Crude Pops, Gold Drops, Crypto Flops As Nvidia Suffers Worst Week In 2 Months

Image Source: Unsplash

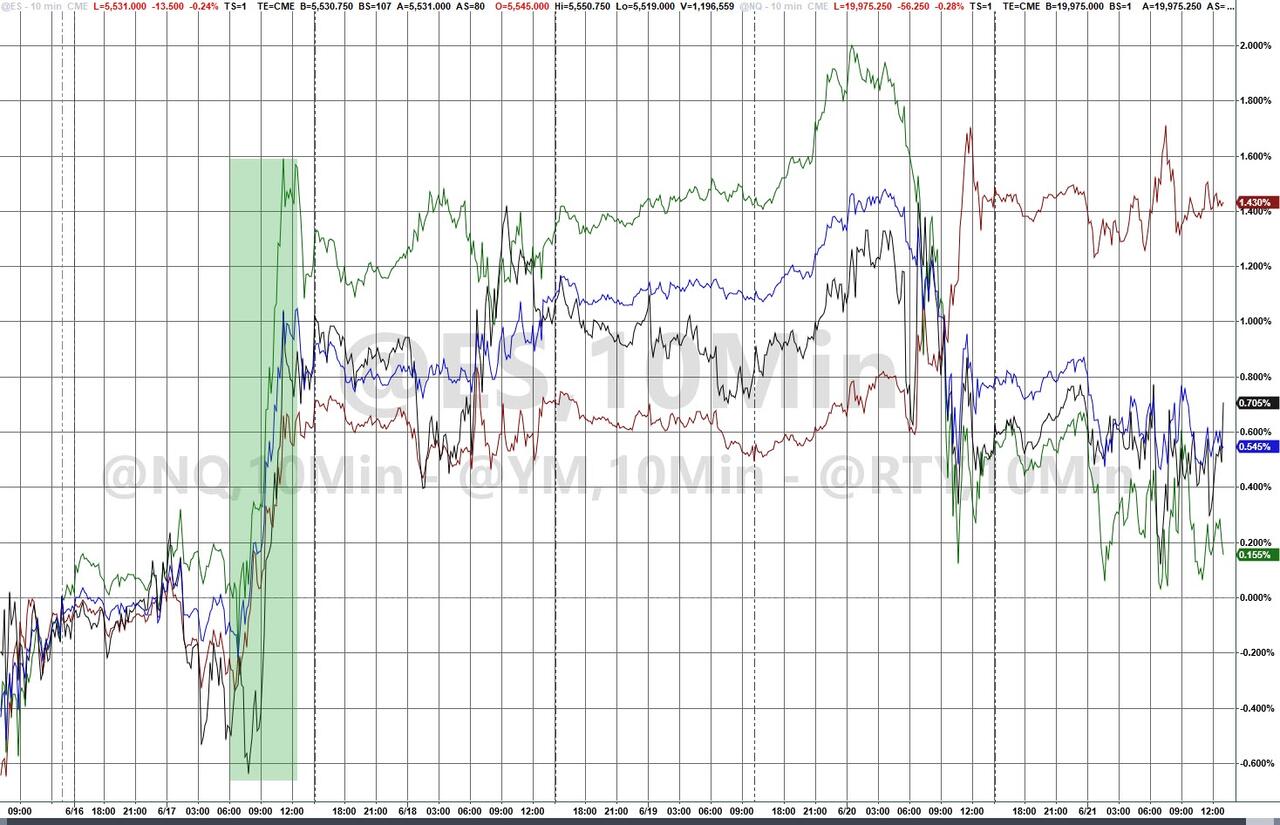

The biggest 'quadwitch' ever saw a tight trading range outside of the open and the close.

A chaotic start - as $3 trillion notional options expired on the open - left stocks to tread water for much of the day (even as bond markets suddenly gave a shit about flash PMIs), until the volume exploded into the close.

It was another ugly week for US macro data overall - with the Bloomberg Economic Surprise Index tumbling to its weakest since Feb 2019...

Source: Bloomberg

But the decline was dominated by 'hard' real data (worst since Sept 2022) while soft survey data improved off nine-year lows...

Source: Bloomberg

On the week, The Dow outperformed while Nasdaq lagged as Monday's huge squeeze higher saved the entire week...

The fund and games were not over until the last second. The Nasdaq Composite cash index closed last Friday at 17688.88. Thanks to some last-second shenanigans from the machines, the Nasdaq Composite cash index closed this week at 17689.36... +0.48pts or 0.002%... to ensure the 8th positive week in the last 9 weeks...

Source: Bloomberg

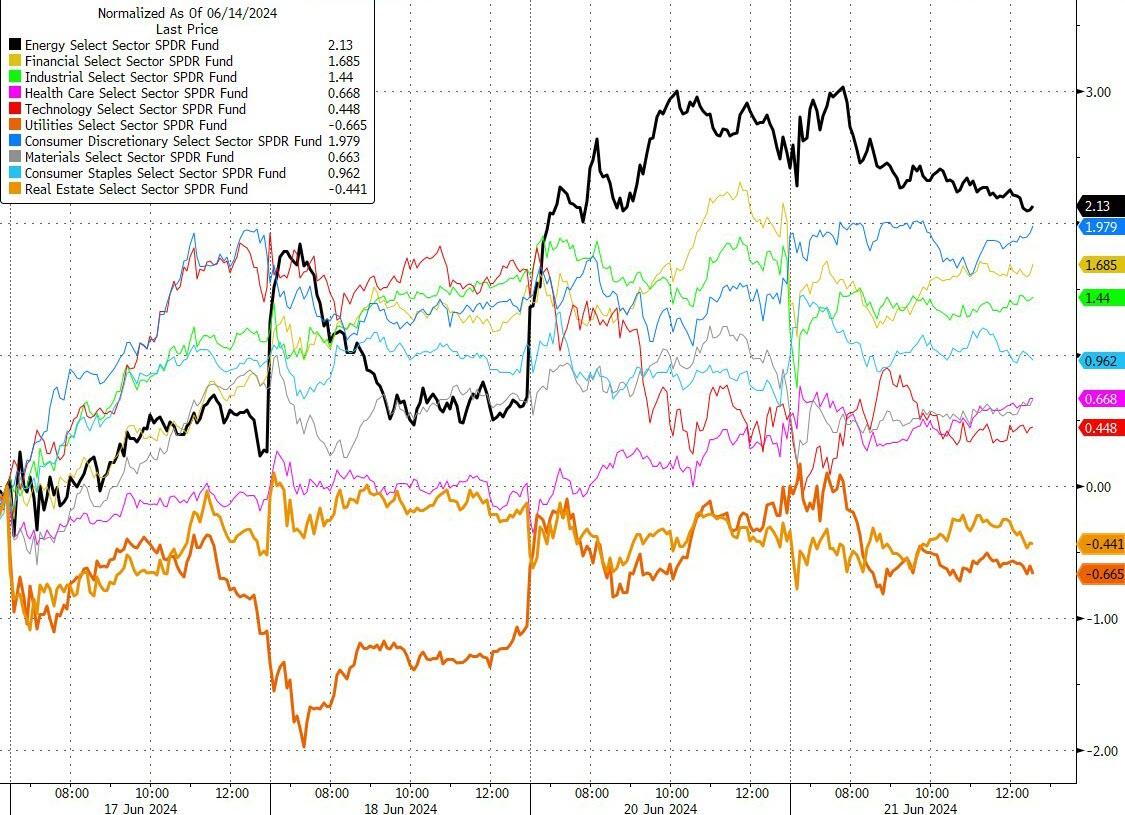

Utes and Real Estate were the only sectors to close down on the week as Energy outperformed...

Source: Bloomberg

NVDA suffered its first down-week in two months...

Goldman Sachs said that their floor tilted -22% better for sale, driven by supply within the LO community. But, they highlighted that as expected, some massive opening prints w/ quadwitch (and noted that the close will be 5x). We did have asset managers take advantage of these opening prints.

-

LOs are currently -6% better for sale. Supply from this group is largely being driven by Info Tech, Healthcare, and Consumer names.

-

HFs are slightly better to buy, led by Consumer Disc and Healthcare. HFs are modestly selling Fins, REITs, Materials, and Energy. HF trading during first 30 mins driven by factor models. Little Mo drawdown mostly concentrated in tech w/ MU, NVD, AVGO, QCOM underperforming vs TXN, INTC, ON, MCHP outperforming.

Stifel’s Barry Bannister says the US stock benchmark has a shot at reaching the 6,000 mark before the end of 2024 as investors keep piling in, up from just below 5,500 Thursday. But by mid-2026, he expects the gauge to sink back to where it began this year — around the 4,800 level — erasing a fifth of its value.

To be clear, the forecaster says risk assets, and equity markets in particular, are due for a correction much sooner. His official year-end S&P 500 target stands at 4,750, implying a drop of some 13% from today. The index retreated after touching all-time highs Thursday as technology shares came under pressure. Still, the euphoria among investors that’s powered the market for months is set to propel shares higher before they eventually plunge, he says.

“Timing is everything,” Bannister and his team wrote Wednesday in a note to clients, “and we are aware that investors may be in full-fledged bubble/mania mode which looks past our concerns.”

Bannister is not alone as Mark Spitznagel, the founder and chief of Universa Investments, said:

"I've been saying this for a year and a half because people got 2022 so incredibly wrong (we're not in the 70s!). The Fed recklessly popped the greatest credit bubble in human history and now as people realize that the Fed needs to about-face, they're going to get increasingly juked the other way in a face-ripping rally. At the point of euphoria — which is coming — the high will be in and the market will crash worse than the global financial crisis."

"What matters more than my views on this are how Universa's clients are positioned for it — for both a face-ripping rally and for the worst crash since 1929."

Is this week's NVDA weakness a sign of things to come?

Source: Bloomberg

Or is the macro picture signaling something that stocks don't know...

Source: Bloomberg

Looking at US bond yields trade this week, it's clear we are entering the 'illiquid summer' season as yields snapped and crapped constantly to end the week marginally higher...

Source: Bloomberg

But, on the bright side, at least they're not French where the OATS spread exploded to its widest since 2012 (the EU Debt Crisis)...

Source: Bloomberg

US rate-cut expectations for 2024 and 2025 were basically unchanged on the week...

Source: Bloomberg

The dollar ended the week very marginally higher

Source: Bloomberg

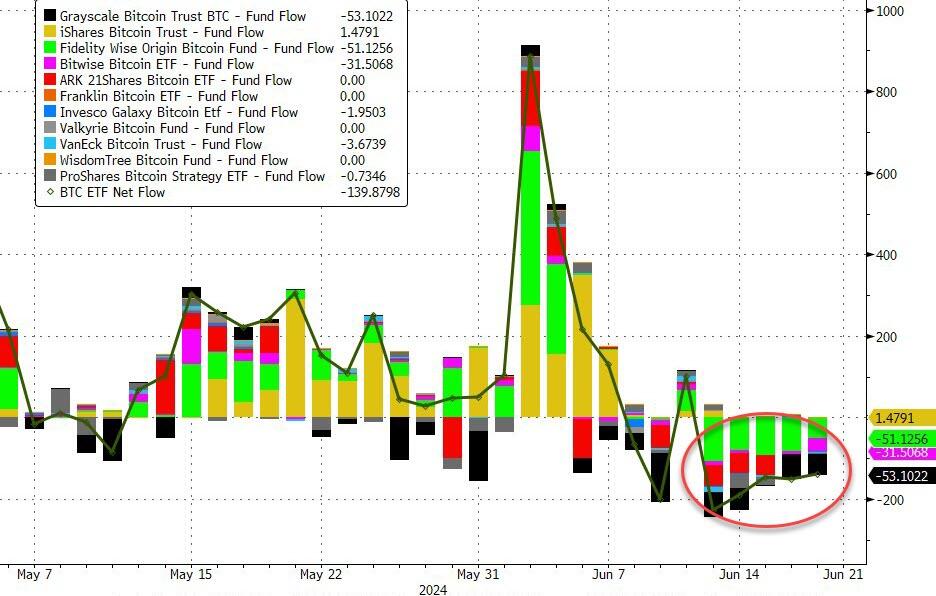

Bitcoin suffered this week with ETF outflows for five straight days...

Source: Bloomberg

Bitcoin fell to $64,000 and found some support at six-week lows...

Source: Bloomberg

Gold was performing well all week until this morning's hot PMIs which sent the barbarous relic into the red...

Source: Bloomberg

Despite a dip today as contracts rolled, the front-month WTI futures price rallied up to its highest since April this week...

Source: Bloomberg

Finally, Messers Biden and Powell may be about to have a problem...

Source: Bloomberg

...as pump-prices are about to chase wholesale gasoline prices and crude prices higher.

More By This Author:

"Everything Is Frozen": Third-Day Of Cyberattack Leaves 15,000 Auto Dealerships Crippled

Futures Fall, Tech Rally Fades Ahead Of Record $5 Trillion OpEx

WTI Extends Gains After Surprise Crude Inventory Draw; Pump-Prices Set To Soar

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more