Currency Pairs In Focus - Sunday, Dec. 21

Image Source: Pixabay

GBP/USD

(Click on image to enlarge)

The British pound moved all over the place during the trading week, only for it to show signs of hesitation, as the 1.34 level has been offering a bit of resistance. At this point, the pair could see the US dollar strengthen.

It would also not surprise me at all to see the British pound fall down to the 1.32 level below. Any significant move below that point would open up the possibility of a fall to the 1.30 level. A break above the 1.35 mark would likely change things, but this market appears to be rather soft at the moment.

EUR/USD

(Click on image to enlarge)

Much like the British pound, the euro tried to break out, but it failed. The 1.18 level has been serving as significant resistance and acting as a major ceiling. The euro rolling over at this point would make sense, as it could continue through the overall range that it has been stuck in for months. Add to that the fact that this upcoming week features the Christmas holiday and a severe lack of volume, and it makes a perfect recipe to continue the generally sideways action.

USD/CAD

(Click on image to enlarge)

The US dollar fell against the Canadian dollar during the trading week, but it has since turned around to show signs of life. With that being said, the currency pair could try to bounce and break back above the 1.38 level, but I also recognize that with the upcoming holiday trading action, the market could experience essentially “dead money” for the next several sessions.

Either way, the pair may try to find the floor in order to bounce. With the US dollar's strength against other currencies starting to return, perhaps this one does have enough momentum to rally, but I would anticipate seeing some very sluggish movement.

USD/CHF

(Click on image to enlarge)

The US dollar tried to rally against the Swiss franc during the week, but it has continued to struggle. This makes sense, as there are still a lot of global economic concerns to contend with, and, of course, the Swiss franc is often considered to be a safety currency.

Ultimately, I do think that the Swiss National Bank will keep the Swiss franc from appreciating too much, as they have made several comments about not liking its behavior. With that being said, I believe the pair will likely remain in consolidation. Traders would need to be very patient to buy the US dollar against the Swiss franc, but the bit of payment at the end of the day could make the trade a little more palatable.

Bitcoin

(Click on image to enlarge)

Bitcoin has experienced a significant amount of downward pressure, but it managed to turn things around and form a bit of a hammer at the end of the week. That being said, there are still concerns that the risk appetite for cryptocurrencies has been significantly damaged as of late. It is worth noting that the $80,000 level seems to be holding as support, and as long as it can stay above there, I think there is at least a chance that Bitcoin could start to turn things around eventually.

USD/JPY

(Click on image to enlarge)

The US dollar initially fell against the Japanese yen during the trading week, but it found enough support at the JPY155 level to turn things around and show signs of life. After the Bank of Japan meeting, the US dollar appears ready to continue its march higher against the Japanese yen, and it seems to have the JPY158 level in its sights. If the dollar can break above there, then the JPY160 level would be the next target. Short-term pullbacks may continue to serve as buying opportunities at this juncture.

USD/MXN

(Click on image to enlarge)

The US dollar was negative against the Mexican peso at the beginning of the week, but it did come back a little bit to show signs of life. As things stand right now, the market has been hanging around the MXN18 level, and therefore, it could be on the precipice of a pretty big drop.

Short-term rallies at this point in time may continue to act as selling opportunities, as the interest rate differential will likely continue to favor the Mexican peso. Additionally, the better the US economy performs, the more Mexican goods are brought into the US, thus helping the Mexican peso strengthen further.

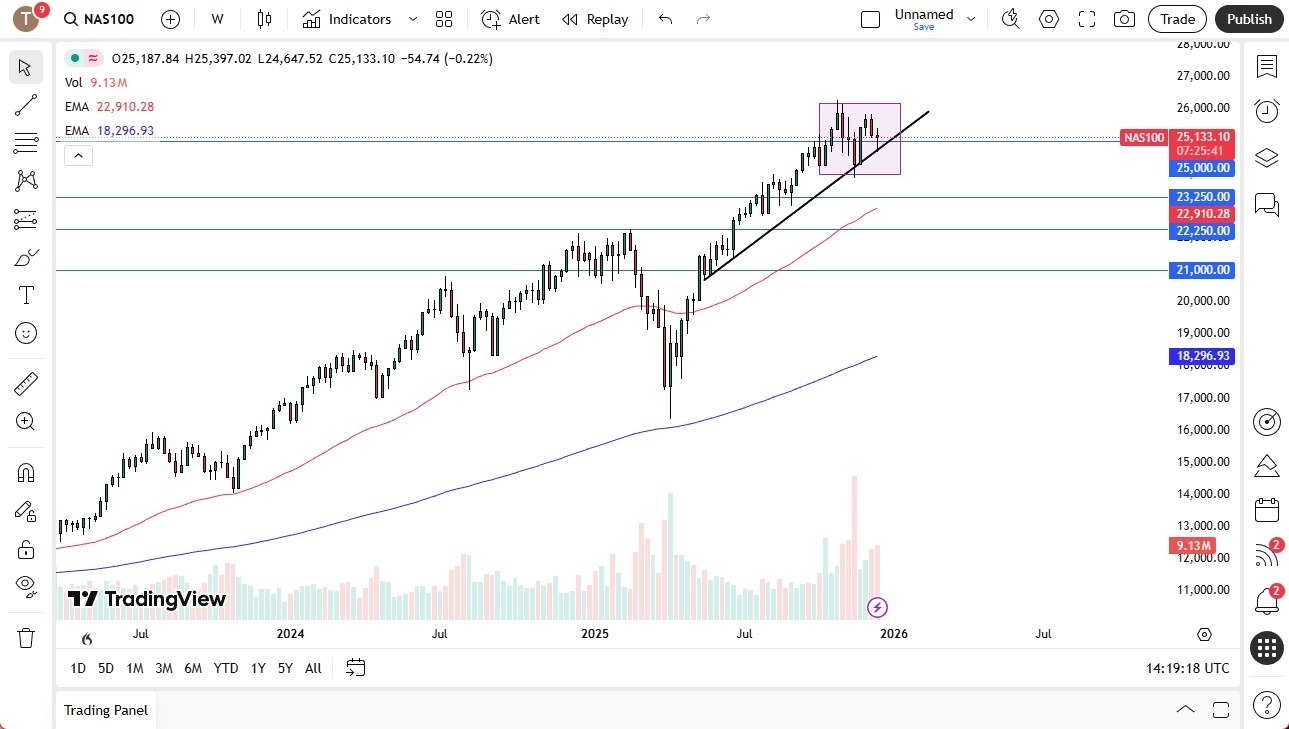

Nasdaq 100

(Click on image to enlarge)

The Nasdaq 100 fell to test a major uptrend line during the week, but it has since turned around to show signs of life. If the index can stay above the 25,000 level, then that would be a very bullish sign that could send this market higher.

We are getting close to Christmas, and of course, Christmas will be on Thursday, so it’ll be interesting to see whether or not there is a “Santa Claus rally” on the way out the door, or if we just see sideways movement. Regardless, this is still a bullish market, and I believe that the Nasdaq 100 will eventually move higher.

More By This Author:

USD/CHF Forecast: SNB Limits Franc StrengthUSD/JPY Forecast: Pullbacks Still Attract Buyers

AUD/USD Forecast: Shy Away From Ceiling

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more