Crude Oil Futures: Extra Weakness Appears Favoured

Image Source: Unsplash

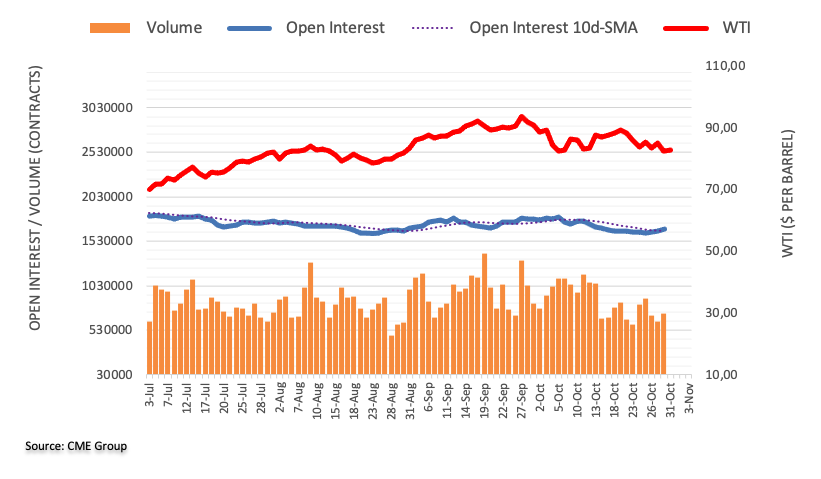

CME Group’s flash data for crude oil futures market noted traders increased their open interest positions for the third straight session on Monday, now by around 22.5K contracts. Volume followed suit and went up by nearly 91K contracts, setting aside two daily drops in a row.

WTI: Next on the downside comes $80.00

Monday’s marked retracement in prices of WTI was on the back of increasing open interest and volume, indicating that further weakness remains in the pipeline for the commodity in the very near term. That said, immediately to the downside emerges the key $80.00 mark per barrel ahead of the 200-day SMA at $78.15.

More By This Author:

Crude Oil Futures: Further Weakness On The CardsCrude Oil Futures: Further Upside Unlikely Near Term

Crude Oil Futures: Further Retracement Could Be Losing Momentum

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more