Could Hospitality Properties Trust Become Another Sucker Yield REIT?

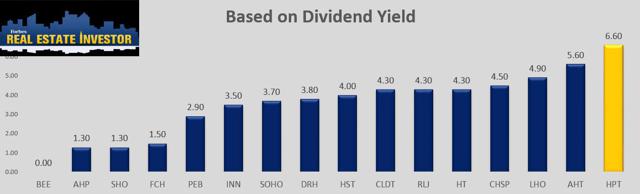

As I glanced across the long list of Lodging REITs today one name jumped out in front of me like a deer in headlights: Hospitality Properties Trust (NYSE:HPT), better known for its externally-managed hotel platform, pays out a whopping 6.6% dividend yield - higher than any of the other Lodging REIT peers.

When I see such a disproportional dividend yield (compared to the peers) I always ask myself, "is this a sucker yield"?

By my very nature, I have trained myself to sniff out the ugly ducks and it's become a common part of my research to always ask myself, "is the yield too good to be true"?

That was exactly my thought pattern when I decided to step off the gas pedal with American Realty Capital Properties (NASDAQ:ARCP), Campus Crest (NYSE:CCG), and Wheeler Real Estate (NASDAQ:WHLR). The words "sucker yield" kept popping up into my brain, and of course that means I don't ever want to be a sucker (and lose hard earned capital).

So I started thinking about HPT and the other REITs that I just referenced - pondering whether there were any similar characteristics that would make HPT the beneficiary of the sucker yield club. Here's how I defined the term (sucker yield) on Investopedia:

A "sucker-yield" is based on quantifiable high yields, seemingly ridiculous, when the underlying security has a flawed or vulnerable business model. Companies that fall under the "sucker-yield" definition typically have unpredictable and unreliable earnings histories with unsafe dividend payouts.

I also added some examples and suggested that,

In the business of investing, as well as real life, the words "too good to be true" means that "all the glitters is not gold". If a stock seems to pay a dividend yield that is exceptionally high, investors should look harder at the sources of payment behind the dividend. That is, how profitable is the company? Can the sources of income cover the dividend payment? How sustainable is the dividend? Are there threats to the underlying business model?

Let's Begin with the Basics

As I mentioned above, HPT is externally managed. That does not mean the security is a sucker yield simply because of the management platform; however, it does tell me that there could be conflicts that could possibly impact the sustainability of the dividend.

Companies don't become "sucker yielding" operations by themselves - it takes a management team to direct the policies that eventually move the shares into a sound or unsound investment thesis.

The potential for conflicts of interest are much higher with HPT and there have been very few positive examples of externally-managed REITs that have outperformed.

HPT is managed by REIT Management & Research, which is majority-owned by Barry Portnoy, and the company went public in 1995. HPT also became the first of several incubator REITs to form subsidiary operating platforms, including Senior Housing Properties Trust (NYSE:SNH), a REIT that primarily owns healthcare properties; Government Properties Income Trust (NYSE:GOV), a REIT that primarily owns and leases office buildings that are majority leased to government tenants and Select Income REIT(NYSE:SIR), a REIT that is focused on owning and investing in net leased, single tenant properties.

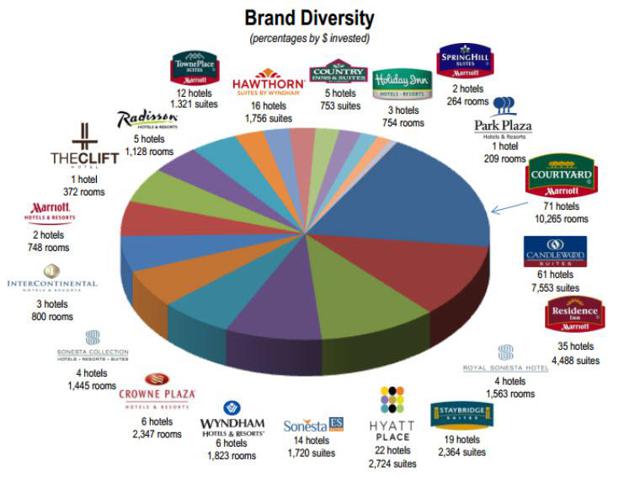

One rather unique feature of HPT is the broad-based income that the REIT generates. As noted above, HPT is essentially an owner of real estate leased and operated by well-known hotel brands including many "best in class" hotel chains such as Marriott (NASDAQ:MAR), Carlson, Hyatt (NYSE:H), andWyndham (NYSE:WYN). HPT currently has around $5.2 billion invested in 292 hotels operated under 20 nationally recognized brands.

In addition to the hotel operations, HPT also has a portfolio of 184 travel centers leased to TravelCenters of America (NYSE:TA) that represents around $2.86 billion of invested capital.

Now as we peel back the onion we can see how the conflicts of interest set in…

On January 31, 2007, HPT completed the acquisition of TravelCenters of America, Inc. Upon completion of the acquisition, HPT restructured the business of TA and distributed all of the common shares of the former subsidiary, TravelCenters of America LLC, to shareholders in a spin-off transaction.

TA is one of the largest operators of truck stops along the U.S. interstate highway system and formerly owned most of the sites it operated. TravelCenters and a smaller truck stop chain (Petro Stopping Centers) were purchased by HPT and simultaneously whereby HPT entered into a sale/leaseback transaction (see my article on sale/leasebacks here) and retained the real estate, and entered into a long-term lease agreement with TravelCenters, which it spun off to HPT shareholders.

In a previous Seeking Alpha article (Why TravelCenters of America's Relationship With Hospitality Properties Trust Is Key), Skeptic LLC, explained that the sale/leaseback transaction between TravelCenters and HPT are considered self-dealing:

TravelCenters does not own the locations it operates. Instead it leases them mostly from Hospitality Properties Trust. HPT is managed by REIT Management & Research, which is majority-owned by Barry Portnoy. TA was spun off from HPT and right now Barry Portnoy has a higher interest on HPT than he has on TA, which might mean that he can favor HPT when setting the leases and other contractual affairs. Also, TA's CEO and CFO are employees of RMR and two of its managing directors (one of whom is Portnoy) are also directors for RMR (source: Nathan Kawaguchi, IgnoreTheMarket.com).

In the same article, Skeptic LLC went on to explain the apparent conflicts of interest with the self-dealing transaction:

The potential for conflicts of interest in negotiating a suitable, stable long-term economic arrangement between HPT and TA (and RMR, the management company) are huge and unsustainable. Why should all of these parties expose themselves to ongoing charges of self-dealing rather than using the negotiation of deferred rent due as a catalyst to redo the deal and put it on a sustainable footing.

HPT is basically being offered a mulligan on the TA transaction, and it would be wise to take the opportunity. Continuing to have such a large exposure to such a shaky tenant is clearly not going to build long-term value and credibility at HPT.

HPT Getting More Truck Stops

Yesterday TA and HPT announced a new transaction that will add 30 more travel centers to HPT's growing TA-leased empire. The deal is valued at $397 million and the 30 sites include 11 sites which HPT currently owns and where HPT will acquire some or all of the improvements, land and ancillary property owned by TA.

These agreements also provide that HPT will sell five travel centers to TA for approximately $45 million that will result in a gain on sale to HPT of approximately $10 million. These properties are currently leased by HPT to TA and subleased by TA to its franchisees.

The annual net cash rental increase which HPT expects to realize as a result of its expected net investment of approximately $352 million is approximately $30.2 million/year, plus percentage rent in the future. That's represents an 8.6% cap rate (plus percentage rent in the future).

This transaction will increase HPT's exposure in TA to over $3.2 billion and close to 40% of annualized rent. In addition, exposure to HPT's largest tenant will grow creating increased credit risks. If you thought ARCP's 12% exposure to Red Lobster was bad, think again.

HPT is also TA's largest shareholder owning approximately 8.9% of TA's outstanding shares, and one of HPTs Trustees is none other than Barry Portnoy who has a higher interest in HPT than he has in TA. HPT did add the following disclosure to the press release yesterday:

Because of these and other relationships between HPT and TA, the terms of the agreements between HPT and TA were negotiated and approved by special committees of HPTs Independent Trustees and TA's Independent Directors who were represented by separate counsel.

Who's getting the better deal though?

It appears that HPT is getting a sweet lease deal and 8.6% is not a bad cap rate in this current low-interest environment. Maybe that's the "sucker yield"… and as long as TA can pay the higher freight on the truck stop portfolio, times will be good…but if there's a bump in the road, HPT may be the sucker.

Is HPT a Net Lease Business?

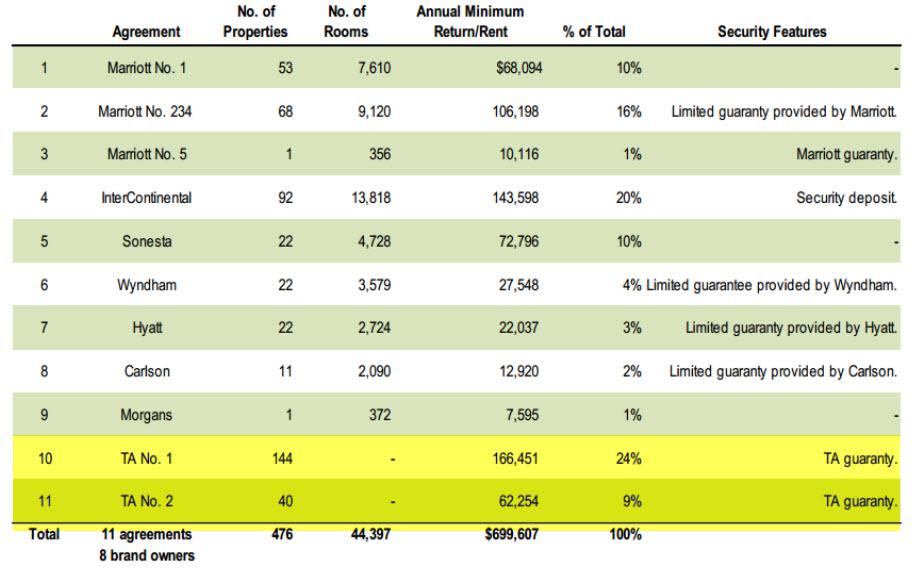

As I extrapolate the business around HPT it becomes clear that the REIT is really operating as more of a Net Lease business since most of the hotel properties are operated under portfolio agreements. A majority of the returns and rents are secured by deposits or guarantees.

As an owner, this type of arrangement is good because it protects the cash flow when operations aren't adequate to cover minimum rents. There is also upside since the management agreements provide for additional returns. Then when you combine the TA portfolio, the value proposition supports the Net Lease nature of the combined portfolios.

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more

thanks for the heads up..