Credit Delinquencies Below Recession Levels

Image Source: Pexels

“Davidson” submits:

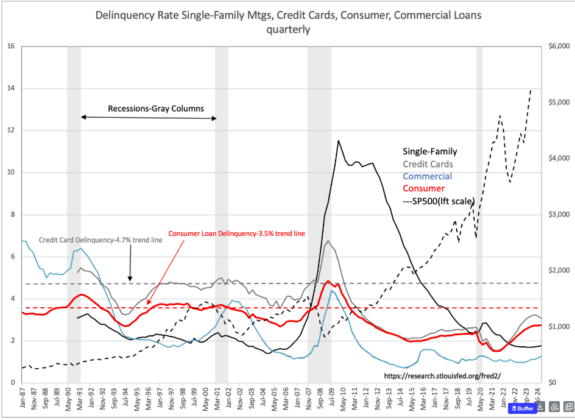

High consumer delinquencies are the condition for recessions that are triggered when lenders are shocked into withholding further credit extension when suddenly scared by unexpected events. The levels that spell high recession risk are 4.75%delinquencies for consumer credit cards and 3.5% for consumer loans. The former has dropped to 3.08% while the latter is holding at 2.75% which reflect normal levels of delinquencies during the business cycle. Overall, the financial system is not experiencing “delinquency stress” and sudden shocks, called “Black Swans”, are not likely to precipitate recession.

There have been dramatic events lately discovering waste and fraud in government spending. It has been suggested that income taxes could be reduced or eliminated by eliminating wasteful government spending. Should this occur, we could see several years of even lower delinquency rates ahead.

More By This Author:

Truck Tonnage SurpriseEconomic Data Still Supports Continued Growth

The Fuel For The Next Rally

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more