is 2.5% year over year—but it becomes more unlikely that inflation will reach the BoE's 2% target until 2027. It appears that the OFGEM October price cap reset and other short-term energy price base effects will contribute to higher CPI inflation in H2 2024. Beyond this, however, studies of inflation forecasts conducted by businesses and consumers have indicated a further moderating of price growth. The BoE Decision Maker Panel (DMP) survey series, which asks businesses about changes they anticipate in the prices of their own products over the next year, remains the source of the greatest anxiety. 3.7% is too high to meet the 2% CPI target and is still below pre-pandemic levels. The most recent information on this will be provided today, but overall, the UK story remains more consistent with a profile of rate cuts that are very gradual, particularly when compared to the rate of rate cuts in the US that the market now expects to occur more quickly.

Overnight Newswire Updates of Note

-

Germany Faces Jobs Crisis ‘Of A Thousand Cuts’

-

Japan Real Wages Unexpectedly Rise, BoJ Hike Path

-

Fed’s Daly Sees Rate Cuts For Labour Health

-

Fed’s Bostic: Jobs, Inflation Risks Balanced

-

Australia’s Trade in Goods Account, July

-

Unemployment Rise May Force RBA Rate Cuts

-

New Zealand Councils Risk Downgrades Due To Debt

-

US Efforts Push For Urgent Mideast Ceasefire

-

US Seizes Russian-Linked Disinformation Websites

-

Putin’s Flagship Arctic Gas Project Faces Struggles

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

-

EUR/USD: 1.1000-05 (2.5BLN), 1.1010-20 (1.5BLN), 1.1030 (422M)

-

1.1050-60 (1.6BLN), 1.1075-80 (4BLN), 1.1085-90 (1.4BLN), 1.1100 (1.7BLN)

-

1.1120-25 (2.4BLN), 1.1145 (2.9BLN), 1.1150-55 (1.7BLN)

-

USD/CHF: 0.8450 (614M), 0.8470-75 (2.1BLN), 0.8500 (534M)

-

EUR/CHF: 0.9300 (290M), 0.9400-10 (583M)

-

EUR/GBP: 0.8480-85 (900M). GBP/USD: 1.3075 (738M), 1.3090-1.3100 (390M)

-

EUR/SEK: 11.3900 (1BLN). EUR/NOK: 11.80 (457M), 11.90 (451M)

-

AUD/USD: .6625-40(3.4BLN), .6690-0.6700(2.9BLN), .6730 (951M), .6750 (762M)

-

NZD/USD: 0.6150 (1.1BLN), 0.6175 (1.6BLN)

-

USD/CAD: 1.3515-25 (950M), 1.3565 (793M)

-

EUR/JPY: 156.00 (1.1BLN), 161.60 (1BLN)

-

USD/JPY: 143.00 (647M), 143.35-50 (885M), 143.70-80 (1BLN), 144.00 (1.2BLN)

-

144.20-25 (858M), 144.35 (500M), 144.95-145.00 (2.4BLN), 145.50 (1.2BLN)

-

AUD/JPY: 97.00 (320M), 97.52 (800M), 98.25 (380M), 98.50 (794M)

CFTC Data As Of 4/9/24

-

Swiss Franc posts net short position of -24,612 contracts

-

British Pound net long position is 89,931 contracts

-

Euro net long position is 92,838 contracts

-

Japanese Yen net long position is 25,868 contracts

-

Bitcoin net short position is -166 contracts

-

Equity Fund Managers raise S&P 500 CME net long position by 15,425 contracts to 989,851

Technical & Trade Views

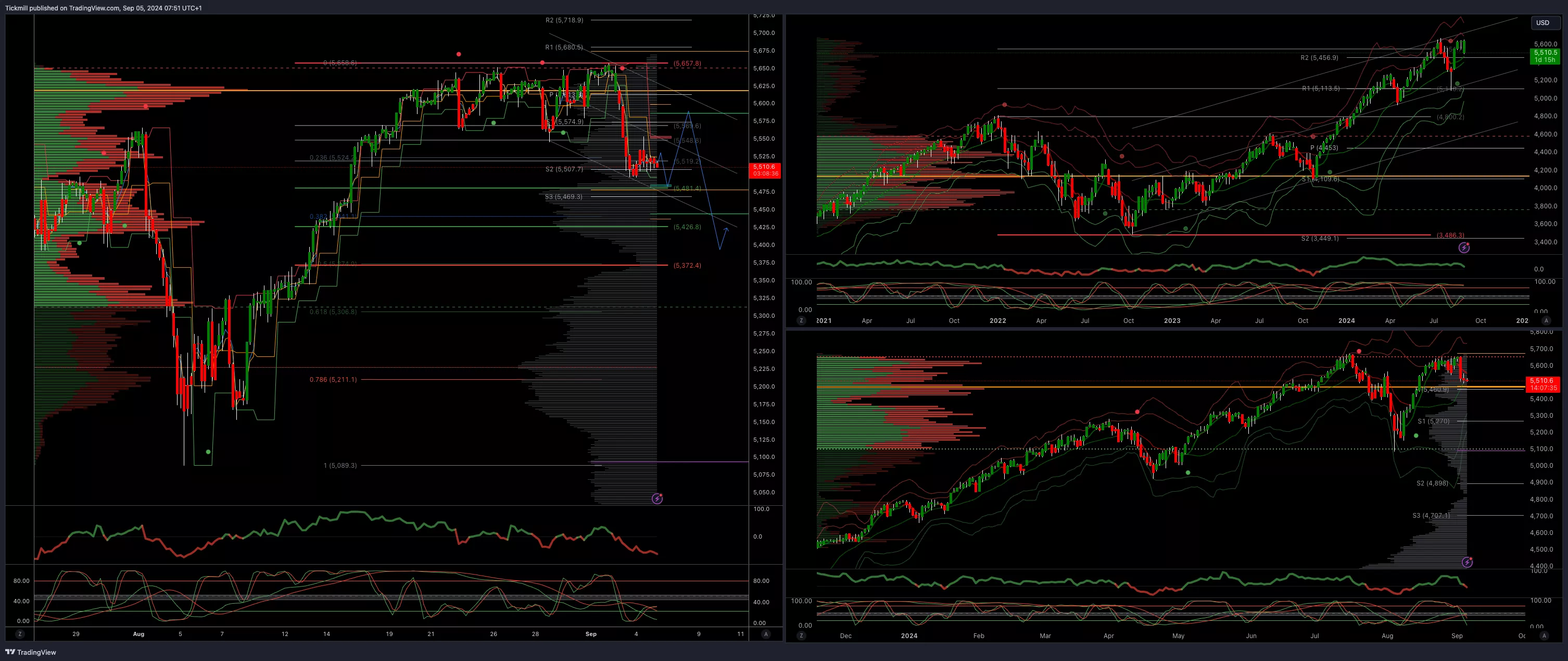

SP500 Bullish Above Bearish Below 5550

-

Daily VWAP bearish

-

Weekly VWAP bullish

-

Below 5510 opens 5470

-

Primary support 5460

-

Primary objective is 5375

(Click on image to enlarge)

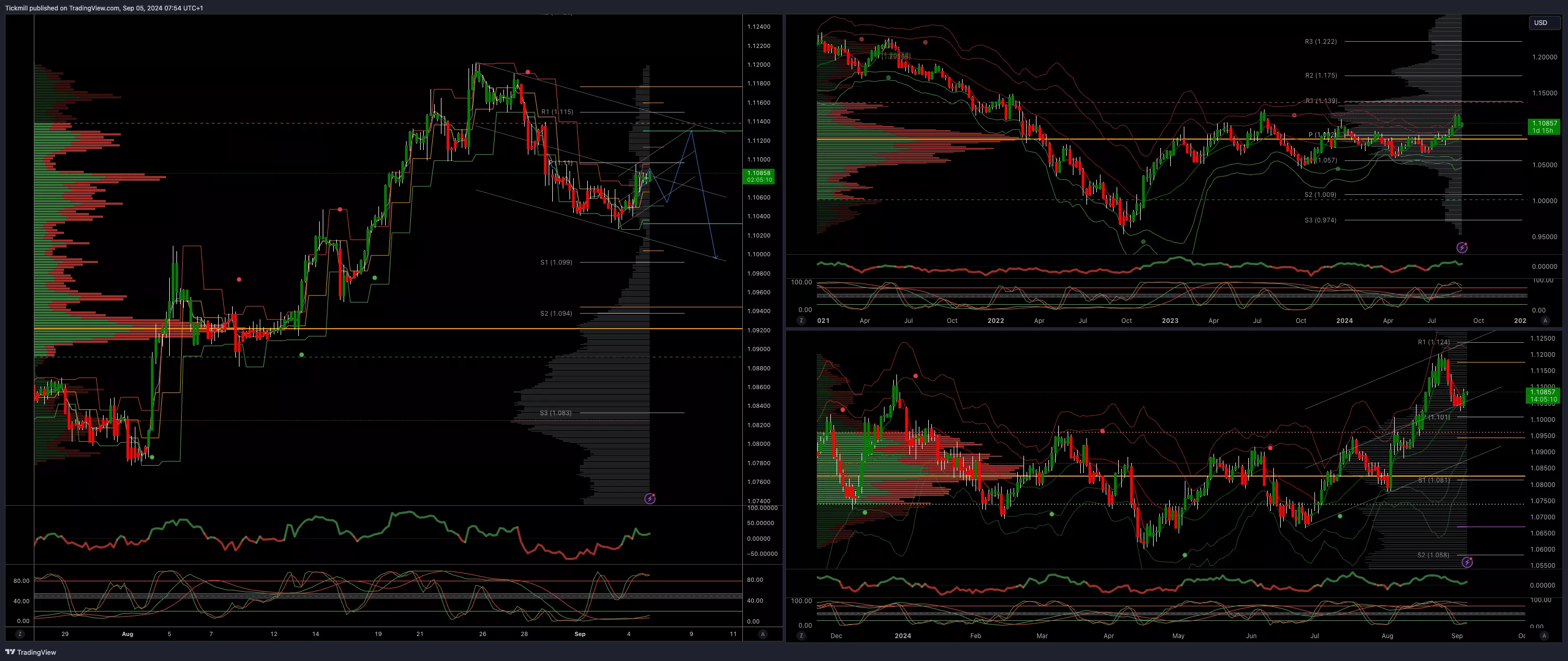

EURUSD Bullish Above Bearish Below 1.1140

-

Daily VWAP bullish

-

Weekly VWAP bullish

-

Below 1.09 opens 1.0850

-

Primary support 1.0850

-

Primary objective 1.0950

(Click on image to enlarge)

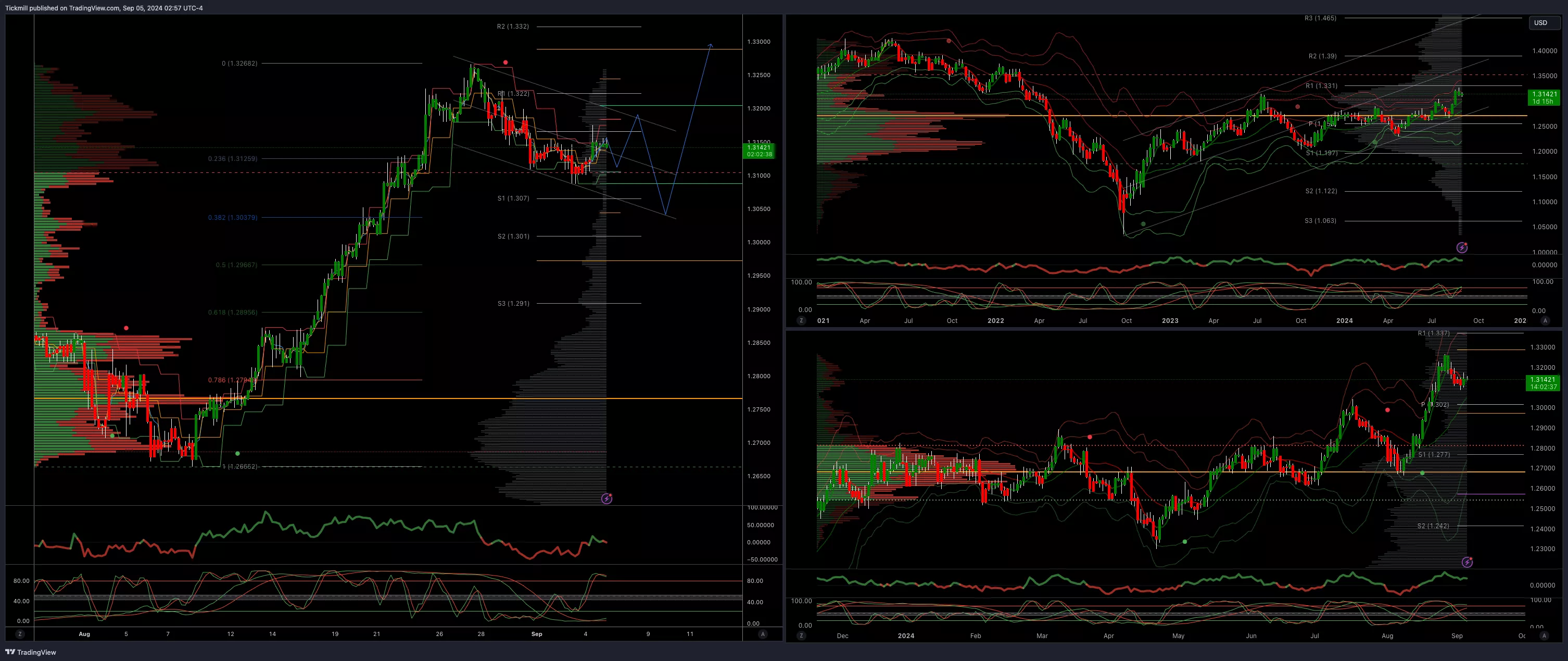

GBPUSD Bullish Above Bearish Below 1.3190

-

Daily VWAP bullish

-

Weekly VWAP bullish

-

Below 1.3050 opens 1.2960

-

Primary support is 1.2730

-

Primary objective 1.3390

(Click on image to enlarge)

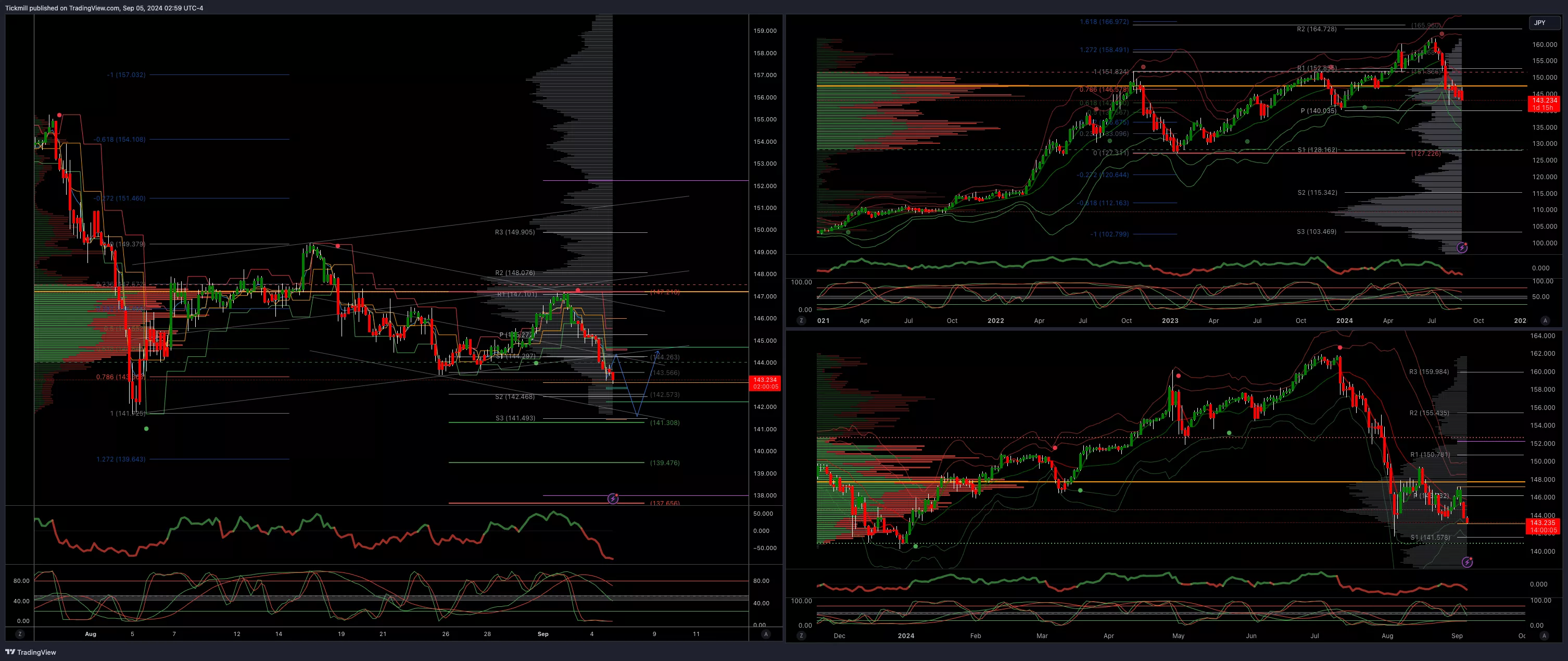

USDJPY Bullish Above Bearish Below 143.70

-

Daily VWAP bearish

-

Weekly VWAP bearish

-

Above 146 opens 150

-

Primary support 140

-

Primary objective is 139.60

(Click on image to enlarge)

XAUUSD Bullish Above Bearish Below 2450

-

Daily VWAP bearish

-

Weekly VWAP bullish

-

Below 2450 opens 2400

-

Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

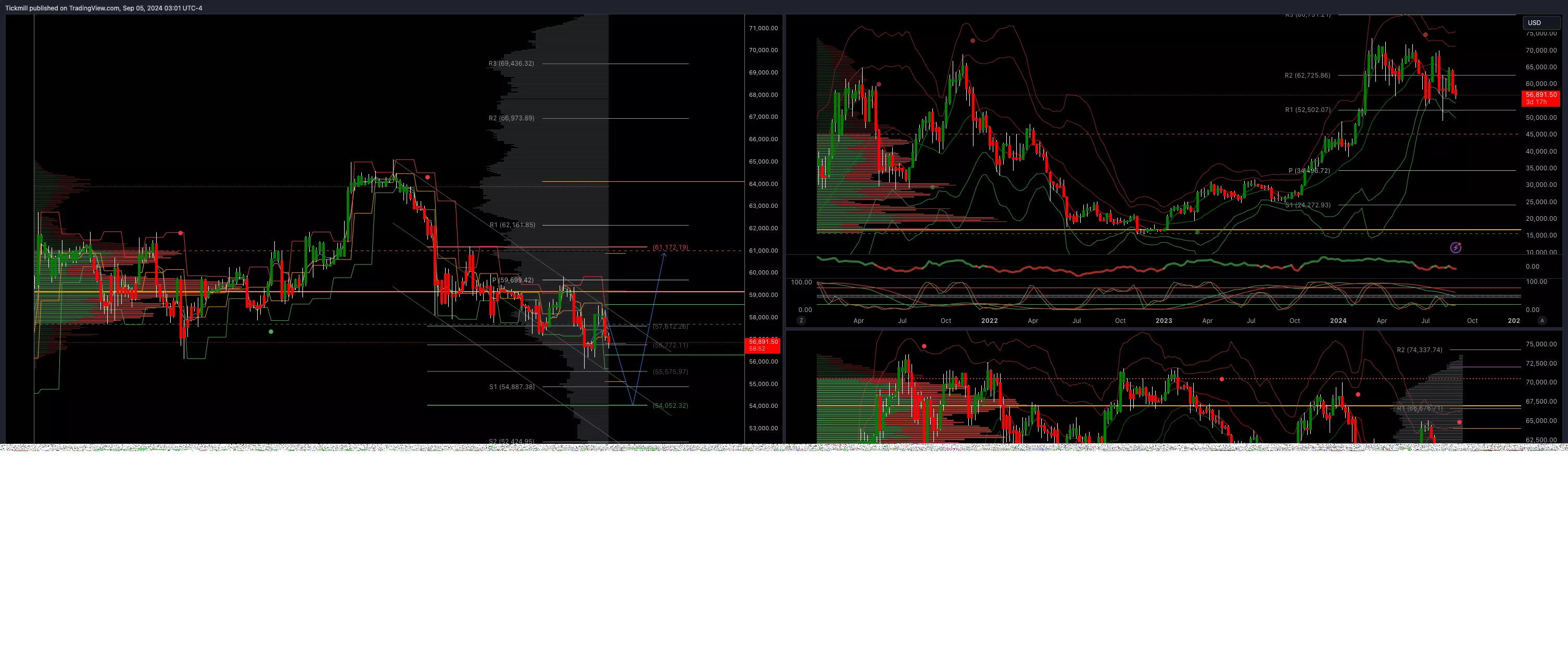

BTCUSD Bullish Above Bearish Below 54000

-

Daily VWAP bearish

-

Weekly VWAP bearish

-

Below 54000 opens 50000

-

Primary support is 50000

-

Primary objective is 70000

(Click on image to enlarge)

More By This Author:

SP500 & US500 Daily Trade PlanDaily Market Outlook, Wednesday, September 4

US500 Daily Trade Plan - Friday, August 23