Core Durable Goods Orders Rise At Fastest Annual Rate In 3 Years

Image Source: Pexels

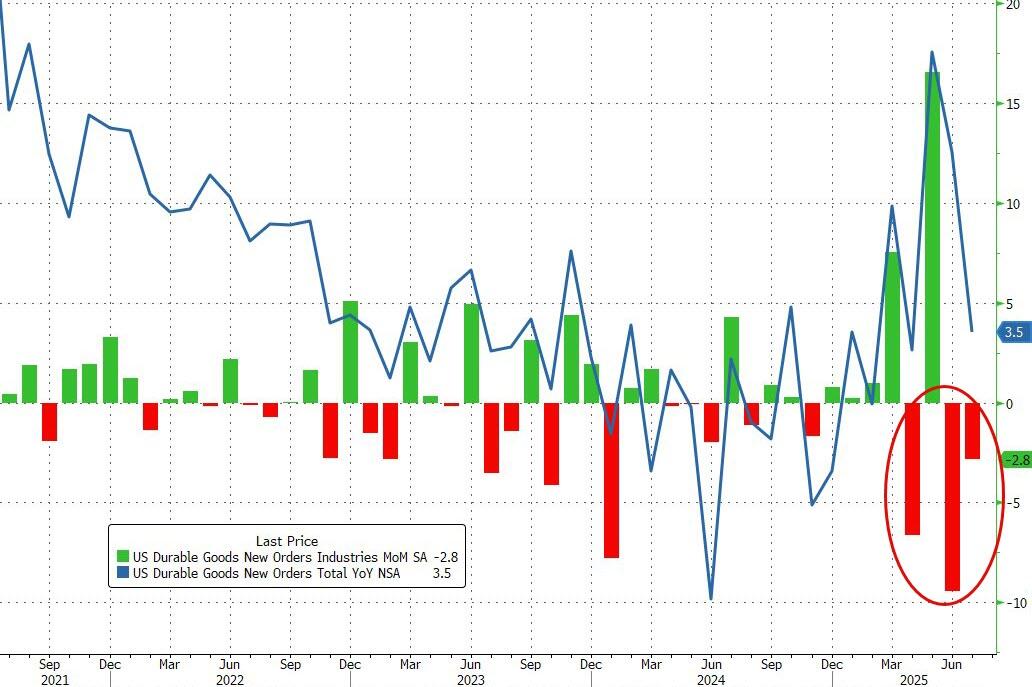

Amid chaotic swings MoM driven by the variability of Boeing plane orders, analysts expected preliminary July data to show a 3.8% MoM decline (following June's big plunge, following May's big surge). The good news is that the actual print was better than expected (-2.8% MoM) but still in the red for headline orders. This dragged down the YoY headline growth to 3.5% as the front-running of tariffs fades and earlier this month, Boeing Co. reported a fewer orders in July than in June.

Source: Bloomberg

Under the hood, ex-Transports, durable goods orders rose over 1.0% MoM (the fourth straight month of gains), lifting core orders 3.8% YoY - its strrongest growth since Nov 2022...

Source: Bloomberg

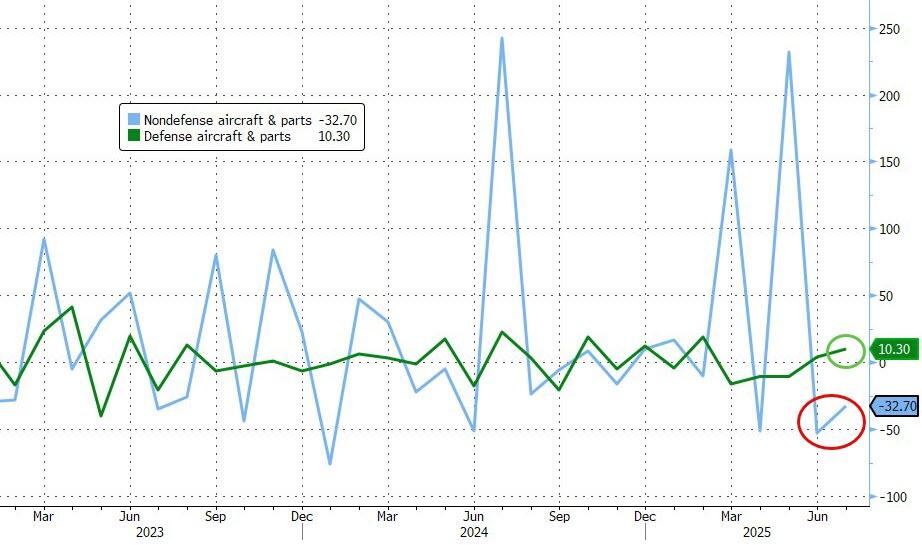

Once again, non-defense aircraft orders plunged (while defense aircraft orders rose)...

Source: Bloomberg

Capital Goods Orders, non-defense ex-aircraft rose 1.1% MoM (better than expected).

Non-defense capital goods shipments including aircraft, which feed directly into the equipment investment portion of the gross domestic product report, rose 0.7% after an upwardly revised gain a month earlier. Rather than orders, which can be canceled, the government uses data on shipments as an input to GDP.

The import/export tariffs - and the frontrunning of such - has clearly sparked chaos in the data.

More By This Author:

Key Events This Week: Core PCE, Durables, And Fed Speakers But All Eyes On Nvidia EarningsNvidia Halts China-Specific H20 AI Chip Production, Information Says

Beyond The Data Center: Goldman's Silicon Valley Field Trip Finds AI Moving From Chips To Workflows

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more