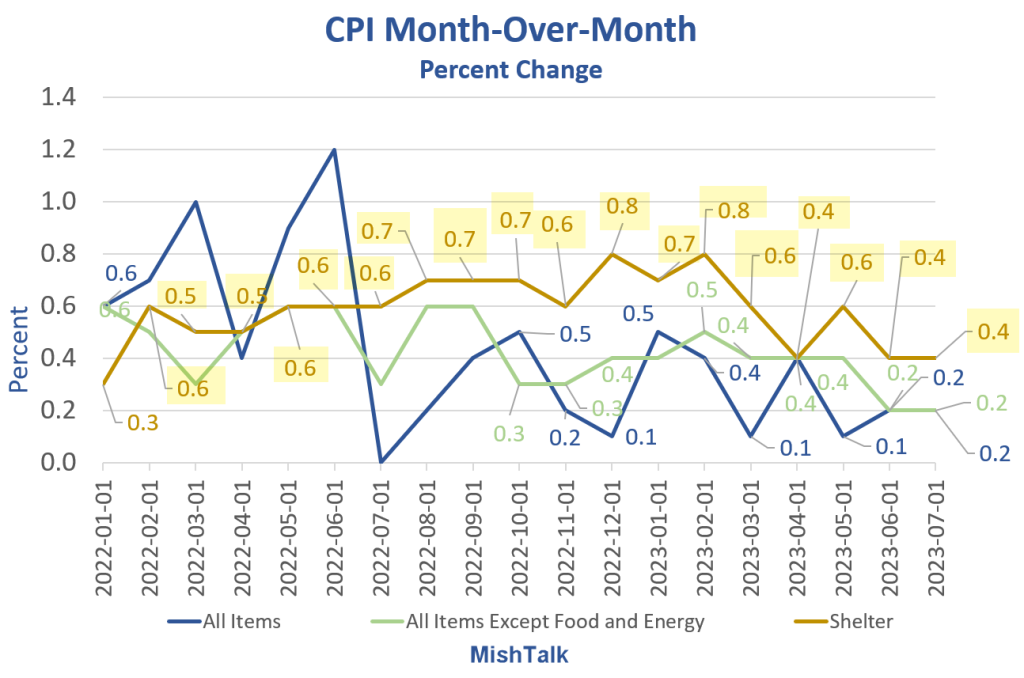

CPI Rises 0.2 Percent, Shelter Again Accounts For Most Of The Increase

CPI data from BLS, chart by Mish

For the 18th straight month the price of shelter has risen at least 0.4 percent. For a year, analysts have predicted not just a slowing pace of increases, but falling prices.

Let’s tune into the BLS Report for the details.

CPI Month-Over-Month

- The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in July on a seasonally adjusted basis, the same increase as in June.

- The index for shelter was the largest contributor to the monthly all items increase, accounting for over 90 percent of the increase, with the index for motor vehicle insurance also contributing.

- The food index increased 0.2 percent in July after increasing 0.1 percent the previous month. The index for food at home increased 0.3 percent over the month while the index for food away from home rose 0.2 percent in July.

- The energy index rose 0.1 percent in July as the major energy component indexes were mixed.

- The index for all items less food and energy rose 0.2 percent in July, as it did in June.

- Indexes which increased in June include shelter, motor vehicle insurance, education, and recreation.

- The indexes for airline fares, used cars and trucks, medical care, and communication were among those that decreased over the month

CPI Shelter

CPI shelter data from the BLS, chart by Mish

Shelter Notes

- Shelter comprises 34.73 percent of the CPI

- Rent of primary residence is standard rent (not owner occupied), unfurnished without utilities.

- Owners’ Equivalent Rent (OER), is the estimated price one would pay to rent one’s own house, unfurnished and without utilities. It is the single largest CPI component at 25.54 percent.

- The shelter index increased 7.7 percent over the last year, accounting for over two-thirds of the total increase in all items.

CPI Year-Over-Year

Year-over-year CPI data from the BLS, chart by Mish

Year-Over-Year Details

- Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment.

- The all items less food and energy index rose 4.7 percent over the last 12 months.

- The energy index decreased 12.5 percent for the 12 months ending June

- The food index increased 4.9 percent over the last year.

- Motor vehicle insurance increased 17.8 percent from a year ago.

- Shelter is up 7.7 percent from a year ago.

Leading Indicators

And, little suprise, rents are starting to come down

— Adam Taggart (@menlobear) July 10, 2023

57 of the 100 largest cities in America now have declining rents (source: @nickgerli1 ) https://t.co/oKbAUIZvaK

Sorry folks, as I stated last month, rent prices are NOT coming down, despite such reports for over a year now.

If 57 of the 100 largest cities in America had declining rents, the BLS would reflect that. I will accept that the price of new leases is falling, but most renters do not move.

Would you move to save $50 a month? $100? It’s not worth the hassle unless the new place is cheaper, nicer, and more convenient.

Most analysts have been expecting the price of shelter to come down.

I have not been in that camp and still aren’t although we are getting closer to smaller increases.

The idea that the price of new leases leads the way has certainly not lived up to its deceleration billing.

What About Supply?

Housing Units Under Construction

— Mike "Mish" Shedlock (@MishGEA) July 12, 2023

There are 1.7 million homes under construction.

It hasn't mattered yet for existing leases.

Eventually it will matter but there are 44 M renters with an increase in supply of 1.7 M, although supply keep churning with new construction. pic.twitter.com/laRjkDkUkI

The Starter Home Is No More, Even in Second Tier Markets

In 100 of 100 markets, the average renter cannot afford a lower tier house.

Powell is waiting, and so are renters, because homes are miserably unaffordable with the average mortgage rate of 7.04 percent according to Mortgage News Daily.

For discussion, please see The Starter Home Is No More, Even in Second Tier Markets

Until the price of homes crash, or prices steady and mortgage rates crash, those looking to buy an affordable starter home will be out of luck.

This has widespread implications for household formation and the economy. Many people are trapped into renting, even when they want out.

More By This Author:

Moody’s Downgrades 10 Small- To Mid-Size Banks, 6 More Under ReviewHoot Of The Day: US Policy Dramatically Increases The Need For Political Risk Insurance

US And EU Corporations Slam The Brakes On Demand For Business Loans

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more