Current Earnings Outlook Reflects Positivity

Image Source: Unsplash

- What we saw in the Q1 earnings season is a resilient and steadily improving profitability picture, both in terms of the growth rate as well as the evolving revisions trend. Positive revenue surprises were a bit less commonplace relative to other recent periods, but margins expanded at a better-than-expected rate.

- Total earnings for the 461 S&P 500 members that have reported Q1 results are up +4.8% from the same period last year on +4.1% higher revenues, with 77.4% beating EPS estimates and 59.7% beating revenue estimates.

- The earnings and revenue growth pace for these 461 index members represents a modest acceleration from what we had seen in other recent periods. The +4.8% Q1 earnings growth pace improves to +11.4% once the Energy sector and Bristol Myers’s one-time charge are accounted for.

- For 2024 Q2, S&P 500 earnings are expected to be up +9.1% from the same period last year on +4.5% higher revenues. Estimates have been increasing since the start of April, with the current +9.1% earnings growth pace up from +8.7% on April 3rd.

In recent weeks, we have consistently flagged signs of improvement in the overall revisions trend, with estimates starting to go modestly up. We are seeing this trend for the current period (2024 Q2) as well as for full-year 2024 estimates.

We started seeing this favorable turn in the revisions trend roughly around when the Q1 earnings reports started coming out. That said, several sectors, including Tech and Retail, had already been enjoying positive estimate revisions for quite some time. At present, half of the 16 Zacks sectors have higher aggregate earnings estimates than expected at the start of the year.

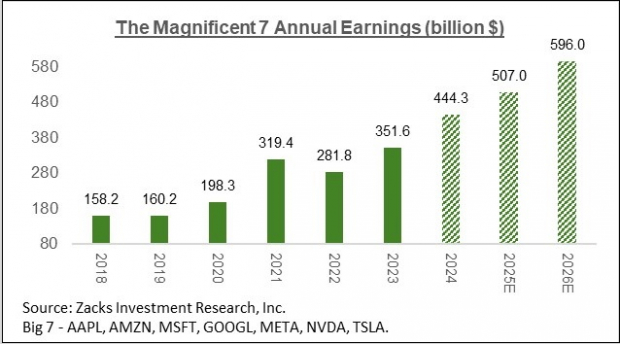

We have recently highlighted the favorable revisions trend for the Energy sector in this space. This week, we will discuss the evolving earnings outlook for the ‘Magnificent 7’ stocks.

The chart below shows aggregate earnings totals for the group on an annual basis.

Image Source: Zacks Investment Research

Please note that the $444.3 billion the group is currently expected to earn in 2024 is up from $443.9 billion last week and $438.1 billion the week prior to that.

We all know that the revisions trend for Tesla (TSLA - Free Report) has been negative for a while now, while the same for Apple (AAPL - Free Report) is also negative, though the magnitude of negative revisions for Apple is far less severe.

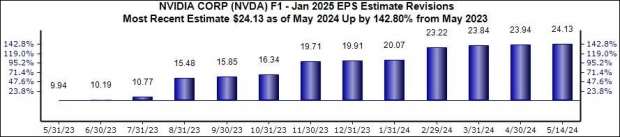

The revisions trend for the remaining five members of this group is positive enough to more than offset the Tesla and Apple effects. Of these five, Nvidia (NVDA - Free Report) is in a league of its own, as the chart below shows.

Image Source: Zacks Investment Research

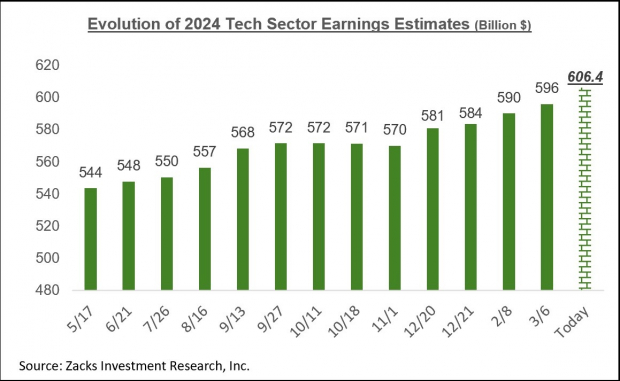

The chart below shows how the aggregate full-year earnings estimate for the sector has evolved over the past year.

Image Source: Zacks Investment Research

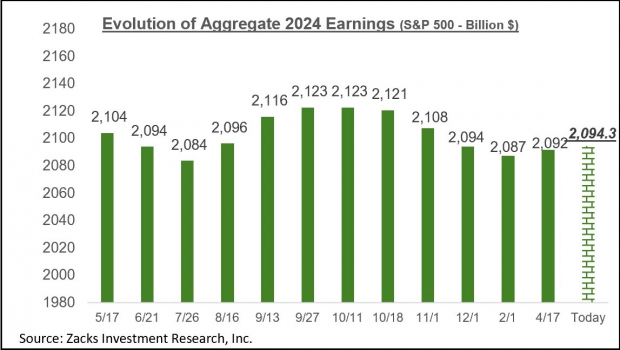

The chart below shows how S&P 500 aggregate earnings estimates for full year 2024 have evolved.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

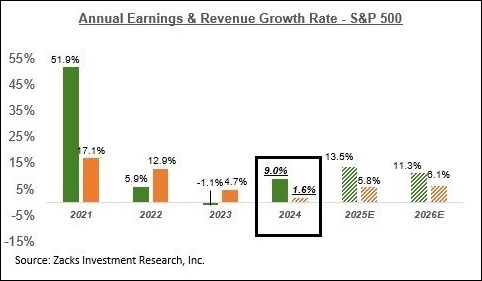

Below, we show the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment Research

A big part of this year’s earnings growth is expected to come from margins reversing last year’s declines and starting to expand again. The expectation is that aggregate net margins this year get back to the 2022 level, with the Tech sector driving most of the gains.

More By This Author:

Retail Earnings Loom: What To Expect

Earnings Growth Poised To Accelerate

Top Research Reports For Apple, Linde & Comcast