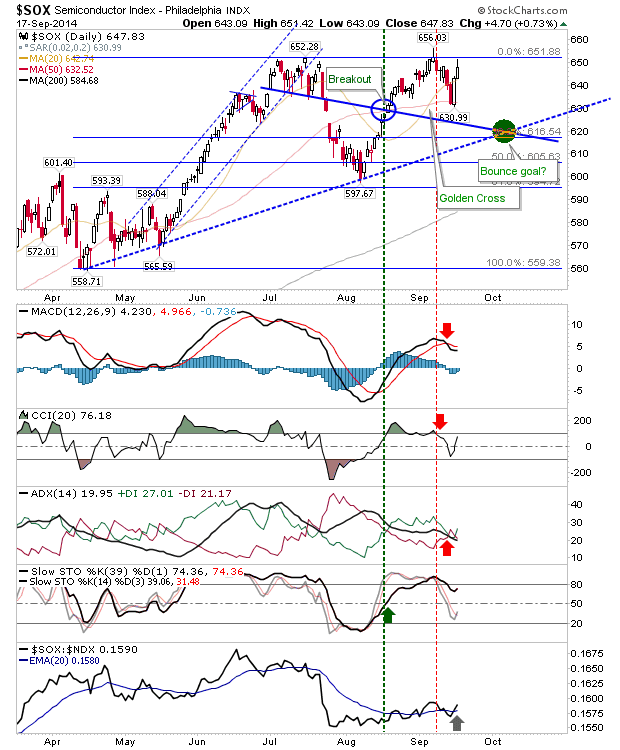

Daily Market Commentary: Semiconductors Advance

It was a roller coaster day, but the Semiconductor Index was the one to finish with an edge to the bulls. It looks like a break of 652 will happen sooner rather than later, with the swing low at 631 a handy place to mark risk (for a stop).

For the Nasdaq 100, yesterday marked a positive test of convergence between the channel and 3,998. A breakout in the Semiconductor Index will help the Nasdaq 100 get to the top of the channel.

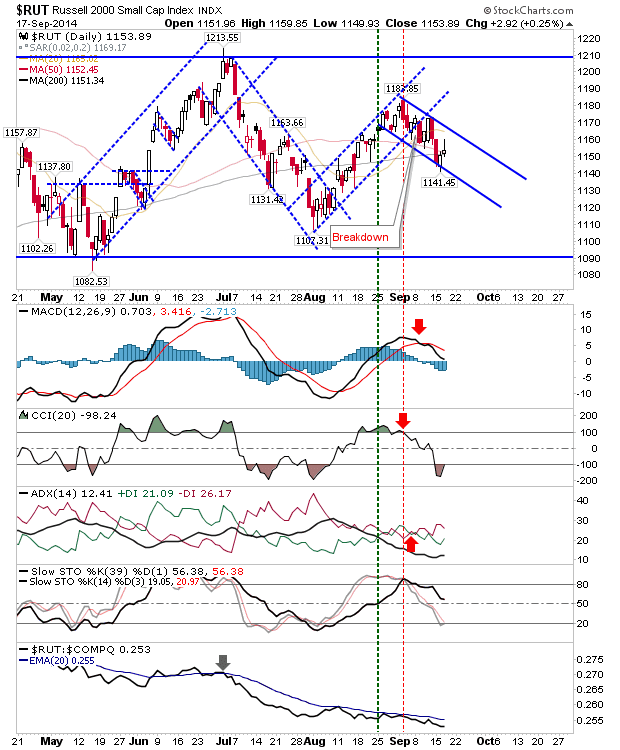

The Russell 2000 finished near the day's low. However, it remains above the 200-day and 50-day MAs. While the index is caught inside a broader range, the narrower channel is offering some (weak) upside potential.

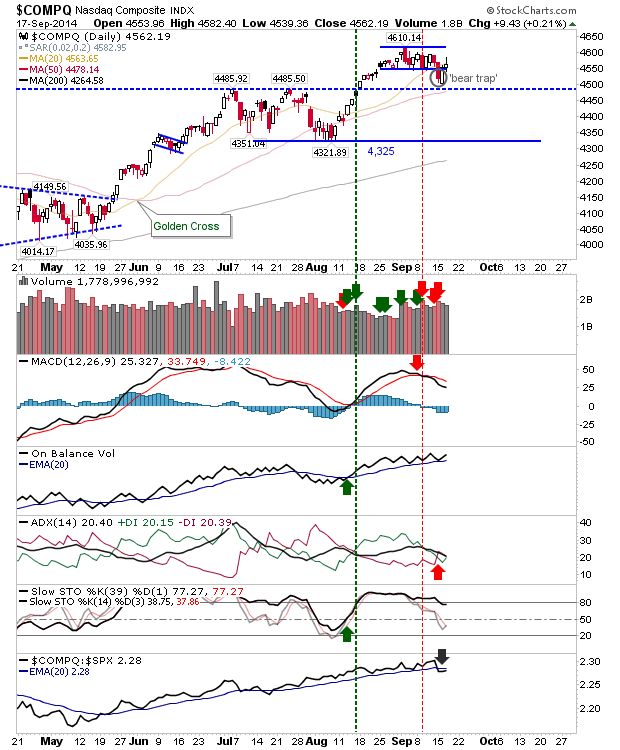

The Nasdaq is holding to the 'bear trap'. By week's end, a challenge of 4,610 would not be unlikely.

While today was marked by indecision and wide range days, there is reasonable expectation to expect additional gains. Technicals are weakening, but there should be enough from yesterday's swing low to generate interest for bulls.

Disclosure: None.